Three years ago, on August, 25 2021, I started running a weekly simulation of Australia’s main electricity grid. The intention was to show that it is possible to get close to 100% renewable electricity with just 24 GW / 120 GWh of storage, enough storage to supply average demand for 5-hours.

Each week, the simulation uses actual demand data from the previous week, with no modifications. It also uses actual wind and solar generation data, but they have been rescaled so that they provide a little over 60% and 45% of annual demand respectively.

The simulation uses the 120 GWh of storage and existing hydro to match supply and demand. If these are insufficient, then it uses something defined as ‘Other’, likely to be gas or diesel peaking generators in the short to medium term, though longer term there are clean options to replace these fossil fuels.

The following summarises some of the key results from the 3 years of simulations

– The simulation has averaged 98.4% renewable electricity. The remaining 1.6% is met by ‘Other.’

– Average supply from ‘Other’ was 373 MW but reached a maximum value of 9,043 MW on 4th July 2020.

– The simulation tends to be 100% renewable from September to March each year, but from mid-Autumn till the end of winter (April to August), it needs supplementation from ‘Other’ on a regular basis.

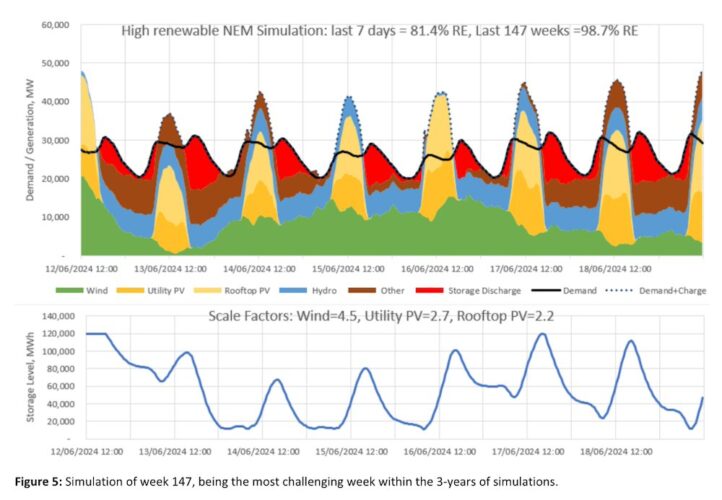

– The most challenging week was the week starting 12th June 2024, when ‘Other’ was required to supply 18.6% of demand. 2024 proved to be a far more challenging year than the previous 2 years, due to a sustained wind drought from early May till late June.

– 16% of the wind and solar generation was in excess of requirements and ended up being curtailed.

- – Only 10% of supply had to pass through storage. Wind and solar directly supplied 82% of demand without having to pass through storage or be curtailed. Another 7% came directly from hydro.

My simulation was based on the Australia’s National Electricity Market (the NEM), which represents approximately 80% of Australia’s electricity demand.

Each week, I would download demand and generation data from OpenNEM. I left demand unchanged. I rescaled generation data for wind, rooftop and utility solar by the factors that would get them to 60%, 25% and 20% of annual demand over the previous year respectively.

For example, over the last year rooftop PV generation has met 11.5% of NEM demand. The target for rooftop PV was 25%, so I rescaled the last 7 days of data by 2.2x (25% divided by 11.5%). The scale factors slowly reduce each week as more wind and solar is installed on the NEM.

Note that the sum of 60%, 25% and 20% is greater than 100%. This is important. Any optimised model of a highly renewable grid will have significant amounts of over-generation. It is better to over-generate and have some curtailment than to generate exactly what you need over the year, but with significant shortfalls during some periods which would require huge amounts of storage or fossil fuel backup. As will be seen later in this article the simulation ended up having 16% excess generation (or spilled energy) over the year.

The decision to use 60% wind and 45% solar was based on rough optimisation experiments that I did several years ago. A mixture reasonably close to 50:50 takes advantage of the fact that NEM wind and solar are negatively correlated with each other. Wind tends to generate above average during the night and during winter, complementing the solar generation.

My model has a bias to wind because wind requires less short-term storage, which is used primarily to shift solar generation from the day to the evening and night. Less storage helps keep the predicted cost down. Since I did those optimisation studies, the cost of solar and batteries has reduced far more than the cost of wind. Despite that, the 60:45 wind to solar ratio remains very close to optimal as I’ll discuss later.

The simulation is simple, particularly due to it not considering transmission constraints. That makes it overly optimistic, though in other ways it is conservative. Despite the lack of transmission constraints, it arrives at a similar result to AEMO’s 2024 Integrated System Plan (ISP).

The ISP averages 98% renewable in the 2nd half of the 2040s using approximately 640 GWh of storage. The ISP predicts demand to have doubled by this time. Thus, 640 GWh of storage is sufficient to provide average demand for 13 hours. Most of that storage comes from Snowy 2.0, which only provides a little over 1% of demand. If you remove the effect of Snowy2.0, then the ISP would achieve 97% renewable supply with under 6 hours of storage.

My simulation used 24 GW / 120 GWh of storage (5 hours at average demand) and existing hydro to firm up the wind and solar in order to match supply with demand. Both the hydro and storage were assumed highly flexible.

