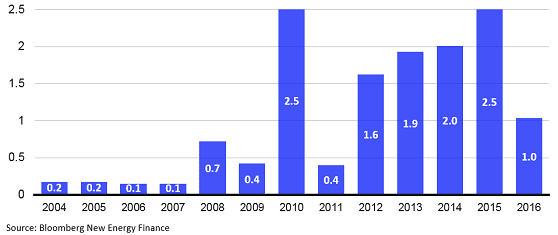

Global investments in renewable power dropped the most on record in 2016 as demand in China and Japan faltered, according to Bloomberg New Energy Finance research published on Jan. 12. Worldwide spending on clean energy fell 18 percent from 2015’s record high, to $287.5 billion.

However, even as spending ebbs, the amount of wind and solar connected to power grids around the world is still climbing: the total jumped 6.6 percent in 2016, according to BNEF.

That’s in part because investors are getting more for their money as competition and technological advances have dramatically reduced the price of photovoltaic panels and wind turbines.

Spending in China tumbled 26 percent to $88 billion from an all-time high in 2015. China’s electricity demand has stagnated and the government has cut subsidies for wind and solar power. Spending in Japan slumped 43 percent to $22.8 billion.

Meanwhile, China was helping boost growth in other sectors, partly by cutting subsidies at home. BYD Co., China’s largest electric vehicle maker, is setting up two new factories in Latin America this year to produce electric buses as it seeks to overcome obstacles in selling them to more cities at home.

The new factories will produce for the local markets and add to existing plants in the U.S., Hungary and Brazil. Expanding overseas has proven easier in some cases than expanding in China, said Senior Vice President Stella Li.

Billionaire founder Wang Chuanfu started BYD as a manufacturer of handset batteries and is pushing the company into the mono-rail business, identifying it as its next major growth area after building the company into the biggest producer of electric vehicles in China.

Over in Europe, the year has started with a bang for so-called green bonds, or at least for planned green bond issues. In Italy, Enel SpA’s financing unit arranged its first green bond for institutional investors, with a 1.25 billion euro ($1.32 billion) offering to support renewable energy projects and power grids.

The bonds will pay a 1 percent coupon and mature Sept. 16, 2024, according to a statement Jan. 9 from the Rome-based utility owner. The bonds are backed by a guarantee from Enel and received investment-grade ratings from three major agencies. The issue is expected to settle Jan. 16 and the notes will trade on the Irish and Luxembourg exchanges.

Separately, France plans to issue more than 20 billion euros ($21 billion) within three years of a class of bond that specifies proceeds must be used for environmental projects in areas like renewable energy, said Anthony Requin, chief executive of Agence France Tresor, the government office handling debt issuance.

An initial offer of green bonds that began marketing last week will raise at least 2.5 billion euros, Requin said. Further sales will follow, amounting to 20 billion euros “over two to three years including 2017,” he added. The deal marks the second use of green bonds by a sovereign issuer, following Poland’s 750 million-euro sale in December.

Beyond bonds, the past week has seen a few firsts in other new energy investments. In Latin America, the Brazilian city of Barueri will build the country’s first power plant to incinerate urban solid residential waste and turn it into electricity, the plant’s builder said Jan. 9.

Environmental consulting firm Foxx Haztec will begin construction of the $100 million power plant in the next few months and expects to complete it by early 2019. It will have the capacity to incinerate 825 metric tons of urban solid waste per day and generate 17.5 megawatt hours of electricity. Foxx Haztec will buy technology from Scandinavia.

In the U.S., power generator NRG Energy Inc. and Japanese energy producer JX Nippon Oil & Gas Exploration Corp. completed the world’s largest system to capture carbon dioxide produced from burning coal at a power plant.

The $1 billion Petra Nova project, which collects carbon emissions from an existing coal-fired power plant southwest of Houston, passed testing in late December and was turned over for operations, the companies said Jan. 10. The carbon dioxide is sent by pipeline to an oil field jointly owned by NRG, JX Nippon and Hilcorp Energy Co. where it can be used to draw crude out of the ground.

Also in the U.S., the prospect of newly designed nuclear reactors edged closer to reality when NuScale Power LLC applied for design certification for its 50-megawatt small modular reactor from regulators. But don’t hold your breath — the application submitted to the Nuclear Regulatory Commission contains 12,000 pages of technical information and is expected to take 40 months to review, the Corvallis, Oregon-based company said.

In India, AES Corp. and Mitsubishi Corp. announced the first grid-scale storage project. They agreed to build a 10-megawatt system to support wider use of renewable energy on the grid operated by Tata Power Delhi Distribution Ltd. AES and Mitsubishi will own and operate the system, which will demonstrate the batteries’ ability to improve reliability, according to a statement Jan. 12.

Finally, and as Donald Trump’s inauguration as U.S. President approaches, New York and California both showed they have a renewables agenda of their own.

New York Governor Andrew Cuomo agreed to provide $360 million for 11 clean renewable-energy projects that are expected to leverage almost $1 billion in private investment.

The wind, solar and hydroelectric power plants will have as much as 260 megawatts of capacity and will sell electricity at an average cost of $24.24 a megawatt-hour under 20-year contracts, according to a statement Jan. 12 from New York State Energy Research & Development Authority, which is administrating the funds.

The investments will help New York meet its goal of getting 50 percent of its electricity from renewable sources by 2030, a key component of Cuomo’s effort to reduce emissions of greenhouse gases that cause global warming.

California, for its part, is considering a system to protect projects that cut global-warming emissions from a market downturn that may worsen under a Trump administration.

The state may guarantee the money these project developers get for emission-reduction credits by auctioning options that oblige California to pay a minimum price for them, based on measures the state’s considering. Having a buyer of last resort encourages private finance.

Source: BNEF. Reproduced with permission.