A huge solar and battery project near the city of Port Pirie has landed a “first of its kind” financing package and will be built in time to help the state of South Australia reach its landmark target of 100 per cent “net” renewables by the end of 2027.

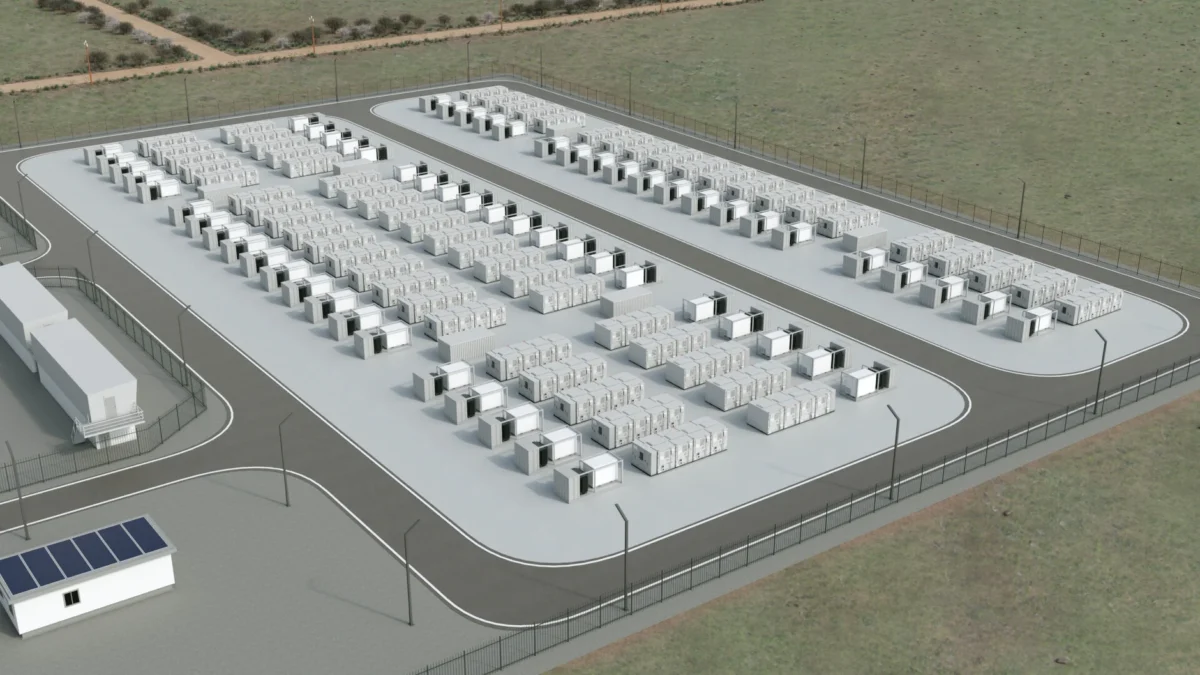

The Bungama project – owned by Toronto-based Amp Energy – will feature a 339 MW (DC) solar farm and a 250 MW, 500 MWh big battery storage system – both of which would be the largest in the state if operating now.

The non-recourse senior debt finance has been provided by two Australian institutions – CBA and Westpac – and Export Development Canada on a fully merchant basis, a first for battery storage in the country. Capital is also being provided by Amp Energy backer Carlyle, the major international investor.

Daniel Kim, the former head of Ark Energy who now heads Amp Energy, says the project will help propel the state towards the net 100 per cent renewable target, and boost energy reliability and security on the grid.

Bungama is the first of a series of solar and battery projects that will support the company’s ambitious green hydrogen and “power to X” projects in the state.

Stage 1 of the project, which comprises a 150 MW, 300 MWh battery, began construction in October last year. Stage 2 will be the rest of the battery and stage 3 will be the solar component.

“This milestone is a significant achievement for Amp and marks a crucial step in our mission to build a high-quality Power-to-X platform in Australia and accelerate the energy transition,” Kim said in a statement.

South Australia is already operating at an average of more 72 per cent renewables, which is the highest in the world for a region with no hydro or geothermal.

Bungama is one of a number of new projects that will deliver the net 100 per cent renewables target, including the 412 MW Goyder South wind farm under construction, and the Goyder North and Palmer North wind projects that both won contracts in the federal government’s Capacity Investment Scheme.

A number of big battery projects are also under construction, or about to begin, including the Blyth, Templers, Limestone Coast, Hallett and Clements Gap projects, along with the Emeroo and Solar River.

Amp Energy has two other big solar and battery projects in the pipeline in South Australia, at Robertstown and Yorndoo Ilga, and has big plans for a potential multi gigawatt scale green hydrogen electrolyser at Cape Hardy supported by another 2.5 GW of wind and solar to be built on the Eyre Peninsula.

It owns two operating solar farms – Hillston and Molong – in NSW and it has a total pipeline of projects that includes 1,500 MWh of battery storage, 2,059 MW of solar PV, 1,400 MW of wind, and the Cape Hardy green hydrogen project.

Carlyle’s head of global infrastructure Richard Hoskins says he expects Amp Energy to become a leading developer and operator of renewable and battery storage projects in Australia.

“Carlyle is pleased to provide the capital necessary to enable such an important project to start construction,” he said.

CBA’s head of energy Neil Fraser said the Bungama battery will play a critical role in a region with the highest penetration of wind and solar in Australia, while Westpac’s Jon Pooley said the project is the first to be financed by commercial lenders on a full merchant basis.

Amp has previously announced that Finnish-based Wärtsilä will supply the battery and provide a long-term service agreement. Enerven is the balance of plant contractor and ElectraNet is currently building a 275kV transmission line to the site. The first stage of the battery is expected to begin operations early next year.

Amp was commercially advised on the financing by Victor Martinez. Ashurst advised in multiple areas of project development and acted as borrower’s counsel with White & Case acting as lenders’ counsel. Transaction due diligence advisors were Ashurst, Aurora, Arup, Alvarez & Marsal, JPA, and Aon.