In this longer note on Origin Energy (ORG) we cover:

(i) the announced IPO of ORG’s upstream business. We think this is a poor business that ORG will be well rid of.

(ii) APLNG is now in a “pay down debt mode”. It can pay ORG maybe $200-$300 m per year of cash in the next couple of years.

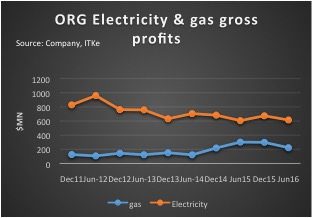

(iii) the prospects for ORG’s utility business. These prospects are pretty poor if ORG doesn’t make some major changes. Electricity profits have stagnated for years, the gas fired generation is doing better but fuel costs are increasing very sharply. We can’t see the electricity business improving with more innovation and a change of direction.

If it were us we would have a look at making a preemptive offer for Endeavour Energy and/or making a very serious push into the Queensland renewable energy market, not just with a me-too strategy but with the aim of developing Australia’s first large scale “renewables energy on demand” business.

The starting point for this discussion is the Orange line in figure 2. That is the worm line that needs to move up. Without that ORG has no real credibility.

Perfect practice makes perfect

ORG has been struggling for years with a lack of purpose. Or rather too many purposes. The company has made three major strategic moves in the past decade:

- Buying Contact Energy. In the end this didn’t work because New Zealand was a dead end. Too small and too parochial. Many a multinational has been there and come to the same conclusion. Great place to live, not so good for a growth business.

- Buying 50% of the NSW electricity retail customers and one of the coal generators. The jury is still out on this but right now it looks like a substandard use of capital. ORG got its timing dead wrong here. Buying a semi regulated business just as demand was tanking. It also got its tactics wrong. By boxing AGL into a corner, a seemingly clever move, it in fact forced AGL to go out and grow its customer base organically. AGL did this quite successfully at the expense of both EnergyAustralia and ORG.

- Not accepting the then BG $15 a share offer and instead accepting sugar daddy ConocoPhillips offer to partner in the “grand follie” of a large CSG, LNG plant. Both COP and ORG misjudged each other in this deal. ORG thought it had made a huge profit and received billions of dollars of cash for its vast, but unmarketable CSG reserves. It took ORG shareholders five years to work out that every dollar received from COP had to go straight back to APLNG and that in fact shareholders would have to continue putting their hands in their pockets for years. COP, supposedly the LNG expert grossly underestimated the cost of the project, grossly overestimated the demand side of the market, completely missed the “USA shale gas to LNG” opportunity.

Upstream co is a bit of a dog, all things considered

On the face of it the assets to be sold have barely been cash flow positive over the past six years. Cumulative EBITDAX (earnings before interest tax, depreciation and exploration expense) totaled $2.4 bn over the six years. This was more than matched by cumulative capital expenditure of $2.9 bn. Lets be generous and back out the 2014 Poseidon acquisition (no reserves as yet, but plenty of gas if only there was a market) and we would be left with a net positive cash flow of $166 m.

You might think that all that capital expenditure would have resulted in substantial reserve upgrades but as the table shows where there has been a net 57 PJ increase in gas reserves there has 88 PJ decline in the much more profitable oil and condensate reserves. 2P (proved and probable) reserves of 1204 PJ compare to annual production at around 75-85 PJ. So at least there is about 15 years of production left.

Also in mitigation we note:

- Upstream co has been undercharging ORG for its gas and particularly if the Otway and Bass contracts are reset to market profits would improve by maybe $50 m or more

- Included in the capital expenditure totals is a bunch of capex on deep sea oil exploration of Vietnam and New Zealand. More conservative management, or management with less deep pockets may not take some of those risks.

Net value of Upstream Co to ORG of perhaps $1.5bn

We have always found parts of this portfolio unconvincing, eg production increases in the offshore Otway are very short lived, the Bass Gas project has been beset by difficulties from conception and the Cooper Basin’s future is problematic.

