As Australia’s energy transition accelerates, data from the National Electricity Market (NEM) and Western Australia’s Wholesale Electricity Market (WEM) further underscores how renewables are systematically displacing gas generation.

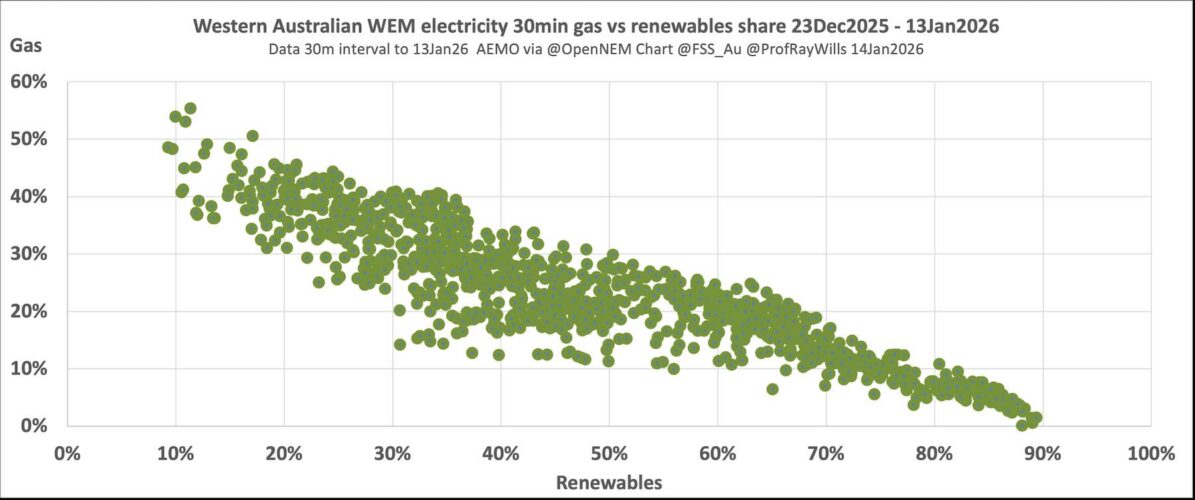

Two scatter plots, based on 30-minute interval data from 24 December 2025 to 13 January 2026, reveal distinct dynamics in these grids, highlighting the diminishing role of gas even in short-term operations.

In eastern Australia’s NEM, the plot shows a tight negative correlation between renewables’ share and gas penetration. Gas rarely exceeds 10% of supply, even when renewables dip to around 20-30%. As renewables climb above 50%, gas approaches zero, with data points clustering densely and sloping downward.

This reflects the NEM’s diverse renewable mix – solar, wind, and hydro – allowing for reliable displacement without heavy gas fallback. Despite gas’s low volume share, it remains influential in price setting during peaks, as we’ve seen in specific pricing events, and in broader trends where higher gas correlates with elevated costs.

Contrast this with the WEM, the world’s largest isolated grid. Here, the correlation is also negative but with greater variability and a steeper threshold. Gas can surge to 60% at low renewables (below 20%), underscoring its historical dominance in Western Australia’s smaller, solar-heavy system.

However, significant gas reduction only kicks in above 80% renewables, and near-elimination requires 90%+ renewables.

The scatter reveals more spread, indicating vulnerability to intermittency, yet also potential for rapid shifts during optimal conditions – often aided by batteries absorbing excess solar and extending dispatch, as we reported earlier in RenewEconomy.

In our piece, The rise of battery storage and why the grid is rapidly passing gas, we detailed how batteries are outcompeting gas for firming roles, driving down prices as their penetration grows.

In that analysis, NEM battery dispatch reached 1.5-1.7% by late 2025, stabilising renewables at 40-60% with fewer price spikes. The WEM’s higher battery share (up to 25%) mirrors this, enabling those 80-90% renewable thresholds to squeeze gas further.

Together, our new graphs affirm batteries’ pivotal support, turning intermittent renewables into a dominant force.

Australia’s grids are world-leading in this shift: renewables on the NEM now average ~50%, and the WEM pushing 55%. With no signs of instability, these insights signal that scaling storage and renewables can marginalize gas entirely, slashing emissions and costs.

Policy makers should prioritise this trajectory – accelerating battery deployments and grid upgrades – to lock in a net-zero future. As data accumulates, the message just gets more certain: the era of gas is passing quickly.

Ray Wills is Adjunct Professor at The University of Western Australia and managing director at Future Smart Strategies

Peter Newman is John Curtin Distinguished Professor at Curtin University