Note that I did not use the actual hydro generation data. I completely changed the dispatch of hydro so that it had minimal generation during periods when it wasn’t needed, and elevated levels whenever there was a day with significant shortfalls of wind and solar relative to demand. This is reasonable as most of the hydro capacity on the NEM is associated with large storage dams, making the hydro highly dispatchable. However, to maintain consistency with historical generation, hydro generation was also subject to the following constraints:

– Hydro generation was kept between 200 MW and 6,000 MW

– Weekly hydro generation was kept above 168 GWh

– Annual hydro generation was targeted at between 6% and 9% of demand, though ideally closer to 15,000 GWh, or about 7.5% of demand.

If the wind, solar, storage and hydro was unable to meet demand, then the model supplements generation with ‘Other’. ‘Other’ is deliberately left undefined. In the short to medium term, it is likely to be existing gas or diesel peakers that will help firm renewables along with storage and hydro.

But longer term, ‘Other’ could be a highly flexible dispatchable generator running on renewable fuels such as synthetic gas, biofuels or green hydrogen, or it could be long-term storage such as Snowy 2.0, iron air batteries or compressed air storage. When calculating the renewable percentage of the simulation, I have assumed ‘Other’ is not renewable, even though it is hoped that in the future it will become renewable.

Each week I posted the results of the simulation of the previous seven days to my twitter (X), Bluesky and LinkedIn accounts. On 21 August 2024, I posted the 156th week, marking three years of simulations.

Generation summary & general observations

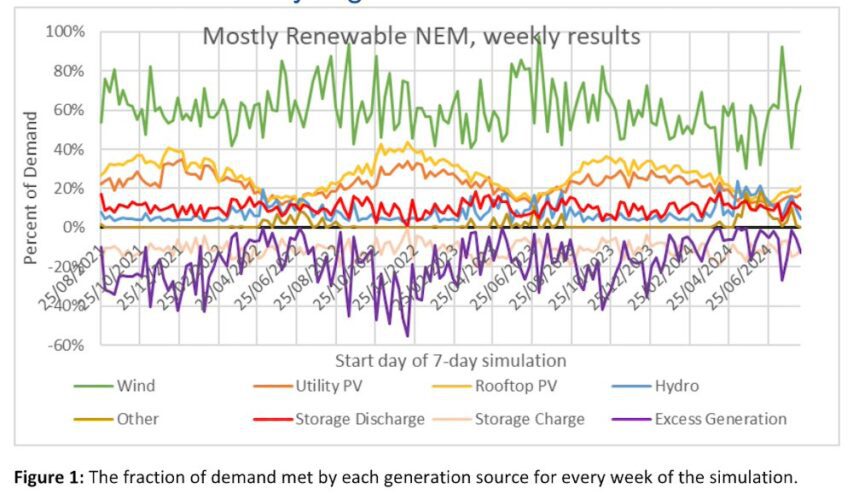

Figure 1 shows the fraction of demand met by each generation source for every week of simulation. It shows that while the target penetration of wind was 60%, the weekly values varied between 27% to 100% due to the variability of wind. Similarly, while the target penetration for utility solar was 20%, the weekly values ranged from as low as 10% in winter up to 35% in summer.

Figure 2 shows that wind and solar generation ended up slightly exceeding the targets of 60%, 20% and 25% for wind, utility solar and rooftop solar respectively. It is impossible to know in advance if the years would be above or below average, so it is not surprising that they did not exactly hit their target. However, the methodology used to rescale the wind and solar data meant that it was very likely that they would exceed their targets.

Another important observation from Figure 2 is that only 10% of demand was met by discharge from storage. The vast majority of demand (82%) comes directly from the wind and solar farms without having to pass through storage.

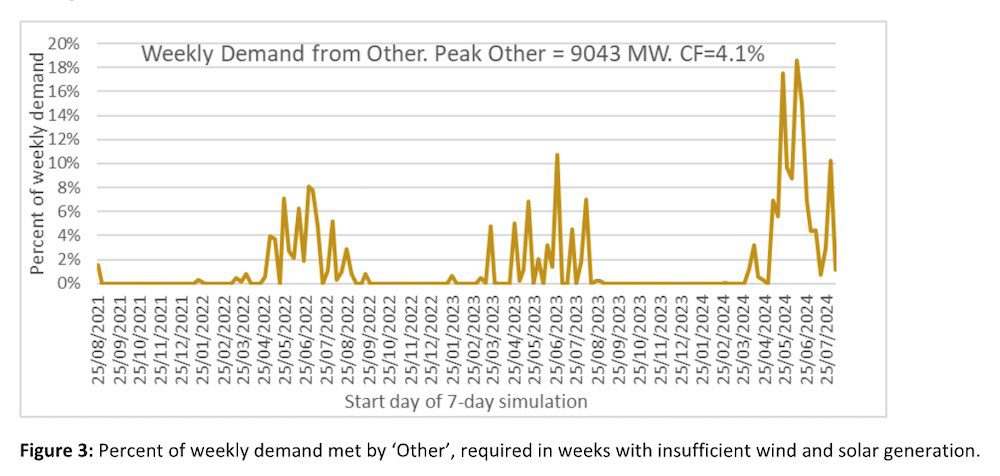

Figure 3 shows the weekly fraction of demand that was met by ‘Other’. Levels of ‘Other’ were close to zero for almost 7 months each year from around September to late March. However, by April though to late August many weeks required some levels of ‘Other’, due to the inability of wind, solar, storage and hydro to entirely meet demand.

The week starting on 12 June 2024 proved to be the most difficult week of the simulation, with ‘Other’ having to provide 18.6% of demand. The figure illustrates clearly that late autumn and winter will prove to be the most challenging period for a mostly renewable grid in Australia.