Neverthless the outlook for gas prices is good. There is a shortage of gas at the moment for most players (ORG is an exception to this)

After allowing for the requirement for ORG to have buyback presold oil production at a total cost of about $350 m we estimate the net proceeds to ORG will be around $1.4 bn

In addition ORG will be able to save on overheads and will avoid eventual end of life field remediation capital expenditure. On the other hand ORG’s cost of buying gas will surely increase, although probably only by about 5-8%.

In addition ORG may be able to buy more gas from APLNG.

ORG ex Upstream Co

The ~$1.4 bn that ORG should get from the upstream asset sale will reduce net debt to about $7.7 bn. ORG’s cost of debt will fall further this year as a result of redeeming some perpetual subordinated notes in December.

Energy markets focus – Gas profits hide the lack of growth in electricity

Perhaps CEO Frank Calabria’s biggest achievement at ORG prior to assuming the CEO role was to position the company to be relatively long gas in the domestic market. First of the majors to negotiate new contracts with BHP/Esso, pipping Santos to Beach’s “surplus” Cooper Basin gas and contracting sales at oil linked prices in Qld were all solid achievements. And they have been supported by pipeline contracts that let ORG shift gas around the network.

However these profits will be somewhat dented by contracts to be written between ORG and the newly formed upstream company. If for the sake of argument we allow 25 PJ at as little as $2.50 GJ above today’s rates and $3 seems like a better number that’s still around a $65 m hit pretax.

Meanwhile the electricity gross profit is $200 m less than four years ago and there is no visible sign of forthcoming improvement. The decline in profits stems from two sources:

- Decline in electricity consumption per mass market customer

- Poor generation profits particularly gas generation

Comparisons with AGL and Energy Australia

Differences in disclosure and accounting policies make comparisons of only limited use. AGL for instance pulls out over $100 m of cost into “unallocated” overheads. EnergyAustralia, being a subsidiary of Hong Kong based CLP reports only limited information.

Still a broad look at the volumes and customer numbers shows ORG, the utility business, with the largest electricity retail business in the country but a lower return on funds employed and lower total utility ebit than AGL.

Electricity business needs some skill and investment

ORG made its last big investment in electricity in 2011 when it bought its NSW business in December 2010. Since then the only real achievement has been to get the mass market customer care system up and running. For the rest of the time the business has basically been on care and maintenance with management focus on APLNG and the balance sheet.

During the same period AGL has bought the Macgen and LYA assets and picked up over 0.5 m NSW electricity customers, mostly organically. You can question the long term return on capital of investing so much in ageing coal generation but over the next couple of years its certainly going to provide a bunch of cash for reinvestment.

ORG has to an extent been lucky that Energy Australia has had its own internal transformation to deal with and has similar to ORG, not been prepared to do much more than fix up its balance sheet (by selling the Iona gas storage plant) and cut costs.

Still all things considered ORG simply cant, and it is not in the nature of senior management to allow its electricity gross profit to drift along indefinitely in the way it has for the past three years. So the question is what will management do?

Options for the electricity business

ORG’s issues in the electricity business have been

- that volumes per customer have fallen 10%;

- competition has eroded margins to some extent in Victoria;

- gas fired generation has not earned a return on capital, particularly the Uranquinty and Mortlake open cycle stations. That’s mostly because until about 9 mths ago low wholesale prices had meant a sharp decline in volatility.

- Qld State owned generators and the fact that mass market prices have been largely regulated in QLD have meant that ORG’s business in QLD has generally been problematic.

Gas generation – not as easy as you might think

ORG’s gas fired generation volumes have declined over the past couple of years as gas has become scarcer, but pool revenue is probably inching up, certainly in 2017, as prices increase. The chart below shows annualized, 30 day moving totals of all of ORG’s gas fired generation combined.

The average received pool price is volatile but is arguably trending up. This is good news for profits but its likely that the cost of that gas is also trending up and pretty sharply. Historically the gas used to run Darling Downs (say 30-40 pj per year) came from ORG’s 1000 PJ @ 40 PJ per year contract with APLNG. Prices for that gas are around A$3.50 GJ. However in 2012 and 2013 ORG sold the gas it will get from APLNG in the 2016-2026 period to GLNG. This means that to run Darling Downs gas has to be taken either from ORG”s small Cooper Gas reserves, its share of production from offshore Otway, of from other more market based contracts it has with BHP/Esso and Beach Petroleum.

