Opposition leader Peter Dutton keeps on telling us that battery storage is not really a thing. “Hopefully, the battery technology is about to be discovered, but not yet,” he said just a few months ago.

Well, Dutton may be shocked to learn that battery storage has been well and truly “discovered.” So much so that Tesla’s battery business alone is already valued by analysts at around $A200 billion, and may soon be worth more than the company’s electric car business. Perhaps it’s time for a phone call or another billionaire tweet.

The $A200 billion valuation for Tesla Energy, which makes the Powerwall battery that goes into people’s homes, and the Megapack product that is used in large scale storage projects, and helps to keep the lights on in Australia and other major grids, comes from a new analysis from investment bank Morgan Stanley.

That valuation would rank the Tesla Energy business more than most companies listed on the Australian Stock Exchange, around the same as the country’s biggest bank, the CBA, and behind only mining giant BHP.

It’s significant, because batteries are already playing an increasingly important role, both on the grid and in transport in electric vehicles, and will become the vital cog in the transition away from fossil fuels and towards renewables.

Morgan Stanley’s lead analyst on Tesla, Adam Jonas, says Tesla’s energy business will achieve higher margins than the company’s electric car business this year, and in fiscal 2024 will deliver total revenues of around $US7 billion ($A10.5 billion).

That’s fairly significant for a business based around a technology that Dutton, and many in the federal Coalition, pretend does not exist. It’s worth pointing out that CATL, the Chinese company that is also regarded as one of the leaders in battery technology, is worth around $A170 billion.

Tesla CEO Elon Musk has said on several occasions that the energy business will outgrow the car business, and while EV sales have indeed fallen back from their significant growth over the last few years, Musk said as recently as June 13 that the energy business will grow three or even four fold this year.

In Australia, of course, Tesla has played a significant role in the development of battery storage technology, having built the very first grid scale battery at Hornsdale in 2017, within 100 days as promised at the time by Musk, and changing the thinking about what the future of a grid may look like.

Its ability to focus on grid services such as frequent control, inertia and system strength, with the world-first introduction of “grid forming inverters” at scale – as well as actually storing energy – has alleviated many of the feared weaknesses of a grid based around wind and solar.

Tesla has since built what is still the biggest battery in Australia, the 350 MW, 450 MWh Moorabool facility – formerly known as the Victoria Big Battery.

And while it may lose that crown next year when the 850 MW, 1680 MWh Waratah Super Battery is due to come on line in NSW, Tesla will retake the crown with the completion of the 560 MW, 2240 MWh Collie battery in W.A, which will be one of the first four-hour batteries in Australia, shifting solar output from the middle of the day to the evening peak.

Batteries are still only a minor part of the energy grid, but their role in keeping grids stable – thanks to their speed and flexibility – has already been proven on multiple occasions, and ensuring the lights are kept on despite major disturbances on the grid.

In California, which has the most battery storage installed in any grid in the world, they are playing an increasingly dominance role in the evening peak, time shifting solar from the middle of the day to the demand peaks, and regularly becoming the biggest power source on the grid.

The Morgan Stanley analysis highlights some of the other qualities of battery storage that are often painted over as the fossil fuel industry and their elected representatives try to talk down the transition to renewable grids.

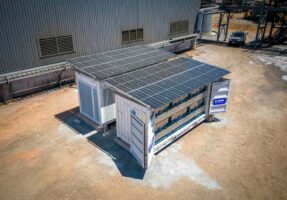

Jonas notes that the Megapack units are shipped fully assembled and ready to operate, which allows for quick installation timelines and reduced complexity. The systems require minimal maintenance and include up to a 20-year warranty.

So far, Megapack has deployed around 16 gigawatts hours of storage capacity across 16 countries, and Morgan Stanley’s Jonas expects this to grow to 90 GWh by 2030.

“Megapack can connect to any grid globally,” he notes in the report. “It’s the most energy dense solution on the market – at upwards of 300MWh/acre, and Megapack is two times more energy dense (than) a traditional power plant.”

The Powerwall battery is also changing the way that households can think about their power supply, because it allows them to customise their energy usage, store energy from their rooftop solar systems to charge their EV or their home appliances, or even share the EVs battery power to extend a home’s back up support during an outage.

These are important developments, because the energy debate at the political level is mired in old-school thinking about the way that grids can and do operate. New technologies, particularly the smart controls, is allowing the market and consumers to operate in ways that would have been unimaginable a decade ago.

So much so that under Morgan Stanley’s “bull case” scenario, the Tesla battery business is valued at $A330 billion, which would make it by far the biggest company in Australia, and one of the biggest in the world. Probably time for the Duttons of the world to catch up.