Eastern Australia is an exciting place at the moment. It’s home to the world’s largest battery (for now, at least) and is tackling the challenge of integrating growing amounts of renewable energy into one of the world’s longest interconnected energy systems.

In the east-coast National Electricity Market (NEM), demand response (DR) is playing an increasingly important role in facilitating this transition—approximately 180 MW of new DR resources have entered the ancillary services markets in the past six months alone.

Since EnerNOC has developed the bulk of this new demand response capacity, we thought we’d share some details on how it works and the impact these new resources are having on the NEM’s ancillary services markets.

A recent rule change in NEM allowed independent DR aggregators to bid into the NEM’s Frequency Control Ancillary Services (FCAS) markets for the first time beginning in July 2017, and it only took a few months for DR to arrive and make an impact.

A recent report by the market operator AEMO found that the entry of the new grid-scale battery (known as the Hornsdale Power Reserve) and EnerNOC’s DR resource into the markets were the major drivers behind a 57% reduction in FCAS costs between Q4 2017 and Q1 2018.

What are Frequency Control Ancillary Services, and what role do they play?

Frequency Control Ancillary Services (FCAS) are the services AEMO procures around-the-clock to ensure grid frequency remains tightly controlled around the nominal 50 Hz. There are two types of FCAS:

- Regulation FCAS involves AEMO continuously dialing some generators (and batteries) up or down every 4 seconds to correct for small imbalances between supply and demand.

- Contingency FCAS involves AEMO procuring resources to be on standby to respond automatically when large, unexpected events occur on the power system, such as the trip of a transmission line or (more commonly) the trip of a large generator. Contingency FCAS resources are sometimes referred to as “spinning reserve”, though that term is becoming a misnomer because FCAS services are increasingly being provided by resources like batteries and DR that do not “spin” the way a synchronous generator does.

When a large online generator “trips” and stops generating electricity unexpectedly, the balance between supply and demand on the system is thrown out of whack and system frequency dives below 50 Hz. In this circumstance, the system has a matter of seconds to restore the balance by either increasing generation or reducing demand.

Failure to restore the balance quickly enough can result in involuntary load shedding or, in the worst-case scenario, a black system. Every grid operator in the world procures some flavour of Contingency FCAS resources in order to protect against generator trips, which occur inevitably from time to time.

The NEM’s fleet of thermal generators is ageing, and there have been several significant unit trips so far this year, including instances where multiple generators tripped in rapid succession. Earlier this month, three separate unexpected generator outages occurred in a single day.

The NEM’s FCAS resource mix is changing rapidly

The NEM has traditionally sourced its contingency FCAS resources from synchronous generators, which are paid to maintain “headroom” so that they are able to ramp up and increase output on short notice.

But starting in October 2017, EnerNOC and the Hornsdale Power Reserve battery both entered the Contingency FCAS markets and have carved out a 16% market share between them on average so far in 2018.

This has put downward pressure on FCAS prices and displaced some incumbent suppliers. FCAS costs are ultimately borne by consumers, so the extra competition in the markets should help to reduce the cost of ancillary services over time.

In addition, the NEM saw a wind farm bid into the contingency FCAS markets for the first time ever in 2018, as part of a trial supported by the Australian Renewable Energy Agency (ARENA). After many years without a new entrant, the past six months have seen the NEM’s first grid-scale battery, first aggregated demand response resource, and first wind farm register to begin participating in the FCAS markets.

Demand response and batteries are providing FCAS continuously

The chart below shows the “Fast Raise” Contingency FCAS resources procured by AEMO over a recent four-day period. If a large generator were to trip at any point in time, these are the resources that would fill the gap to replace it within 6 seconds.

AEMO procures a varying amount of Contingency FCAS throughout the day, typically in the neighbourhood of 400 MW. The amount varies based on the largest online risk (“credible contingency”) on the system (usually the Kogan Creek generator—a single 750 MW turbine) and the level of system demand.

During the four days in the chart, the Hornsdale battery (red) was available to supply a continuous 63 MW of FCAS, and EnerNOC’s demand response (dark green) was available to supply a nearly continuous average of 52 MW. The remainder was primarily procured from coal-fired generators.

During the period shown, the quantities procured from coal-fired generators seem to vary throughout the day. This isn’t because coal units are any more flexible than batteries or demand response, but rather because FCAS sourced from the NEM’s coal units is generally more expensive, and thus less likely to clear the market.

