It has been estimated that around one quarter of the revenue earned by Australia’s electricity generators – and nearly all their profits – come from a short period – between 36 and 100 hours – of “super peaks” of demand that push wholesale electricity prices beyond $5,000 per megawatt hour or more. But what if those peaks never came?

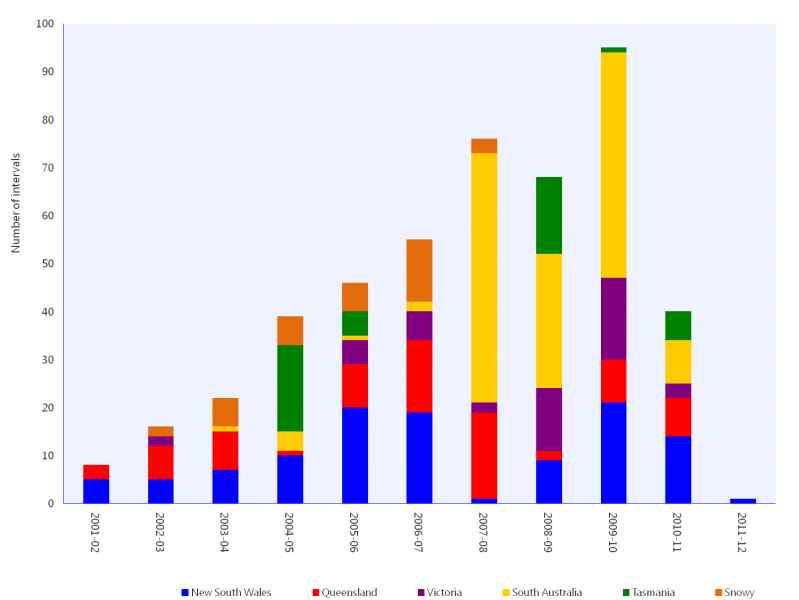

We’re about to find out, because this graph below published by the Australian Energy Regulator reveals that there were virtually no peaks above $5,000/MWh in 2011/12. The graph tells the story for previous years.

The returns for Australia’s generators for this period have not yet been announced, but as we saw in the December half with Loy Yang A’s plunge into the red (before its purchase and refinancing by AGL Energy) those generators with high debt levels will be suffering badly. Those generators owned by vertically integrated companies can take it on the chin and offset it with higher earnings from their retailing operations.

Sadly, the record low wholesale costs being recorded this year in the NEM are not passed on to consumers. At least not yet.

And what is the reason for the disappearing peaks? For that we can go to the Australian Energy Market Operator report and find that milder weather (fewer extreme hot days when everyone flicks on their air conditioners at the same time), reduced demand from manufacturers, more efficient and cautious use by commercial and residential users in the face of higher retail prices, and the growing impact of rooftop solar (its deployment trebled in the past year). Welcome to the merit order effect.