It’s been over a year since we “flicked the switch” at Stucco, turning on the first big battery bank in an Australian apartment.

So how has the Stucco Solar + Storage system performed? Has it lived up to our dreams of slashed power bills, carbon neutrality, and high levels of energy independence? How is the economics stacking up for Stucco (the owner of the system)?

Thanks to the system’s outstanding monitoring, with Enphase monitoring each panel and battery module and SwitchDin monitoring each apartment’s consumption, we have plenty of data to help answer these questions.

Before we do, a quick overview for any readers not familiar with the Stucco Solar + Storage project. Stucco is a housing co-operative in Newtown, Sydney, that has been providing affordable housing for 40 students of Sydney University since 1991.

In 2015 a group of residents developed a project to install a solar and battery storage system to reduce the resident’s power bills as well as their carbon footprint.

In early 2016 the City of Sydney awarded Stucco an Innovation Grant to help support this first demonstration of a Solar + Storage system in an Australian apartment, for the council recognises that apartments pose a major hurdle to their zero carbon plan.

The project proved to be quite challenging, requiring Stucco to first set another precedent with (what we understand to be) the first residential embedded network retrofit, as well as negotiating unprecedented battery fire controls and the building’s heritage status.

Eventually, in December 2016, with all approvals in place, Solaray Energy installed the 114 solar panels and 36 batteries to deliver Stucco 30 kW of solar capacity with 40 kWh of usable battery storage.

The Solar + Storage system is now the primary source of energy for the building and residents buy all their electricity from Stucco Co-operative, who acts as the embedded network manager and retailer.

Now, the data…

Impact 1: Slashed power bills for tenants

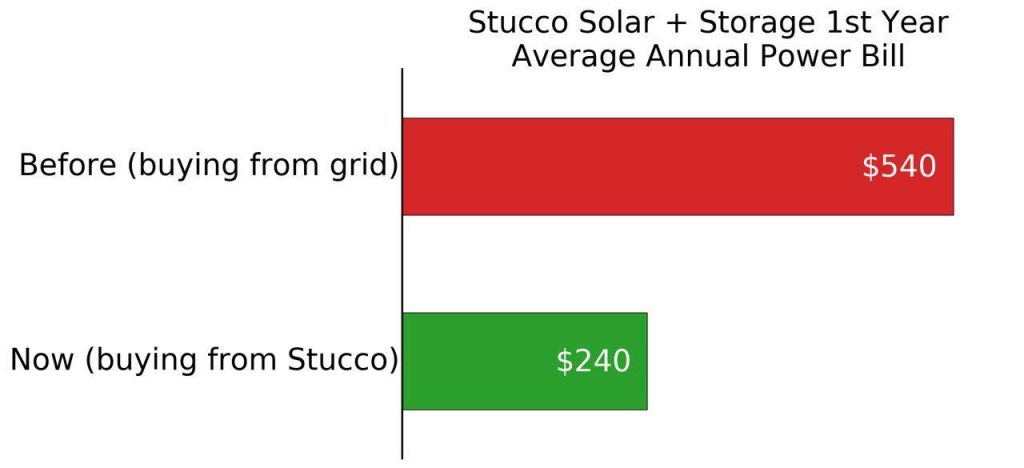

In 2017 Stucco’s tenants saved on 55% on their power bills!

The average resident paid $240 p.a. for all their electricity, including connection charges etc., compared to an estimated $540 if they were still buying from a grid retailer.

Individual’s bills and savings depend on the size and shape of their load profile and how this interacts with Stucco’s innovative Time of Use pricing structure with different rates for grid power and local power (from the Solar + Storage system).

Impact 2: Attractive returns on investment for Stucco

In 2017 the system generate over $10,000 of value for Stucco Co-operative. This comes from the sale of locally produced and stored electricity to tenants, plus income from the sale of excess solar power to the grid (FiT), plus savings on the Co-operative’s own bills for the common areas.

This gives a (simple) return on investment of 7.7% on full project costs of $130k, which is a payback period of 13 years. With the generous support of the City of Sydney, the ROI for Stucco’s investment of $50k is around 20%, or a 5 year payback.

While the 13 year payback period unfortunately exceeds the 10 years warranty period of the battery, this was forecast by our modelling, and mainly reflects the ambitious nature of the project and battery prices of late 2015 (which is a distant memory in this rapidly evolving market). The figures also highlight how effective grant funding can be in supporting early demonstrations of new technologies.

Ofcourse the ROI could be improved by increasing the rates charged to residents, but this runs counter to Stucco’s primary objective of providing affordable housing. The current pricing arrangement appears to strike a good balance between the interests of the co-operative and the residents.

Impact 3: Carbon neutral (?)

