Welcome home! After a week away on holidays, one of the first emails we opened on our return was an “eff-you” from our recently signed up government-owned electricity retailer, announcing that our tariffs would rise by up to 25 per cent from July 1.

“The price of your electricity is about to change,” Momentum Energy told us in the email.

And how!

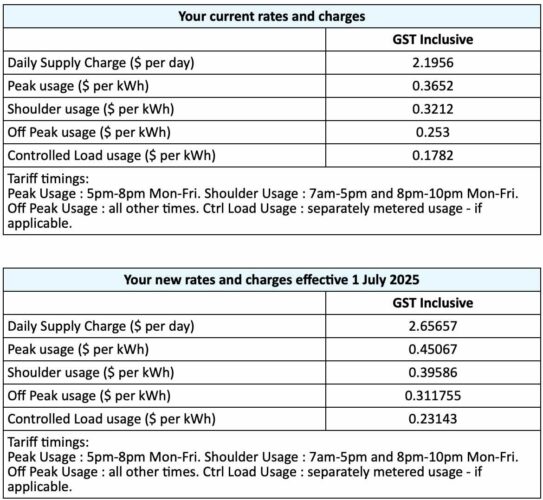

The peak rate will jump 25 per cent to 45c/kWh from 36.5c, the shoulder rate will jump to 39.6c/kWh from 32.1c, and the off peak leaps to 31.2c/kWh from 25.3c. Even the controlled load jumps to 23.1c/kWh from 17.8c/kWh.

Worst of all, the daily supply charge – the cost of being connected to the grid – leaps to $2.66 a day from $2.20, meaning that we will pay a fixed charge of $970 a year in northern NSW before we import, or export, our first kilowatt hour of electricity.

The solar feed in tariff remains steady at 5c/kWh.

How are these price hikes justified? Momentum doesn’t tell us much in the email.

“When we review our pricing, we consider all the costs of providing electricity to our customers, including wholesale electricity costs, network charges, government levies and environmental schemes, and our own retailer costs including operating expenses,” it says.

“Our review shows that some of these costs have changed, and this has influenced the price of your electricity.”

But in its latest review of prices for the coming financial year, the Australian Energy Regulator advised that the default market offer price in NSW should only rise by 9.7 per cent, not by nearly 25 per cent.

This system of AER price decisions, and the structure of the DMO, has been widely criticised precisely because it allows, and some argue even encourages, this sort of behaviour.

Ministers want the AER to have a rethink about the design, and Energy Consumers Australia says it is pointless if it is pitched 25 per cent above the market offers. Now, it seems, the market offers are jumping 25 per cent to meet the DMO.

See: Regulatory safety nets not fit for purpose as energy consumers fall victim to rapacious utilities

And: Energy ministers push for rethink on how regulator sets electricity price benchmark

Sure enough, Momentum’s email boasted that our new offer was “4 per cent” below the DMO.

And when we rang the Momentum help line – as a customer – we were told that we had been on a good plan, and that Momentum is now “closing the gap.” And no, there was to be no bargaining, no lower cost deals on offer.

Later, a Momentum spokesperson said: “The vast majority of Momentum customers are on deals at or below the Default Market Offer and will remain below the updated Default Market Offer after this price variation takes effect.

“The average price increase for Momentum residential customers where the DMO applies was 14.8%, however, those on cheaper deals may have received larger increases.”

The AER says customers are encouraged to shop around for better offers. Momentum is not offering one, and it is reported that the biggest retailers, AGL Energy and Origin Energy, are also bumping up their offers by more than the rate stipulated by the DMO, and by 13.5 per cent in NSW.

The AER’s promise and urging of “shopping around” may be of little use.

This is not the first time we have been treated in a cavalier fashion as a customer by an energy retailer. Last year, I wrote of our experience after a “smart meter” was installed at our previous property, and we were transferred – without any warning or advice – to the default market offer.

See: Bill shock: Energy retailers have a nasty surprise with smart meters and time of use tariffs

We found out only when we saw the quarterly bill. Origin was terribly apologetic and tried to tell us that this had not happened to others (ah, really, just to one of the few energy reporters in the country?), and the regulator quickly made it clear that such actions would not be tolerated.

But the grim reality is that the utilities are profiting at consumer expense. They have been able to write the rules of the market in the image of their preferred business models, and for more than two decades even managed to prevent the regulator and policy makers from dialling in climate factors and emissions into their deliberations.

Now they just rort the market. The AER is seemingly powerless to do anything about the “legal” gaming of the system, which allows the big generators to take advantage of scarcity and the lack of competition to jack wholesale prices up to the market cap, and then pass on those hefty costs to consumers.

The depressing issue with Momentum Energy is that it is not a privately owned company desperately trying to shore up investor returns and dealing with imposing executive KPIs.

Momentum is owed by Hydro Tasmania, the utility owned and controlled by the cash-strapped state government, and who, we naively assumed, was still interested in electricity more as an essential public service than a profit centre. It returned $122 million in dividends to the state government last year.

Hydro Tasmania boasts of being Australia’s largest producer of renewable energy, thanks to its legacy hydro generators, although it has recently re-repurposed its hydro portfolio as a “flexible” generator rather than the “baseload” that it had previously assumed. That has resulted in a big increase in wholesale costs in Tasmania.

See: Tasmania’s hydro power hits record lows as trading strategy shifts from baseload to firming

That is partly due to the challenge of maintaining dam levels in the midst of a drought, and also the growth of variable and lower cost energy sources such as wind and solar – with Tasmania soon to host nearly a gigawatt of large scale solar capacity as its first three big solar farms are built and brought on line.

But the bigger picture is not just the cost of living issue. The energy transition is at stake because, inevitably, the uptake of renewables is blamed for the price increases, even though the evidence points to the growing cost of networks, the failure of ageing coal fired power stations, and the high cost of gas.

The energy retailers go out of their way these days to tell customers how much they value their customers. But this is strictly a numbers game for them.

And there is probably no better time than to get or add to your solar system, and tap into the federal government’s battery rebate. But with a fixed charge of nearly $1,000 a year, there is still a hefty bill to pay.

Note: This story has been updated with comments from Momentum Energy.

You can read more here, with this latest story: “On a hamster wheel:” More state owned energy retailers jack up prices to “close gap” on DMO