It also illustrates that the winter of 2024 was far more challenging than the previous two winters, primarily due to an extended wind drought, the worst since June 2017. Indeed, ‘Other’ met 2.4% of demand in the third year of the simulation, compared to 1.2% and 1.1% in years 1 and 2 respectively.

The challenge of matching supply and demand during winter will be even more difficult as we start to electrify gas space heating, particularly in Victoria. Doing so will elevate winter demand much more than summer demand. In contrast, electrification of transport is likely to elevate demand quite uniformly from season to season.

Moreover, if most charging of EVs is done smartly in response to wholesale electricity prices, namely on days with excess wind and solar generation, then that could greatly assist the integration of renewable supply. Given that electrification of space heating will increase the challenge of meeting most demand with wind and solar, while electrification of EVs should help with the transition, it is fortunate that EVs will require about 10 times more electricity than electrification of space heating.

However, in 2024, an extended wind drought throughout May and June saw a few weeks where wind generation was below 60% of the long-term average. This wind drought emphasises that while wind generation tends to be above average during winter, there are never-the-less are many periods where wind generation is significantly below average during these low solar months.

Figure 4 also shows that the variability of ‘wind+solar‘ is significantly lower than the variability in either wind or solar in isolation. This reinforces the importance of having a good mix of wind and solar generation.

It is important to note that wind in QLD is not well correlated with wind in the southern states. That means that when it is calm in SA, VIC, Tas and NSW, it is often windier than average in QLD, and particularly in Northern Queensland. This was particularly true during the wind drought during May 2024, but less so in June 2024. For this reason, it is unfortunate that wind only made up 4% of QLD demand over the last year, or about 1/3 of the NEM average of 13%.

More wind in QLD will greatly help to improve the geographic diversity of renewable generation, making it easier to match supply and demand over the year. However, it will not completely solve the problem. There will remain many days with poor renewable supply in both the southern states and in QLD. Never-the-less, increases in QLD wind generation will make it easier to get closer to 100% renewable electricity.

It is interesting to note that the ISP is predicting that approximately 16 GW of peaking gas or liquids will be needed in the NEM’s generation mix out to 2050, which is almost double the 9 GW peak requirements of ‘Other’ so far in this study. This is mostly explained by the ISP assuming a doubling of demand by 2050. It is not surprising that a doubling of demand requires a near doubling of peaking gas.

Challenging days and weeks

Table 1 shows some statistics for the 5 most challenging weeks of the 156 weekly simulations run so far. I have ranked them according to the fraction of demand that was needed to be supplied by ‘Other’. The table shows that the most challenging week was week 147, starting on 12 June 2024, which required 18.6% of demand to be met by ‘Other’. The simulation for this week is shown in Figure 5. Four out of the 5 most challenging weeks occurred in 2024, and they all had above average demand and below average wind and solar.

| Rank | Week # | week starting | Other % | Max Other | Relative Demand | Relative Wind | Relative Utility PV | Relative Rooftop PV | Relative VRE |

| 1 | 147 | 12/06/2024 | 18.6% | 8,999 | 110% | 59% | 68% | 63% | 61.6% |

| 2 | 144 | 22/05/2024 | 17.5% | 6,817 | 103% | 51% | 78% | 71% | 61.4% |

| 3 | 148 | 19/06/2024 | 15.1% | 7,900 | 112% | 88% | 66% | 60% | 76.5% |

| 4 | 97 | 28/06/2023 | 10.7% | 9,043 | 107% | 94% | 51% | 51% | 74.8% |

| 5 | 154 | 31/07/2024 | 10.3% | 8,311 | 110% | 74% | 81% | 80% | 77.0% |

Table 1: Statistics relating to the 5 most challenging weeks within the 3-years of simulations. Relative values for demand, wind, solar and variable renewable energy (VRE) are all expressed relative to the 3-year average of those same quantities.

Table 2 shows some statistics for the 5 most challenging days of the simulation. Again, they have been ranked according to the percentage of demand coming from ‘Other’. Once again, the list is dominated by events from 2024, illustrating the effect of the wind drought that occurred during this period. Indeed, 8 of the top 10 most challenging days were from 2024, as were 15 of the top 20 most challenging days.

As with the challenging weeks, it is readily apparent that challenging days are due to the trifecta of above average demand, below average wind and below average solar.

| Rank | day | Other % | Max Other | Relative Demand | Relative Wind | Relative Utility PV | Relative Rooftop PV | Relative VRE |

| 1 | 4/07/2023 | 32.0% | 9,048 | 108% | 55% | 22% | 27% | 41% |

| 2 | 13/06/2024 | 32.0% | 8,999 | 112% | 21% | 54% | 56% | 36% |

| 3 | 5/08/2024 | 30.0% | 8,311 | 111% | 32% | 49% | 60% | 42% |

| 4 | 4/06/2024 | 29.7% | 8,974 | 110% | 35% | 59% | 60% | 46% |

| 5 | 18/06/2024 | 28.0% | 8,383 | 113% | 34% | 81% | 68% | 52% |

Table 2: Statistics relating to the 5 most challenging days within the 3-years of simulations. Relative values for demand, wind, solar and variable renewable energy (VRE) are all expressed relative to the 3-year average of those same quantities.

My simulation is currently only 3-years in length, which is not sufficient for looking at extreme VRE drought events. But it is nevertheless interesting to compare the results from my simulation with a much longer-term study.

