The cost of wind and solar energy has fallen so dramatically that wind and solar plants can now be built in South Africa at nearly half the cost of new coal, according to the country’s principal research organisation.

A presentation from the energy division of the Centre for Scientific and Industrial Research (CSIRO, that country’s equivalent of the CSIRO) illustrates the dramatic different in costs, based on tenders held this year for wind, solar and coal and assumed costs for other technologies.

The analysis by Dr Tobias Bischof-Niemz and Ruan Fourie shows that solar and wind are on par on pricing, and are more than 40 per cent cheaper than new baseload coal plants. Solar and wind are at 0.62 rand per kilowatt hour ($A0.058/kWh), with coal at 1.03 rand/kWh ($A0.09/kWh).

It’s a standout result for South Africa, which unlike developed economies has a shortage of power rather than a surplus, so needs to build new capacity to meet the demands of its growing population and economy.

But they also have implications for countries like Australia, which over the next two decades will need to replace much of its existing fossil fuel capacity. Solar and wind, which are following a similar if slower trajectory in Australia (thanks to its policy environment), will present similar price advantages.

Indeed, the results will be seen as important for any review of the draft update to the Integrated Resource Plan for Electricity (Draft IRP), currently in progress by the Department of Energy and which will set the country’s new energy priorities.

According to the Daily Maverik website in South Africa, that review was to have been delivered earlier this year, but possibly because of the falling cost of solar, in particular, and wind, the process has been delayed.

That program has sought to build 17.3GW of renewable energy and 11.5GW of “non renewables”, including 5GW of coal and 4.7GW of gas fired generation.

A request for proposals for 9.6GW of nuclear power has been put off indefinitely – from its previous deadline of late March and a later deadline of late September – possibly as the result of an assessment of the technology costs.

The push into nuclear has been a major controversy in South Africa because of the high costs and the nature of the contracts with the Russian builders.

Solar prices have been falling dramatically around the world, with recent bids of $30/MWh or less in Abu Dhabi, Dubai, Chile and Mexico, and a 40 per cent slump in the price of modules in the US in just the last few months.

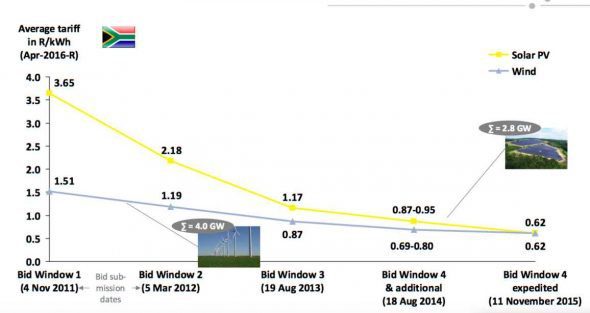

South Africa has also brought down the cost of solar dramatically in five years since it began competitive tenders for large scale projects. As this graph above shows, the most recent tender, in November last year, was one sixth of the cost of its first tender in 2011. The cost of wind energy has also fallen by 60 per cent.

EE Publishers says the solar PV, wind and coal IPP tariffs presented by the CSIR for South Africa are fully comparable, because they are all based on long-term take-or-pay contracts with the same off-taker (Eskom). Notably, the cost of coal does not include the propose carbon tax of 120 rand per tonne of Co2, making coal even less competitive.

The CSIR study suggests that the LCOE for new baseload coal has likely risen in any case to R1.10 to R1.20/kWh, making it twice the cost of wind or solar, while it puts the price of new baseload nuclear at R1.20 to R1.30/kWh, new mid-merit gas (CCGT) at R1 to R1.20/kWh, and new mid-merit coal at R1.50/kWh.