Grid-scale battery storage projects like the Tesla big battery array – currently going through tests on the South Australian grid after charging up for the first time last week – might provide crucial services to a high renewables grid, but can they make money from it?

Quite probably not, according to Australian Renewable Energy Agency investment director, Dan Sturrock. At least, not under the current electricity market regulations.

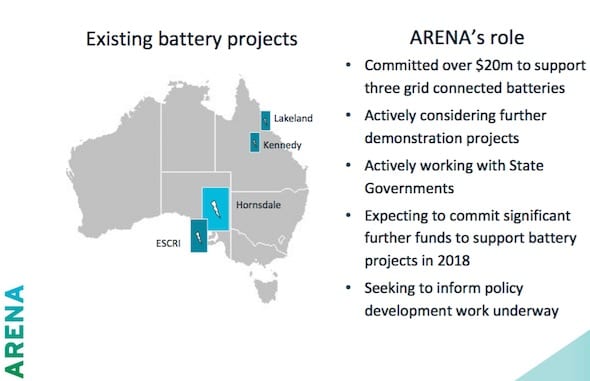

In a presentation to the Large Scale Solar and Storage conference, co-hosted by RenewEconomy in Sydney on Monday, Sturrock said he expected ARENA to play a big role in getting grid scale energy storage projects over the line in the coming year (See graph above).

The scheme is needed not just because of the cost of the technology, but because of the high degree of difficulty of building a business case for grid-scale storage under current market rules that will attract private investment.

“You see a lot of (energy storage) projects, well designed as they might be, and optimised in many other ways, funding them can be difficult,” Sturrock told the conference.

“The only bankable revenue stream (for large-scale energy storage) is wholesale arbitrage,” he continued.

“It’s very hard to build a business case around FCAS (frequency control and ancillary services) in the long-term, because it’s a very shallow market, and very hard to model … in fact impossible to model.

He used the proposed 30MW/8MWh battery storage project known as ESCRI that is being built around the Wattle Point wind farm in South Australia.

The green highlights that funding gap after revenue from network, wholesale markets and FCAS. The installation benefits from a contracted network service to Electranet.

“Very crudely, although we might expect the cost of battery storage to come down by a third or even a half, if all we’re doing in … three to five years is maybe market arbitrage, that’s a very untapped opportunity,” Sturrock said.

“It’s one that needs to be resolved and is being considered through the Finkel Review.”

The Tesla big battery is not getting ARENA funding, but does have a contract with the South Australia government to provide network services, particularly in the case of a major fault.

The developers of the Lincoln Gap wind farm, meanwhile, are not using any government funds to build their proposed 10MW/10MWh battery, but say it would likely not be economic yet as a stand-alone investment, but only part of a renewable-storage package,

Meanwhile, Sturrock said that the best quality of all for batteries was their ability to dispatch power as and when the market operator needs it, but that this was not being accounted for at all in current market design.

“What do batteries do best? Yes they can do arbitrage, but very fast response is really of most value, or potentially of most value, and that’s really what they’re not getting paid for,” Sturrock said.

“You can see the price of FCAS over the last three years rising … we do need, even with cost reductions, a level of value contributed to those services, and it will be interesting to see how that evolves through current reviews going on,” he said, and particularly with the AEMC’s recent discussion paper.