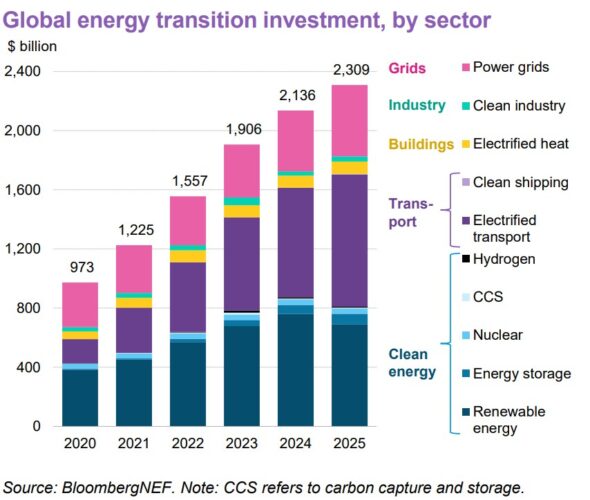

Global investment into the energy transition reached a record $US2.3 trillion ($A3.33 trillion) in 2025, up 8 per cent from the previous year, according to a new report from BloombergNEF (BNEF).

The latest Energy Transition Investment Trends (ETIT) report from BNEF showed increases across all four major clean energy transition indicators – which includes spending to deploy clean technologies, investment in the clean energy supply chain, equity investment in climate-tech companies, and finance for energy transition projects.

This came despite what BNEF artfully described as “trade disruptions and geopolitical tension” – an impressive understatement of US president Donald Trump’s headlong trampling of the international order and his assault on renewable investment.

Diving into the specifics of each indicator, however, highlights some sour notes.

For example, while electrified transport was the largest driver of energy transition investment, amounting to $US893 billion across 2025, renewable energy investment fell to $US690 billion, down 9.5 per cent year-on-year, due to changing power market regulations in China, and reflecting lower technology costs.

Investment in hydrogen and nuclear also fell.

Investment in hydrogen and nuclear also fell. Fossil fuel supply investment also fell for the first time since 2020, declining by $US9 billion year-on-year due mainly to reduced spending on upstream oil and gas as well as fossil power generation.

The Asia Pacific region remained the largest region for global energy transition investment, accounting for 47 per cent of the global total in 2025, with China obviously playing an outsized role.

However, while still the leader in overall investment with $US800 billion in 2025, China posted its first decline since 2013.

Regional neighbour India saw its investment climb by 15 per cent to $US68 billion, while the European Union “shrugged off headwinds” to see its investment increase by 18 per cent to $US455 billion – contributing the most to the overall global uptick.

Even the United States, under the leadership of Donald Trump, saw its investments increase by 3.5 per cent to $US378 billion.

“This past year has showcased that despite policy and trade headwinds, the global energy transition is resilient and provides a number of opportunities for investors,” said Albert Cheung, deputy CEO at BloombergNEF.

“As many economies look to strengthen energy security and build domestic supply chains, clean energy investment will continue to rise, especially as it relates to global data center buildouts.”

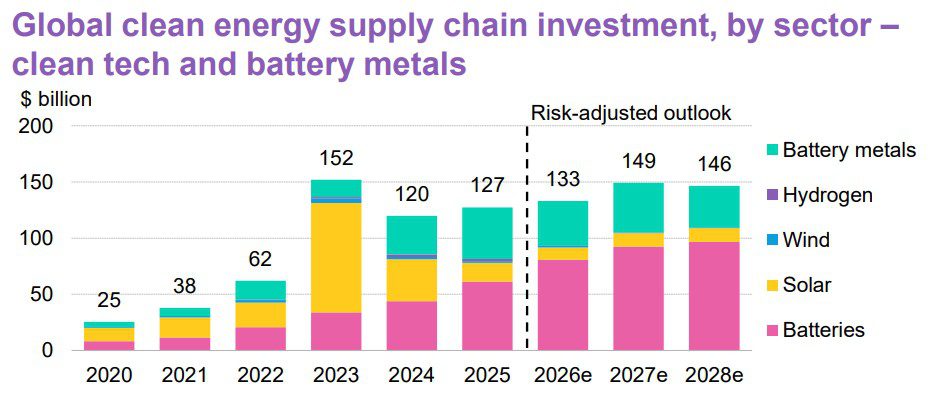

Investment in the clean energy supply chain – which includes spending toward new clean-tech product factories along with battery metal production assets – increased by 6 per cent to $US127 billion in 2025.

This reflects what BNEF believes is the value of factories commissioned for solar, battery, electrolyser, and wind equipment, as well as mines and processing facilities for battery metals.

Growth was unsurprisingly driven largely by increasing battery manufacturing and battery materials investment, but overcapacity will maintain downward pressure on cprices.

Again, China continues to account for the lion’s share of the global supply chain investment, a situation which BNEF expects will continue for at least the next three years.

Climate technology companies raised $US77.3 billion in private and public equity throughout 2025, up 53 per cent year-on-year, the first year of growth after three consecutive years of decline thanks to clean power, energy storage, and low-carbon transport companies.

Energy transition debt issuance was also up in 2025, increasing by 17 per cent from 2024 to $US1.2 trillion. This growth is attributed to increased corporate and project finance flows, which were each up 20 per cent.

A public summary version is available here.

If you would like to join more than 29,000 others and get the latest clean energy news delivered straight to your inbox, for free, please click here to subscribe to our free daily newsletter.