In their 2022 study “Quantifying the risk of renewable energy droughts in Australia’s National Electricity Market (NEM) using MERRA-2 weather data” Joel Gilmore, Tim Nelson and Tahlia Nolan analysed 42 years of simulated wind and solar traces to look at the worst VRE droughts that could be expected .

They found the worst day in 42 years to have a relative VRE supply of 32.8%, or about 4 percentage points worse than the worst day this simulation has seen. An additional deficit of 4% would likely require an additional 1 GW from ‘Other’. An approximate guess might be that the current peak value of 9 GW from ‘Other’ in this simulation might increase to a little over 10 GW if a 1 in 42-year extremely bad VRE day is encountered.

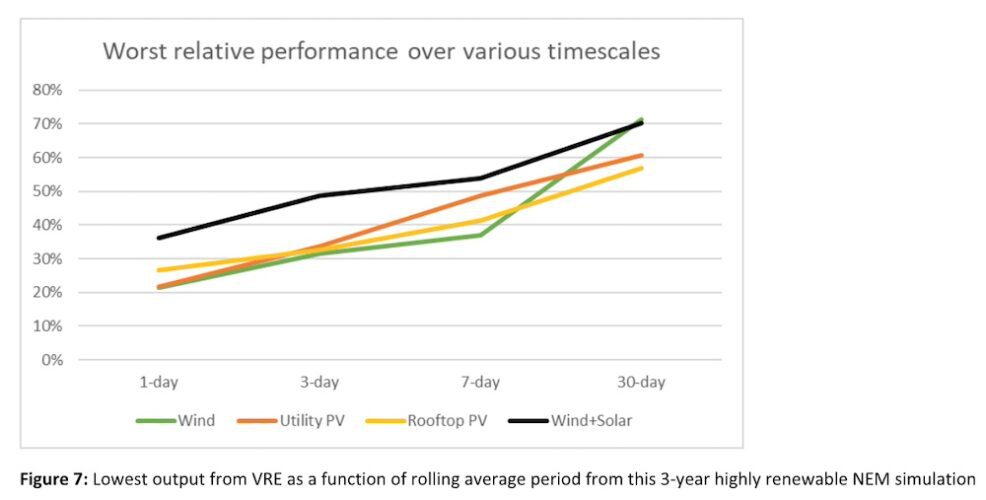

Also of interest from this paper is the figure reproduced in Figure 7 below. It shows that when looking at 42 years of data, the worst day for solar is a little worse than the worst day for wind, about 18% of the long-term average for solar versus about 22% for wind. The worst day for wind and solar combined is much better at 33% of the long-term average.

The worst week is equally bad for wind and solar, both around 40% of the long-term average, rising to 50% when you consider their combined output.

Once the rolling average period exceeds 10 days, the worst periods for solar are much worse than the worst periods for wind.

Figure 7 shows a similar plot for this simulation. In general, the worst periods in this simulation are not quite as bad as the worst periods from the 42-year study, as you’d expect given that this simulation is only 3-years in duration.

But in some instances, particularly for wind rolling averages up to 7-days, they are quite similar. This may well be because the wind in this 3-year simulation, being based on current wind generation, is less geographically diverse than the wind in the 42-year synthetic traces of their study, which is based on the future geographical mix modelled by the ISP.

Other Interesting weeks

Week 131, starting on Feb 21, 2022, was the week containing the highest demand interval, peaking at 38 GW in the afternoon of Feb 22, or 60% higher than average. This was the highest demand ever seen in the history of the NEM. That day also had the highest average demand, at 28.6 GW or 20% above average.

Summer is when the NEM normally sees the day with the highest demand. Both wind and utility solar generation were 17% above average on that day, while rooftop solar generation was 31% above average.

Thanks to the above average performances from wind and solar, the day ended up being 100% renewable. This confirms the trend observed in previous years that a highly renewable NEM with significant quantities of solar and 5 hours of storage is well placed to deal with extreme summer demand.

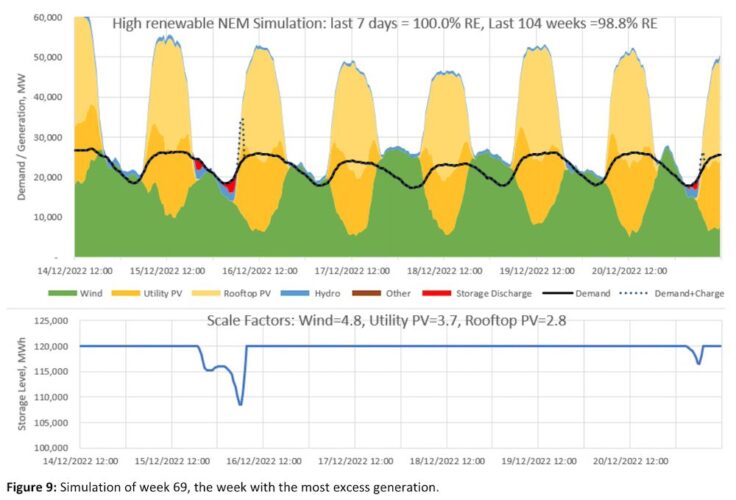

Week 69 starting 14 Dec 2022 was the week with the most curtailment. Generation from wind and solar was 54% above average. Storage was maxed out at 120 GWh nearly the entire week, with almost no need to discharge storage at all. 99.6% of demand was met directly from the renewable supply, with only 0.4% needing to pass via storage.