How a distributed “Virtual Power Station” contributes to the FCAS market

EnerNOC’s demand response resource is sourced from a distributed network of 45 special controllers installed at 30 different commercial and industrial sites around the NEM. Our participating customers include cold stores, data centres, water corporations, wood processors, and universities—to name a few.

Each controller senses grid frequency and automatically and safely switches off carefully chosen loads when a low frequency is detected. We typically don’t take entire facilities offline, but rather targeted, flexible portions of a business’s operational load.

EnerNOC has offered and cleared as much as 105 MW of demand response in the FCAS market, at times when all of our customers are operating (using electricity) at the same time.

Due to varied customer availability throughout the day and throughout the year, EnerNOC’s average cleared FCAS volume in 2018 YTD is approximately 32 MW. We are still commissioning some new customers, so EnerNOC’s resource will continue to grow in size over the remainder of 2018.

In recent weeks, Hydro Tasmania has also leveraged the recent rule change to register as an aggregator, and it has at times offered as much as 76 MW of interruptible load into the FCAS market. Combined with EnerNOC’s 105 MW, this makes approximately 180 MW of new demand side resources that have begun participating in just the past six months.

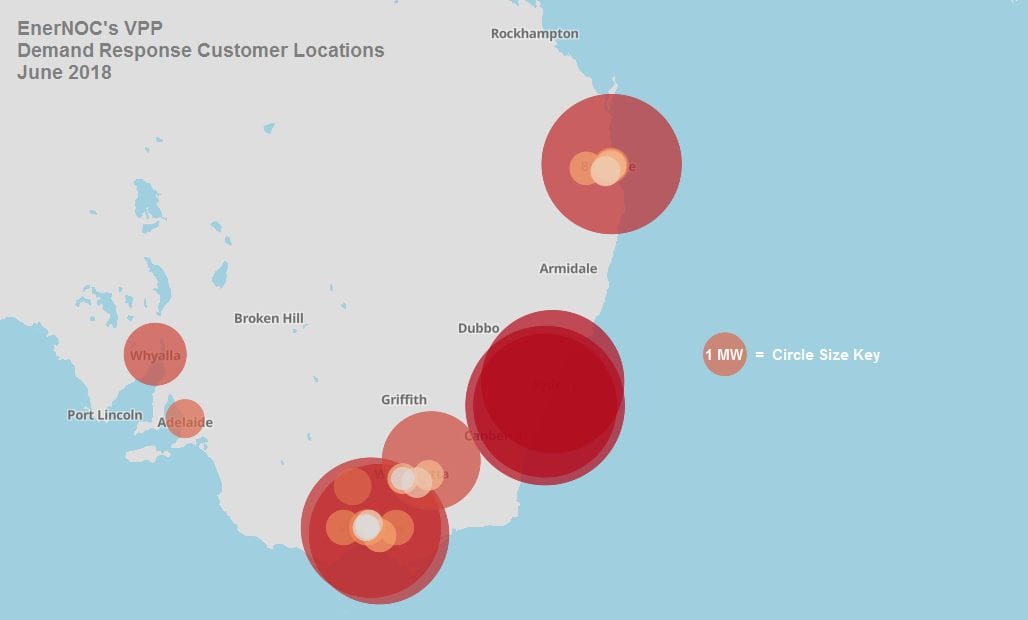

The map below shows the location of EnerNOC’s 30-odd FCAS customer sites around the NEM. About two-thirds of our customer sites contribute less than 1 MW of response during each FCAS event.

Individually, these small sites are too small to participate in the FCAS market by themselves, but by contributing to EnerNOC’s aggregated resource, these small sites are able to participate and earn payments from the wholesale FCAS market for their contribution to maintaining system frequency.

EnerNOC’s customers use existing on-site energy storage to provide flexibility to the grid. While the term “storage” makes most people think of batteries, the term can also refer to the thermal storage inside a cold store or the process storage of a manufacturer outputting to a stockpile.

These types of industrial processes have latent storage that can be utilised to provide grid-balancing services without causing significant disruption to the business’ operations. Of course, batteries are a great source of flexibility too—indeed, some of our customer sites do use lithium-ion batteries to provide FCAS.

EnerNOC’s aggregated portfolio is the first distributed “dispatchable unit” in the history of the NEM. It is currently the only “power station” in the NEM that is not located in a single place—a concept known as a “Virtual Power Plant” (VPP).

