New South Wales has long played second fiddle to Queensland – the “Sunshine state”, when it comes to rooftop solar. Despite its bigger population, NSW is beaten into second place on rooftop solar installations by Queensland, which has already reached the 2GW mark.

But the Australian Energy Market Operator suggests that is about to change.

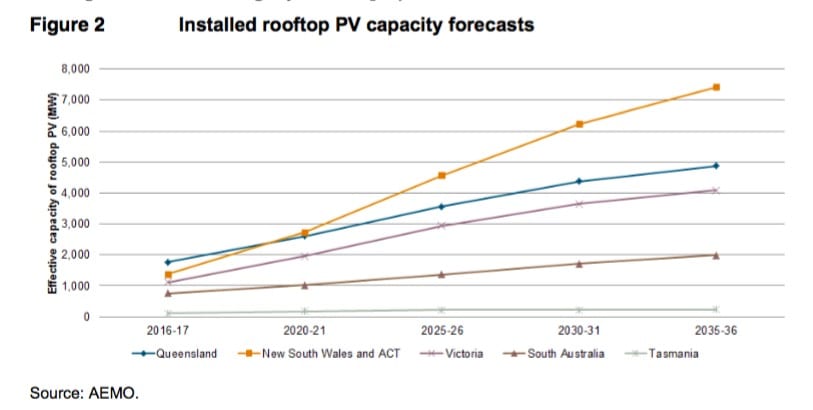

Over the next few years, it expects NSW to overtake Queensland with the most installed capacity (by 2020/21) and by 2035 it expects NSW to have more than 7GW of rooftop solar in the state – 50 per cent more than its nearest rival.

This graph above shows the estimate, including in the AEMC’s Reliability Panel’s annual report, which highlights the growing shift to decentralised energy, which includes rooftop solar and storage.

Indeed, this graph shows only one of AEMO’s installation scenarios – it’s high uptake shows another 3GW of rooftop solar, and many suggest that half of all Australia’s electricity needs may come from decentralised energy within a decade or two.

Recent data suggests that NSW recently pipped Queensland as the biggest market for rooftop solar in the month of February (with just over 28MW installed in the month), but AEMO’s forecasts suggests NSW will continue to set the pace over the next decade or two.

The rooftop solar is already having an impact, delaying and reducing the size of grid peaks, and so reducing the cost of peak demand events. Ausgrid is also looking at providing more subsidies to encourage more rooftop solar in inner-city suburbs to reduce the need for network upgrades.

The AEMO forecasts suggest a total of 18.6GW of rooftop solar PV capacity by 2035/36, which will be accompanies by strong growth of integrated solar PV and battery storage systems.

Indeed, this graph shows only one of AEMO’s installation scenarios – it’s high uptake shows another 3GW of rooftop solar, and many suggest that half of all Australia’s electricity needs may come from decentralised energy within a decade or two.

This will have an impact on the shape of the demand curve in Australia. Not only will it reduce maximum demand, and push it into the evenings, it will also push minimum demand into the middle of the day, rather than overnight.

This is already happening in South Australia (it has been since 2012), but will extend to NSW, Queensland and Victoria. Minimum demand may turn “negative” – where rooftop solar output exceeds customer demand – as early as 2025 on some days in South Australia.

AEMO suggests that in South Australia the excess rooftop solar output can be stored (in batteries) or exported to the rest of the market.

“This signals the important need for market and regulatory frameworks that support storage solutions and maximise the efficiency or shared electricity services for consumers.”

Indeed, the new South Australian government is toying with that idea, proposing its own $100 million plan to subsidise the installation of batteries in 40,000 homes, and considering what to do with the Tesla plan for solar and storage in 50,000 low income homes that would create the “world’s biggest virtual power plant”.

And here’s another interesting graph from a separate AEMO report, one that looks at the last quarter of the electricity markets.

And here’s another interesting graph from a separate AEMO report, one that looks at the last quarter of the electricity markets.

It shows the average rooftop solar PV output in the last quarter, and it is nearing 1GW, having risen from 905MW in the same quarter last year to 969MW in the fourth quarter of 2017.

AEMO says the largest increases were in Victoria (+15 per cent) and South Australia (+8 per cent). These increases correspond with an increase in rooftop PV capacity and higher than average sunshine across all capital cities except Adelaide.