“The pathway that we adopt is the 4 degree pathway”.

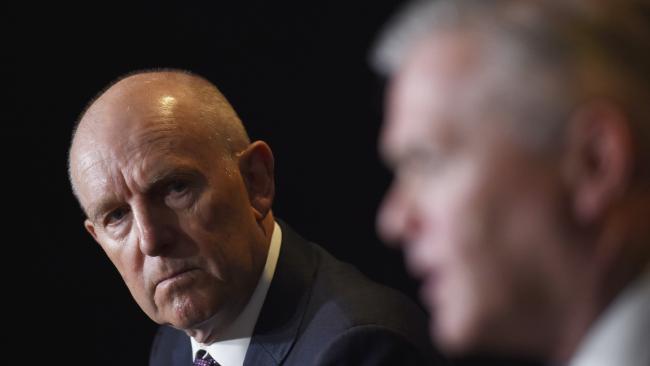

That was Peter Coates, the chairman of one of Australia’s largest and most controversial oil and gas companies, Santos, at the company’s Annual General Meeting in Adelaide on Thursday.

This startling revelation came in response to a question about what scenario analysis the company had conducted, and whether the results of such analysis would be disclosed to shareholders.

If we can put aside the catastrophic impacts 4°C of warming would have for human civilization, let alone Santos’ share price, the statement reveals much about the company.

Despite its lofty commitment to “align its business strategy with the Paris Climate Change Agreement”, the company clearly has no understanding of what that actually means.

Coates attempted to justify this position due to the lack of Nationally Determined Commitments (NDCs), consistent with 2°C. This may be true, but the investment community has been demanding companies plan for a 2°C pathway.

The reality is that there are valid policy pathways, but they’re simply not consistent with Santos’ business strategy.

In fact, just last week, a report from the Energy Transitions Commission – whose board includes representatives from Royal Dutch Shell and BHP Billiton – concluded that gas production can grow by just 2% to 2040, in order to limit warming to 2°C. And that is predicated on drastically reducing methane leakages.

Coates’ admission contradicts his entire industry’s sales pitch that gas is part of the solution to climate change. If gas really is the transition fuel to a low carbon economy, and the “perfect partner for renewables”, then why on earth does Santos not make the case for a 2°C pathway? Well, I think we know the answer.

Coates may have stolen the headlines, but those who lost the most credibility yesterday were institutional investors. The stewards of our retirement have long argued that engagement was the most effective tool with which to achieve change, as opposed to redirecting capital elsewhere, that is. And engage they did, compelling Santos to issue a ‘Statement on climate change disclosure’ less than a fortnight out from their AGM.

Santos committed to ‘review’ the recommendations of the Task Force on Climate-related Financial Disclosures, not implement them; and, issue a climate change report. About which, the company provided no parameters, no timeframes and no promise of any new information.

At Thursday’s meeting, neither the chairman nor the CEO Kevin Gallagher made a single mention of climate change, emissions or the disruption in the energy sector. Until, that is, they were forced to respond to questions from shareholders.

This is a company comfortable admitting that it hasn’t considered the risks a 2°C pathway poses to their business. This is a company that “doesn’t know or care” about the developments in battery technology and the impact it may have on gas demand. Institutional investors were sold, it seems, a lie.

Investors yesterday had the opportunity to send Santos a clear message that disclosure of climate risk matters, but they bottled it. Instead, they largely voted with a board that quite clearly is removed from the reality of climate change.

The question now is what they will do about it, because carrying down the path of failed polite engagement cannot continue to be an option.

Dan Gocher is an analyst and campaigner with Market Forces.