It is also the first dispatchable unit that regularly grows in capacity. Each time EnerNOC commissions a new customer site and adds it to our aggregation, AEMO increases the registered capacity of the dispatchable unit.

EnerNOC was the first distributed dispatchable resource to register in the NEM, but we expect many more such resources to register in the future—it is only a matter of time before aggregated fleets of residential batteries appear in the FCAS markets.

The most interesting question isn’t when residential VPPs will enter the FCAS markets, but from whom: Will residential battery owners access the FCAS markets by switching onto specific retailers like Powershop? Or will an independent aggregator (perhaps a battery system manufacturer like Tesla) be the first to bring a residential VPP to the FCAS market?

For demand response, it’s all about market access for aggregators

It is worth pointing out that using DR to provide FCAS is not a new concept. EnerNOC and our customers have been providing these same grid services in places like New Zealand, Alberta, and Ireland for many years—and we would have entered the NEM sooner, if we had been allowed to.

While the NEM’s market rules have always allowed DR to participate in the FCAS markets, prior to July 2017 the rules restricted bids to “Market Customers” (i.e. retailers)—independent aggregators were prohibited. Without aggregators, DR participation was low—prior to July 2017, the only Market Customer to bid DR into the NEM’s FCAS markets was the Portland Aluminium smelter.

While independent aggregators have gained access and begun competing and making an impact in the NEM’s FCAS markets, they are still prohibited from bidding DR into the NEM’s wholesale energy market.

However, the Australian Energy Market Commission (AEMC) is mulling potential changes to the market rules that would allow aggregators to operate aggregated VPPs in the energy market. This is a hot topic in the NEM at the moment, and the AEMC is expected to make a decision sometime in the middle of this year.

Demand response provides a Fast Frequency Response (FFR)

As traditional synchronous generators are gradually replaced by inverter-connected generators like those used in most wind and solar farms, the level of inertia in the NEM will decrease. In a low-inertia system, following the trip of a large generator, the frequency falls faster and farther than it would (all else being equal) in a higher-inertia system.

This means the NEM will need faster-acting FCAS resources to arrest the falling frequency within seconds and then restore it to 50 Hz over a number of seconds to minutes. Importantly, the NEM is unlikely to need more Contingency FCAS resources (that would only be necessary if someone built a single generating unit larger than the 750 MW Kogan Creek unit), but it will need faster FCAS resources.

Fortunately, DR and batteries are able to detect low frequencies and respond very quickly, helping to ensure the NEM is equipped to remain secure in a low-inertia, high-renewable energy future.

The stacked bar chart below left shows EnerNOC’s aggregate response to a grid frequency “excursion” that occurred on 23 April, when a large coal generator at Loy Yang A power station unexpectedly tripped offline, sending the NEM mainland frequency to 49.55 Hz within a few seconds.

The X axis of the chart shows one second in time: half a second before EnerNOC’s low-frequency trigger point was reached (the yellow line), and half a second after. Across 26 controllers that were bid into the market at the time, EnerNOC’s resource in aggregate removed 27 MW of demand from the grid within 280 milliseconds—that’s 0.28 seconds!

The bar chart below right shows the same data, but inverted to look like a generator increasing its output. To the power system, EnerNOC’s DR has the same effect as if it were a generator ramping from zero to 27 MW in 280 milliseconds.

This type of “Fast Frequency Response” is much faster than any real-world synchronous generator is able to ramp, and will help ensure the NEM is able to control frequency effectively in a low-inertia future.

What comes next?

Over the next year, DR will continue to grow in size and FCAS market share. A handful of new grid-scale batteries are slated to connect to the system and will undoubtedly begin to compete in the FCAS markets, and it won’t be long until a residential VPP is participating as well.

The NEM will reap the benefits of increased FCAS market participation in the form of reduced FCAS costs, which will in turn reduce the burden on consumers.

From here, much of the focus will be on the AEMC’s Reliability Frameworks Review, where the AEMC will decide whether or not independent DR aggregators and distributed energy VPP operators will be allowed to participate directly in the wholesale energy market.

The future is impossible to predict, but one thing is certain—the NEM’s future resource mix will be increasingly distributed, and behind-the-meter resources such as DR will play an ever more prominent role in providing grid services that are fast-responding, dispatchable, reliable, and low-cost.