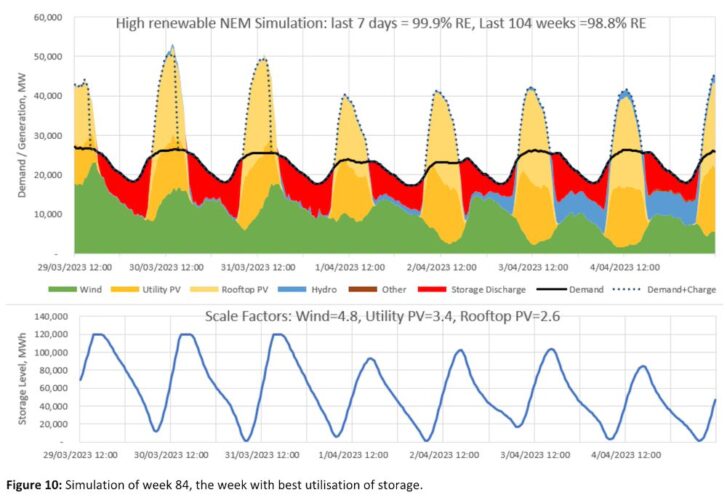

Week 84 starting 29 March 2023 was the week that best utilised the storage. The storage discharged an average of 84% of a full cycle each day, compared to the 156-week average of 48%. The week was 99.9% renewable, but only 2% of generation was excess to requirements. It is arguably the week where the simulation worked best, with almost exactly the right amount of renewable generation and storage needed to match supply.

Average Daily Profiles

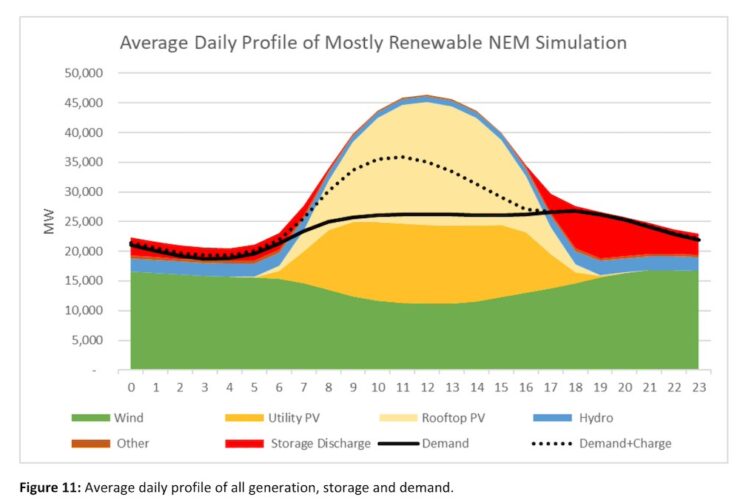

Figures 11 and 12 show the average daily profile of all generation, storage, demand and curtailment. Figure 11 indicates that wind has a bias to night-time generation, complementing to some extent the solar profile.

Figure 12 shows how the dispatch of hydro and ‘Other’ generation is highly biased to the night-time, while curtailment is primarily during the peak solar hours, reaching a peak value of around 13 GW at noon. Storage discharge reaches a peak value of 8 GW at 7pm.

Costs and Emissions

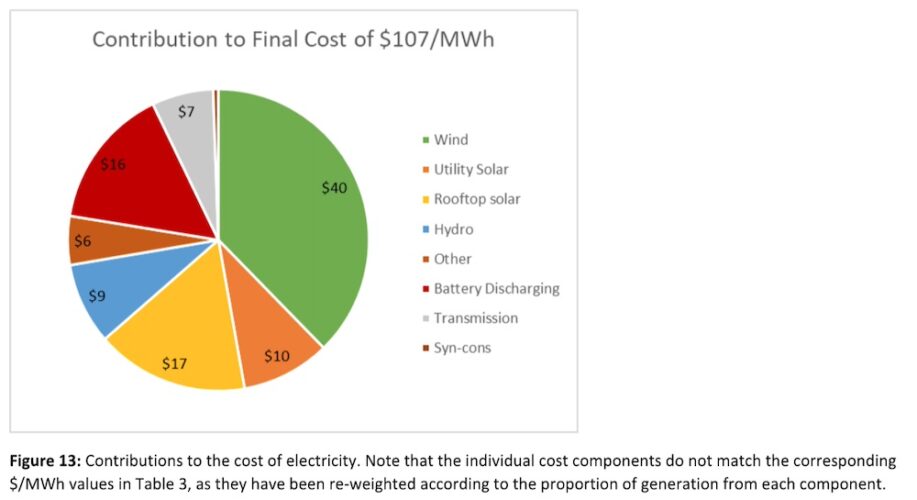

Table 3 and Figure 13 show that this near 100% renewable electricity supply is estimated to cost around $107/MWh, or $22b per year. About 72% of this cost comes from the supply of wind, solar and hydro generation, 5% from ‘Other’, 15% from storage and 7% from extra transmission costs, beyond what we currently pay for transmission.

The $107/MWh cost estimate is up significantly from the $95/MWh estimated last year. A large fraction of the increase is due to a $15/MWh increase in the cost of wind generation, though a $6/MWh cost increase in solar also contributed. As mentioned previously, significantly more ‘Other’ was required this year than in the previous 2 years, which also added to the cost.

This year I’ve also added the cost of synchronous condensers to provide system strength. It is expected that batteries will dramatically reduce physical inertia requirements, but I have assumed that synchronous condensers providing 34,300 MWs of inertia will still be required. Costings are based on the $182m cost of the 4 synchronous condensers providing 4400 MWs of inertia in South Australia in 2019.