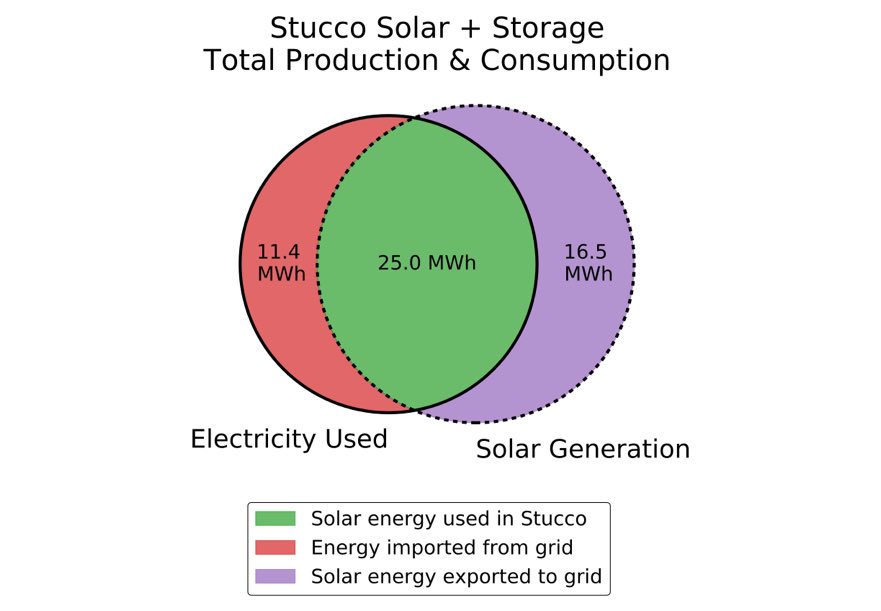

The solar system produced a total of 41.5 MWh of clean power in the year, exceeding the total electricity requirement of the Co-operative of 36.4 MWh.

Unfortunately the building still uses gas for hot water, but my (rough) calculations suggest that the CO2 equivalent emissions from the annual use of 8 MWh of gas is probably a little less than the CO2 equivalent emissions abated by the generation of 5 MWh of excess solar power (ref).

Impact 4: Highly self-sufficient

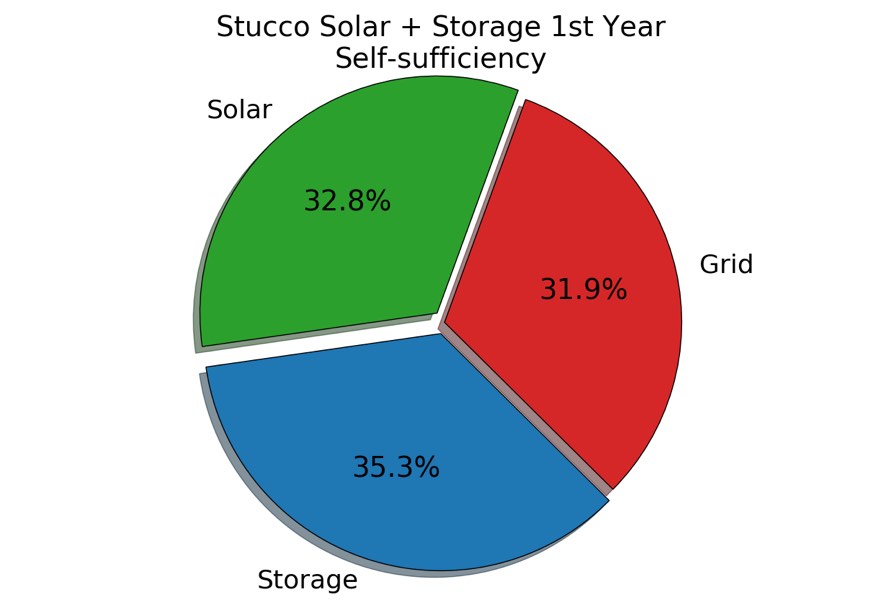

Across the year the building, and it’s 40 residents, was roughly two thirds self-sufficient. This is far greater than we had imagined would be feasible when we started the project, and is even slightly higher than the 60% forecast by our modelling.

A striking aspect is that, across the year, more solar power comes via the batteries than direct from the solar panels. Considering that the battery stored solar power is available during the peak hours, when electricity prices are tripple what they are in the shoulder period and quadruple what they are at off-peak hours, the batteries.

Bonus Impacts

In addition to the immediate impacts of the system we’ve been delighted by the community’s recognition of the project. It won a CEC Install of the Year award, a NSW Green Globe and the Tenant Lead Initiative award from the Australasian Housing Institute.

I was also fortunate to be awarded a 2017 Myer Innovation Fellowship to support me in setting up SunTenants as a social enterprise that builds on the Stucco experience to bring the solar revolution to Australia’s rentals.

Summary

After a year of operation the Stucco Solar +Storage system has proven to be a fantastic success for tenants, who’ve halved their bills, for the co-operative, that is receiving a healthy additional income stream, and for the planet, that is being spared 40 people’s carbon emissions.

What’s more, the system is demonstrating the viability of providing the majority of an apartment’s power needs from cheap clean solar power, with battery storage.

Reflecting back on the project I continue to be in full agreement with the late Lucky Chance, “you can never regret optimistic endeavor”.

Author: Dr Bjorn Sturmberg is founder of SunTenants.

This article was originally published on RenewEconomy’s sister site, One Step Off The Grid, which focuses on customer experience with distributed generation. To sign up to One Step’s free weekly newsletter, please click here.