Australia’s solar market is in the midst of “dramatic changes,” new data has shown, including a significant shake-up of top-selling inverter and panel brands, as retailers struggle to squeeze profits out of a relentlessly tough market.

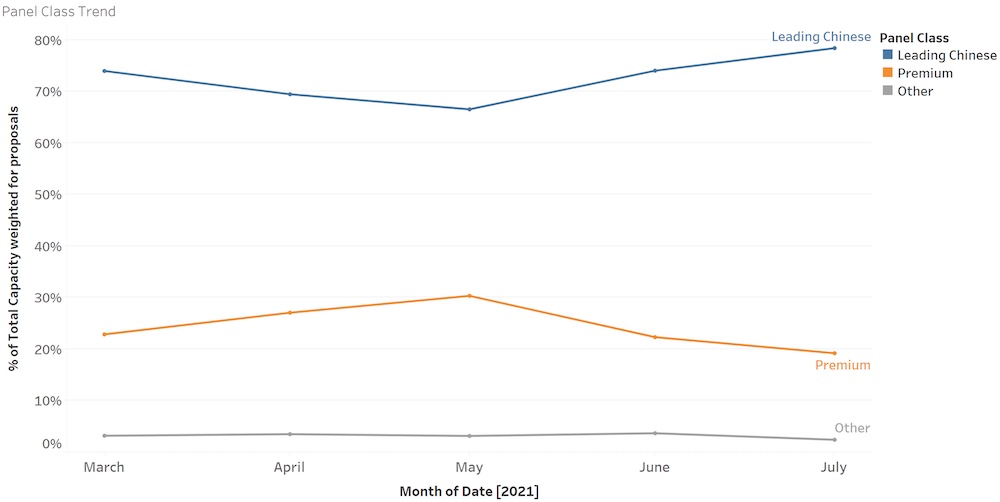

Industry analyst and statistician SunWiz reports that premium panel brands have lost significant market share over the past two months in Australia, as part of a trend towards lower-priced equipment.

That shift to lower price panels is the result of significant price pressures, owing to rising prices of solar panels, falling feed-in tariffs, rolling nation-wide Covid-19 lockdowns, and public concerns about the impending rooftop “solar tax.”

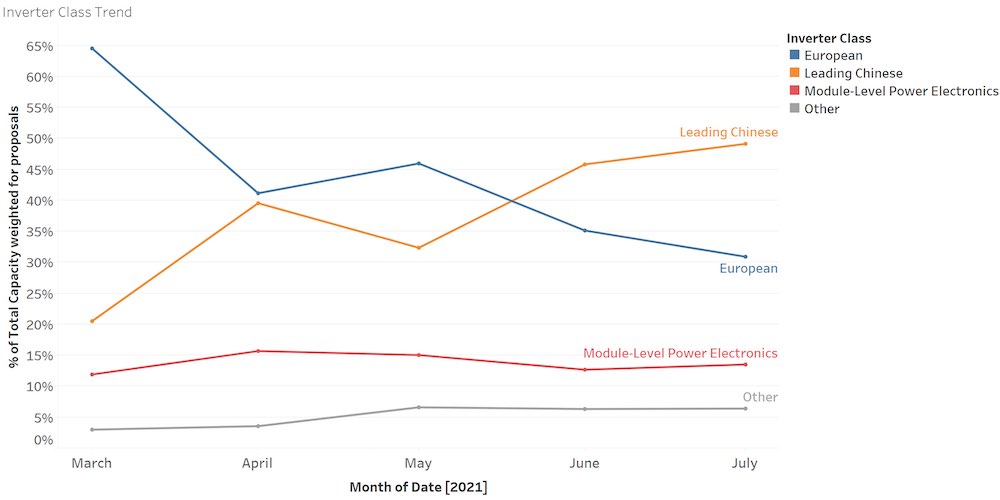

And the impact is not only being seen in the solar panel market. According to SunWiz, it has also meant that, for the first time in many years, the number one inverter manufacturer is not European in origin.

“We see that there’s dramatic changes afoot within the market share of individual manufacturers of both inverters and panels,” said SunWiz managing director Warwick Johnston.