Table 3: Cost estimates for this near 100% renewable electricity supply.

Capex and Opex costs are based primarily on the 2023-24 CSIRO GenCost report and from AEMO’s 2024 Input and Assumptions worksheets. Capex values are based on a 15-year average out to 2038. For storage I’ve assumed 18 GW of 4-hr batteries and 6 GW of 8-hr batteries to achieve the assumed 24 GW / 120 GWh of storage, at a total cost of $33b, annualised to $3.4b per year. Battery cost estimates have decreased slightly since last year’s prediction.

Costs for “Other” assume open-cycle gas turbines, with fuel cost of $12/GJ, heat rate of 10.9 GJ/MWh and capacity factor of 4.2%. Hydro costs of $124/MWh is based on a 30% premium to the average price that hydro received over the 5-year period 2017-21. The $/MWh figures for wind and solar are pre-curtailment. Given that 12% of the wind and 21% of the solar generation was curtailed, the post-curtailment prices would be 14% and 26% higher respectively.

Transmission costs are based on the 2024 ISP. Data from the ISP indicates that each MWh of non-curtailed utility wind and storage generation adds about $15/MWh in transmission costs. This is then applied to the 97 TWh of utility solar and wind generation that is in excess of what was generated in 2022.

Table 4: Emission estimates for this mostly renewable electricity grid.

Table 4 shows two estimates of the emission intensity of the simulated grid. The first estimate includes only direct (scope 1) emissions from each technology and arrives at a grid intensity of 9 kg CO2-e per MWh. In this calculation, ‘Other’ is the only technology with direct emissions, assumed to be 580 kg CO2-e / MWh as appropriate for an Open Cycle Gas Turbine (OCGT).

The second figure is an estimate of the full lifecycle emissions, including the emissions associated with building each technology. The table indicates the assumed kg CO2-e / MWh for each technology. The figure for the battery is based on assumed embodied emissions of 60 kg/kWh, appropriate for a LFP battery built in 2030. The resultant estimated full lifecycle emission intensity of the grid is 37 kg CO2-e / MWh.

It is worth noting that while the wind, solar & batteries have far lower emissions than the ‘Other’ on a per MWh basis, because they are producing far more electricity, the annual full-lifecycle emissions of the wind and solar generation (4.8 GT/yr) is more than double those coming from ‘Other’ (2.0 GT/yr).

The full life-cycle emissions from the batteries are also almost one third the annual emissions from ‘Other’. This emphasises that one should be cautious about aiming to fully eliminate ‘Other’ by building lots of over-generation or storage. Each of these options involve embodied emissions that should not be ignored when considering the optimal mix for a very low carbon grid.

The 600 MT/yr of annual emissions due to the batteries are easily justified by the reduced emissions from ‘Other’ that those batteries enable, but that may not be the case if battery storage levels are increased dramatically beyond what is modelled in this study. Along with cost, this is one of the key reasons that this study does not try to fully eliminate ‘Other’.

The marginal cost of abatement becomes very high. Nevertheless, the predicted full-lifecycle emission intensity of 37 kg CO2-e/MWh of this simulation is lower than virtually all major existing electricity grids in the world.

Zero carbon options for ‘Other’

As mentioned earlier, Australia’s current gas peaker fleet is mostly likely to fill the role of ‘Other’ in the short to medium term. It should be noted that the importance of peakers such as these are not just a feature of grids mostly powered by wind and solar. Even if nuclear was used to mostly decarbonise the NEM, gas peakers would play an important role on days of extreme demand, or during occasions when multiple nuclear units were simultaneously out of action.

It does not make sense to build a nuclear plant that is only required on rare occasions to deal with tail-risk events, just as it does not make sense to build lots of wind and solar farms to enable 100% renewable even on the days with terrible wind and solar resource.

There are far better ways to spend money to decarbonise our society than to build highly underutilised wind, solar or nuclear to eliminate the last 1-2% of fossil generation from our electricity sector. Except for a few grids mostly powered by hydro, all electricity grids around the world have a need for fossil peaker plants. All these grids will require a low-carbon option for ‘Other’ if they want to fully decarbonise.

There are few potential options that could fulfill this role. One option is that the fossil plants could transition to being fuelled by renewable synthetic gas, biofuels or green hydrogen.

Another option is a greatly expanded demand response market. It is likely that in the future demand will be more responsive to price signals. This is particularly true for demand due to charging of electrical vehicles, green hydrogen production, generation of heat (such as hot water) or water desalination. Any additional responsive demand is likely to reduce the requirements of ‘Other’.

This simulation has only used short-term storage. But long-term storage options like the 2 GW / 350 GWh Snowy 2.0 are currently being built, and they can also help to reduce dependence on ‘Other’.

