The Abbott government appears to have already blown its carbon budget, selling emissions abatement in the first round of auctions at a price that would make it impossible to meet even Australia’s modest 5 per cent cut in emissions by 2020 (from 2000 levels).

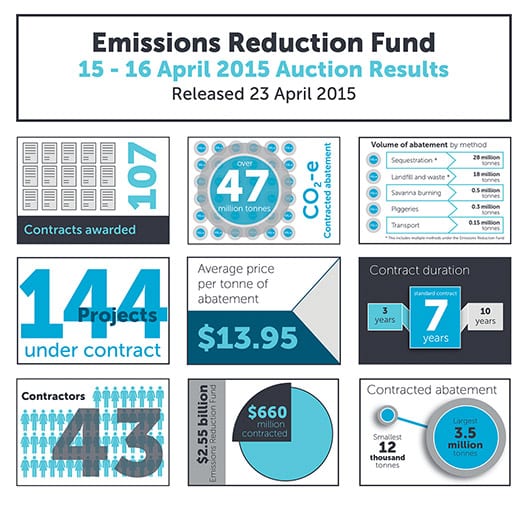

The Clean Energy Regulator said on Thursday said it had contracted to spend $660 million buy more than 47 million tonnes of abatement – mostly from carbon farming and landfill gas projects at an “average” price of $13.95.

It means that the government has theoretically met one quarter of its target at the first go, although nearly half the abatement bought in the first auction will not be delivered before 2020.

Unless the government can find much cheaper abatement, it will not be able to meet the target of buying around 236 million tonnes of CO2 equivalent to meet that 2020 target.

The Climate Institute said at these prices, the government would deliver only 15 per cent of its own 2020 target, but had already spent one quarter of its money. It would only meet 7 per cent of the target recommended by the Climate Change Authority, which calls for a 19 per cent cut below 2000 levels by 2020.

This is no surprise to market analysts, who have said it would be impossible to meet any target with the Direct Action policy. It should also be noted that the CER has said previously that its only task is to buy as much abatement as it can in its $2.55 billion budget, not to meet the 5 per cent target.

That target has been significantly reduced anyway because of a carryover surplus from the Kyoto targets (Australia was allowed to increase emissions 8 per cent over that period, even with generous land clearing credits), and because of reduced industrial production and improvements in the electricity sector (rapidly being reversed since repeal of carbon price).

However, Australia – despite being questioned by China, the US, the EU and others about its modest emissions reductions target – says it will not entertain the sort of targets being proposed by the Climate Change Authority (minus 30 per cent by 2025), or more ambitious targets by other climate experts.

Environment minister Greg Hunt said this week such targets would be “onerous”, and the government would insist on continuing with its Direct Action plan. Citigroup said in a report this month that the plan looked unsustainable and costly, and would not deliver a price signal for decarbonising the economy.

But the government is under intense pressure to not decarbonise. The Minerals Council of Australia said the targets recommended by the CCA would “slash economic growth, real wages and household living standards. ”

CEO Brendan Pearson, whose remit includes the coal industry, told the Guardian: “A 40 per cent cut in emissions is equivalent to closing down Australia’s electricity, transport and agriculture sectors. It is neither feasible nor economically responsible.” However, numerous studies, including one released this week by ANU, says that achieving such targets is possible, and at little extra cost, if any.

Industry analysts Reputex said the auction results indicated that the budget for the Emission Reductions Fund would be quickly exhausted.

Industry analysts Reputex said the auction results indicated that the budget for the Emission Reductions Fund would be quickly exhausted.

“On the present trajectory, the ERF budget would be eroded very quickly, so the medium-term sustainability of the scheme is a concern” said Hugh Grossman, the chief analyst.

Climate Institute’s Erwin Jackson said the government has shifted the responsibility for pollution reduction from the polluter to the taxpayer, which is footing the bill.

“The results highlight the inadequacy of the policy in two key ways. First, the abatement purchased through the auction is a mere drop in the bucket of the level of carbon pollution reduction that the government needs to achieve,” Jackson said in an emailed statement.

“As the government has admitted, Australia’s pollution is continuing to grow, and therefore so will the costs to the public purse of this expensive, inefficient policy.”

“Under the previous carbon laws major emitters would not only be responsible for their emissions, they would be paying around $10 a tonne, whereas the government is paying nearly $14.

“It is good that projects under the Carbon Farming Initiative which began under the carbon laws have come to fruition, but this kind of policy alone is not going to drive the modernisation that is required for Australia’s clunker economy, especially in the electricity sector.”

Reputex’ Grossman said the auction result indicated that landfill gas and native forest protection project developers had sought to ‘cash in’ from the first auction while industry – such as electricity generators – wait on the sidelines.

Grossman said the fact that so much was sold in the first auction indicated that high emitters would need to move quickly, or miss out on funds if they are unable to develop projects in time.

However, Grossman said that the industry is likely to be cautious because of the $14 average price. It may not give a good enough price signal for them to act.

“One the one hand, a $14 average price may allay the worst fears of carbon farmers – who have feared rock bottom prices – yet on the other hand, that price is unlikely to see high emitting companies rush to participate in the scheme” said Grossman.

“Companies will therefore face a decision as to whether it is worth their while to fast-track projects if they want to capitalise while funding is still available” he said.

He said the disclosure of the “average price” would be of little use to companies because it does not reflect the real “market price” of carbon credits.

“Given the figure of $14 does not reflect the real value of abatement, it is largely useless for industry to apply as a forward price signal” said Grossman.

“In disclosing only the average price of abatement, the Regulator is seeking to make prices appear to be lower than they have actually paid. An average is not a true reflection of the real clearing price that the Regulator paid, which is higher”

“Industry will seek to identify the “highest” clearing price, not the average price, which will give firms a better understanding of their abatement value”, he said.

“It is the ‘highest’ price which will ultimately determine whether industry participates in subsequent auctions.”