News flow

From a corporate persepective the main transaction of the past week (to September 27) was Origin Energy’s sale of its “Lattice” Australasian domestic oil and gas assets to Beach energy.

The most jaundiced view of this transaction is that after adjusting for close out of an oil forward sale and purchase of minority interests in the offshore Otway assets, ORG’s net proceeds were not much above $1 billion for an asset that provided $355 million in ebitda in FY17.

More realistically, the forward ebitda multiple might be around 5 times earnings. This multiple points to the decline expected in production from most of the Lattice fields. Along with the decline in main Bass Strait production it re emphasizes that there aren’t many places to get gas in South East Australia.

Furthermore, ORG has agreed to buy the gas from Lattice/Beach at an escalating price over the next three years. This essentially locks in the underlying gas price for any industrial buyer. If ORG the wholesaler is paying an escalating market price, consumers can hardly expect to do better.

The above points again to one of the main advantages of renewables other than carbon. Renewables provide security against rising fossil fuel prices.

And it’s not just the gas price, but also coal.

Consider this quote about spot coal pricing from a recent Platt’s assessment

“Australian thermal coal Oct 2017-Sep 2018 term offer to Japan buyers opens at $100/mt FOB

Perth (Platts)–21 Sep 2017 955 am EDT/1355 GMT

Talks are currently underway in Japan to determine a benchmark price for deliveries of Australian thermal coal to Japanese customers for the year starting October 1.

The term contract negotiations started last week, with an opening offer price in three digits — around $100/mt FOB Newcastle — from a large Australian coal producer for shipments of its 6,322 kcal/kg GAR thermal coal, according to a market source.

Other market sources suggested a price outcome of $110/mt FOB Newcastle for the contract talks, which would represent a significant rise from the last October’s settlement price of $94.75/mt.”

Even if spot coal was readily available for power plants in NSW (and it’s not), it’s unlikely to be supportive of lower electricity prices.

Oil prices are struggling to get much above the US$50 mark this year but this still seems a low price relative to costs from a longer term perspective and the gas price is essentially linked to the oil price.

Turning to the weekly action

- Volumes: were lower than last year, down 2% across the NEM but up 3% in QLD, presumably due to warmer weather. Public holiday timing also influences demand. The real point about demand being flat for years on end is that replacement supply has to drive old supply out of the market rather than naturally fitting into a growing market. It’s one of many reasons why we think some decent electric vehicle policy in Australia would be useful.

- Future prices eased off a little this week with a noticeable 4% reduction in FY19 in Victoria and 2% in other States. It kind of looks like range trading at the moment.

- Spot electricity prices average in the $60-$80 MWh range across the NEM with some sharply negative prices seen in South Australia.

- REC. No change

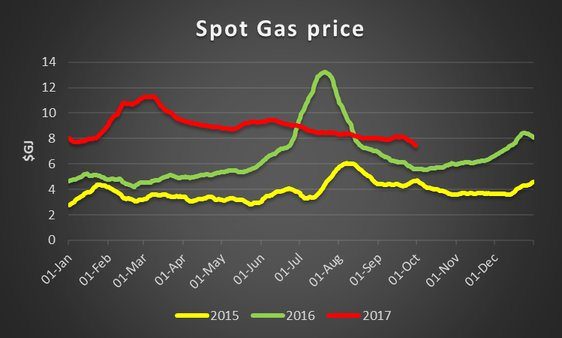

Gas prices .continued to soften and were averaging just $5.20 GJ in South Australia for the week and leading to a visible drop in our 3 State/30 day moving average

- Utility share prices. Over the week utility shares were generally a bit stronger recovering some of the losses of the past month.

Share Prices

Volumes

Base Load Futures, $MWH

Gas Prices

David Leitch is principal of ITK. He was formerly a Utility Analyst for leading investment banks over the past 30 years. The views expressed are his own. Please note our new section, Energy Markets, which will include analysis from Leitch on the energy markets and broader energy issues. And also note our live generation widget, and the APVI solar contribution.