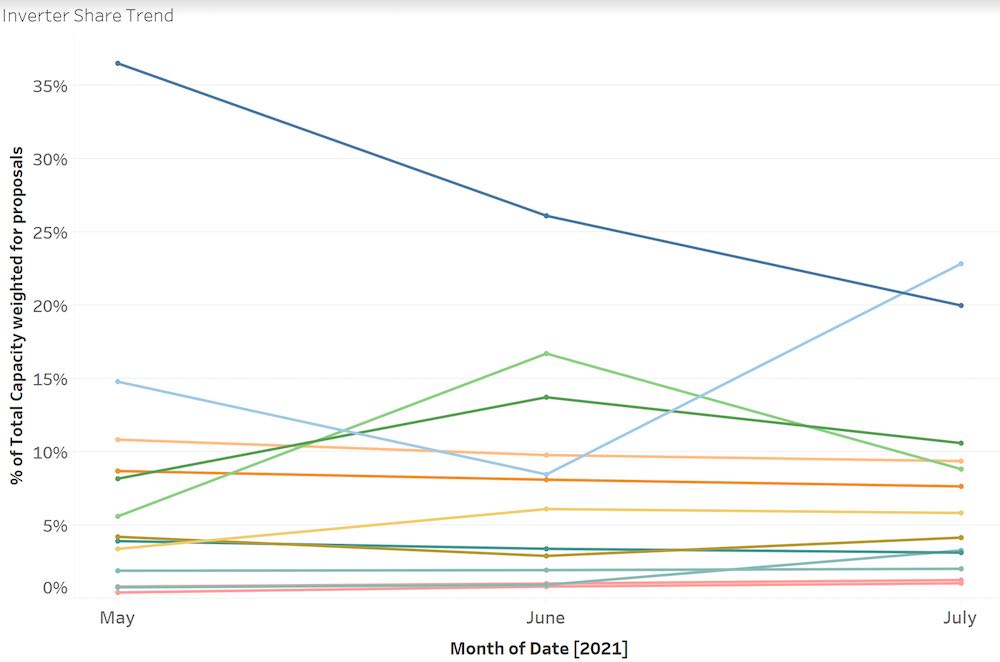

“In the inverter market, the erosion of the leader’s market share is clearly shown in the chart (above) – what’s also interesting is the ups-and-downs of the manufacturers jostling for position.

“As SunWiz’s MarketView services show, this is just part of a trend in recent months towards lower-priced equipment.

“The chart below illustrates a trend away from European inverter manufacturers towards the leading Chinese inverter manufacturers. Even Module-Level Power Electronics (e.g. microinverters) are losing some market share,” Johnston said.

“And the trend is also affecting solar retailers’ choice of panels. The chart below indicates premium panel brands have lost significant market share.”

As SunWiz notes, all of this is happening at a time when the solar industry is being buffeted by a string of different price problems, stemming from global shortages of raw materials such as polysilicon, glass and silver, and exacerbated by soaring shipping costs.

Sources in the solar shipping industry have told RenewEconomy that prices for shipping container-loads of panels have increased exponentially – from while the logistics have become increasingly fraught due to a huge Covid-driven spike in shipping demand and export limits from China.

The source, who wished to remain anonymous, said the per-container cost of shipping solar products from Shanghai to Australia has ballooned from $1800 to a post-Covid price of $9,000-plus.

Panel prices, meanwhile, PV panel prices have been under almost constant pricing pressure since the onset of the Covid-19 pandemic in early 2020, from a relentless combination of the above-mentioned inflated freight costs and shortages of key solar panel ingredients, including glass and polysilicon.

“As the prices of panels trends upwards, it seems that some manufacturers can temporarily gain market share by being the last to raise their prices. However, this effect isn’t very sticky, as shown by the dynamic moves amongst the market share of individual panel manufacturers in the chart below,” Johnston said.

“In our current environment, the challenge is that reducing prices also reduces total profit, and many businesses already have narrow margins.

“It’s a short-term focus that can distract solar businesses from addressing the foundational factors that drive profitability: differentiation, sales skills, and business process automation.”