Bottom line in our opinion gas fired generation profits are increasing but maybe not that much.

ORG is a net buyer of electricity

Historically ORG has set up its electricity book to be long retail. Essentially it’s a net buyer in QLD, Victoria and South Australia with a more balanced positon in NSW due to its ownership of Eraring power station.

ORG’s hedge book is probably in the money and a source of profits for the next year or two, but some part of its requirements will be purchased from the spot market. A couple of years ago ORG was burned in QLD by being underhedged and the current CEO probably took that lesson strongly to heart.

Is Victoria becoming a problem for ORG, particularly if Portland stays open?

We have looked at the outrageous cost of the subsidy required to keep the Portland smelter going elsewhere.

What ever the broader implications as far as ORG goes what it means is they will need to pay a lot of attention to being properly hedged in Victoria. ORG most profitable household market for electricity is Victoria and its also been the market where historically it has both the least generation and, in our opinion, the least amount of hedge cover. It may well nevertheless be able to make some trading profits by selling longer term Hazelwood contracts back to Engie. Medium term though its going to need to be a lot more hedged and will probably find both Energy Australia via Yallourn and AGL via LYA have some competitive advantage in the State.

Bottom line. More of the same won’t fix ORG’s electricity business

In our view ORG will need to be bolder, craftier and more lateral if wants to build its electricity business. In our role as fantasy strategy consultants we offer up the following suggesetions:

- Buy a network business. 51% of Endeavour Energy is to be either sold or IPO’d this year. Its monopoly network franchise overlaps with part of ORG’s NSW retail franchise. The network business offers stable returns historically in excess of the cost of capital. Furthermore network pricing strategies directly impact on retail pricing strategies as networks are 40-50% of household electricity costs. Endeavour would have to be fully ring fenced from ORG’s retail business but as far as we know its legally possible for its owner to be a retailer.

- Buy some QLD coal fired generation. We don’t like this idea but it may well be profitable for a few years.

- Get into QLD renewables seriously. So far ORG just plays with renewables. Its never done more than the bare minimum a business of its size should. Its built one tiny 30 MW wind farm and then sold it and financed a couple of PV farms. It offers contracts for other wind developers but provides no other input. In the household space it doesn’t stand out. ORG talks a good game in renewables and claims to believe that being short thermal generation is a sensible strategy but really doesn’t believe its own story. Specifically we think ORG could get into QLD renewable generation far more heavily than it has and build up a real “power base”. We think it could build a large integrated solar business backed up with open cycle gas and battery storage and use the QLD business as a model for a push into other States. We think it could do this relatively quickly

APLING – self financing and paying down debt

APLNG’s value to investors is likely to increase for a few years. At current prices it can pay down about A$1 bn of debt per year. There is about $10 bn of debt so if nothing else changes in 10 years time it would be debt free. At that point distributions to equity which we think will be about $3000 m in FY18 could jump to around $700 m per year. On the other hand at some point well productivity is going to decline (more capex required per GJ of gas produced) and at least two new compressor plants are scheduled to be constructed (when the gas wells get too geographically distant from the current plants). An extra US$10 on the oil price in adds about A$700 m to APLNG’s ebitda. We now model APLNG using a long term oil price of US$65 nominal. In our view this covers both upside and down side risks. Our view is that at some point over the next ten years global warming will lead to higher taxes on oil and incentives for substitutes (electric vehicles). Essentially the same battle will be fought as between renewable electricity and coal fired electricity. The difference is that consumers will determine the outcome. A lower oil price may eventually lead to a dismantling of oil linked LNG pricing but that is still years away.

Other than tax arrangements and possible purchase of more gas from APLNG we don’t see APLNG as taking much more of ORG’s management time for the next few years. Of course COP or Sinopec could move to get a smaller or larger share of the project. For the time being ORG shareholders need to put their APLNG investment under their pillows and look to the Energy Markets business for investment up and down.

David Leitch is principal of ITK. He was formerly a Utility Analyst for leading investment banks over the past 30 years. The views expressed are his own. Please note our new section, Energy Markets, which will include analysis from Leitch on the energy markets and broader energy issues. And also note our live generation widget, and the APVI solar contribution.