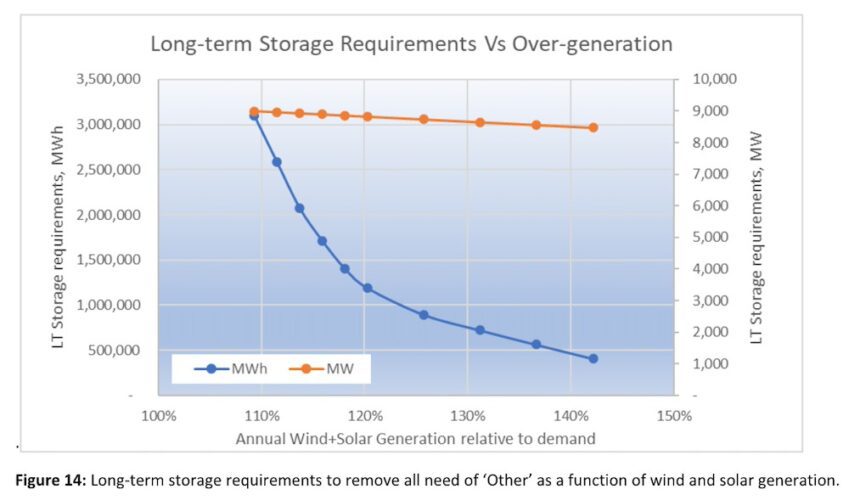

To eliminate all ‘Other’ in my simulation would have required 9 GW / 3,100 GWh of long-term storage, in addition to the 24 GW / 120 GWh of short-term storage already discussed. However, it is possible to reduce the GWh requirements of long-term storage to 900 GWh if wind and solar generation was increased from 109% of annual demand to 126% of annual demand, as shown in Figure 14.

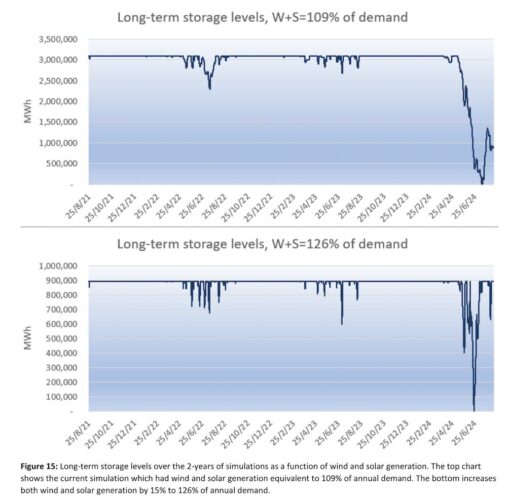

If we were to build 9 GW / 3,100 GWh of long-term storage to eliminate the requirement of ‘Other’ in this simulation, then the top chart in Figure 15 shows how the storage levels would have changed over the 3-year simulation. Storage levels would have decreased to zero on 14 July 2024 after three months of poor wind and solar generation starting in April 2024.

As can be seen in this figure, long-term storage levels remained significantly higher during the first two winters of this simulation. Indeed, only 900 GWh of long-term storage was required to get through the first two winters, less than a third of what was required for the 2024 winter.

The lower chart in Figure 15 looks at long-term storage levels if we instead increased wind and solar generation to 126% of annual demand. Under this scenario, long-term storage requirements would have reduced to 8.7 GW / 900 GWh.

In all these calculations, it has been assumed that the round-trip efficiency of the long-term storage is 70%.

Another option to remove ‘Other’ is hydrogen. If some of the 16% of generation that was excess to requirements was used to generate hydrogen via 3 GW of 70% efficient PEM electrolysers, then it is estimated that they could have run at a utilisation of approximately 63% and produced about 300 million kgs of hydrogen per year.

They would have consumed just under half of the excess generation. If this hydrogen was used to fuel a hydrogen reciprocating generator with efficiency of 32%, then they could have generated 3.7 TWh/y of electricity, which is more than enough to cover the 3.3 TWh/y of generation coming from ‘Other’.

Approximately 360 million kilograms of hydrogen would need to have been stored prior to April 2024 to get through the challenging wind drought of 2024. This could either be in underground storage caverns or above ground tanks, with the latter possibly involving a conversion to ammonia, e-methanol or some other synthetic fuel.

How have the scale factors changed over time?

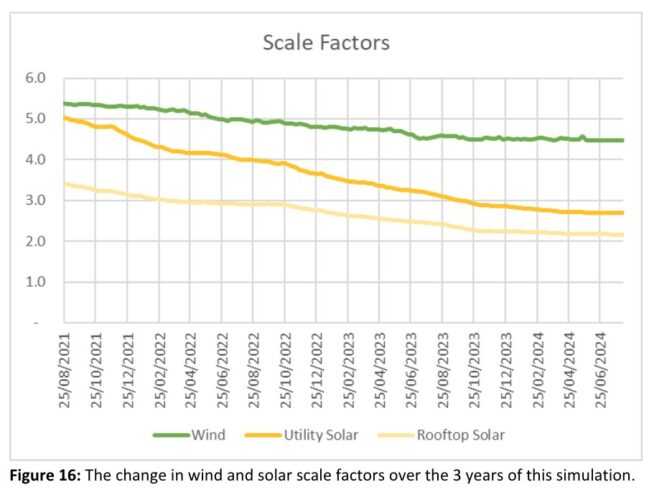

Each week, the scale factors are recalculated to get wind and solar reach their respective target annual penetrations. This results in them slowly decreasing with time, as more renewables are built and supply generation to the NEM, as shown in Figure X.

The scale factors have not reduced significantly in the last year. This is due to the poor growth rate of renewable generation over the last 12 months. It is clear that this needs to improve significantly if the NEM is to decarbonise in a timely manner.

Is this simulation still close to optimal?

The target penetrations of 60% wind & 45% solar used in this simulation were based on rough optimisation experiments conducted a few years ago. Since then, solar and batteries have come down in cost more rapidly than wind. It is reasonable to expect that the optimal solution might now have more solar and less wind. Using the 3-years of data from this simulation, I performed some new optimisation experiments.

It turns out that the ratio of wind to solar in this simulation remains very close to optimal. If the wind target fraction was reduced by 10 percentage points to 50%, and the solar fraction increased 10 percentage points to 55%, then the storage requirements would have increased to 24 GW/144GWh. This is because, in my simulation wind provides an average of 208 GWh of generation during the 13 hours from 6pm to 7am.

Changing the wind fraction from 60% to 50% reduces this night-time supply by an average of 17% or 35 GWh. Some of this can be made up by shifting hydro generation from day to night, but a large fraction needs to be met by additional storage. Hence the extra 24 GWh of storage required. Shifting generation from more expensive wind to cheaper solar would save about $144m per year, but this is more than offset by an extra $610m per year in storage costs.

The cost difference between 65% wind / 40% solar and 45% wind / 60% solar is very small. It is likely that anywhere in this range will be close to optimal on a minimal cost basis using the GenCost cost forecasts. However, as the scale factor chart in Figure 16 shows, this simulation requires a large increase in wind generation supply, much more so than solar.

It is quite plausible that a future NEM might end up with more solar than optimal from a cost basis simply because wind was unable to be scaled up in a timely manner.

It should be noted that the split between rooftop and utility solar was not an outcome of any optimisation experiments. I simply chose a split that seemed reasonable. The cost estimates show that utility solar is about $19/MWh cheaper than rooftop solar, thanks to the higher capacity factor of utility solar. However, this is mostly offset by the extra $15/MWh cost of extra transmission required for utility solar.

This simulation assumed 24 GW / 120 GWh of short-term storage. It is possible that actual storage installations will fall short of this. Earlier it was mentioned that only 10% of generation came from storage, indicating that 88% of supply could come directly from renewable sources without any storage at all.

But the NEM currently has approximately 1.6GW/2.3GWh of utility batteries, 1.7GW/3.5GWh of distributed batteries and 1.3GW/18GWh of pumped hydro. It will soon also have another 6.4GW/13GWh of utility batteries that are financially committed or under construction. So, it is clear that 11GW/37GWh of storage will soon be readily achieved.

Figure 17 indicates the renewable penetration and costs achievable by lesser amounts of short-term storage. It shows that even with just 15GW/60GWh of storage, 96.5% renewable is possible. More storage has a higher storage cost, but this is partly offset by lower costs for ‘Other’. The lowest cost simulation (~$105/MWh) used 18 GW / 72 GWh of storage and reached a renewable penetration of 96.9%.

By having much less storage capacity than the original 24GW/120GWh simulation, this solution reduced annual storage costs by about $1.2b, but this was partly offset by about $0.7b/y in extra ‘Other’ costs. Note that the savings remain small in the overall scheme of things. The extra cost to increase renewable penetration from 96.9% to 98.4% is less than 2%.

Summary

Very close to 100% renewable electricity is feasible for Australia’s NEM at reasonable cost using just several hours of battery storage.

This simulation used 24 GW / 120 GWh (5 hours at average demand) and achieved 98.4% renewable supply at a cost of $107/MWh, including the cost of additional transmission, storage and curtailment. Costs can be reduced further to approximately $105/MWh by reducing the storage to 18 GW / 72 GWh, while still achieving a renewable penetration of around 97%.

Wind, solar & hydro generation directly supplied 88% of demand, without the need to pass through storage.

The predicted emission intensity of the simulation was 9 kg CO2-e per MWh when only considering direct Scope 1 emissions, or 37 kg CO2-e per MWh when considering full-lifecycle emissions.

The most challenging weeks in this simulation were all during late autumn or winter and were characterised by above average demand, poor solar generation and poor wind generation. On the other hand, both wind and solar performed very well on the day with highest demand, which was a hot summer day.

Approximately 9 GW of ‘Other’ generation was required to firm the renewable supply during the most challenging night of the simulation. Over the 3-years of this simulation it would have run at a capacity factor of 4%.

FAQs

How many GW of wind and solar will it take to reach this target penetration?

Based on current demand levels as was done in this simulation, it will take approximately 41 GW of wind, 19 GW of utility PV and 39 GW of rooftop PV, based on assumed capacity factors of 34%, 25% and 15% respectively. However, it is likely demand will more than double over the next couple of decades as we electrify sectors such as transport and heating.

Does your model assume perfect foresight?

For the first 6 days of each 7-day simulation, my model assumes 24 hours perfect foresight. That is, it knows exactly what the wind, solar and demand will be 24 hours in advance. AEMO can reasonably accurately predict these quantities 24 hours in advance (and beyond), though not perfectly. For the last day of my 7-day simulation, the length of the perfect foresight linearly reduces to zero hours.

Does your simulation change the weightings between states, to reduce the influence of South Australian wind which is currently over-represented, and to increase the weight of QLD wind which is currently under-represented?

No, this simulation applies the same scale factors to renewables in each state, which makes the simulation conservative.

What efficiency have I assumed for the storage?

90% 2-way efficiency.

Have you modelled increased demand due to electrification of other sectors?

No, this study used demand exactly as it was. I would like to model increased demand in the future; however the shape of future demand profiles is highly debatable.

David Osmond is a Principal Wind Engineer at Windlab, where he has worked since it was founded in 2003.

You can read his progress report after the first year of simulations here: A near 100 per cent renewables grid is well within reach, and with little storage, and after the second year of simulations here: A near 100pct renewable grid for Australia is feasible and affordable, with just a few hours of storage