- Volumes: Strong volume growth in NSW and QLD overcame ongoing aluminium related weakness in Victoria to see NEM wide volumes up 4% for the week and 2% for the month across the NEM. Hot weather in Sydney and Brisbane is undoubtedly the major contributor and if air conditioning loads could be easily isolated the impact would probably be clear. As Fig 5 shows we can expect a seasonal decline in the absolute volume over the next month. Cross fingers the generation system has coped well with the hot weather with only minor supply interruptions.

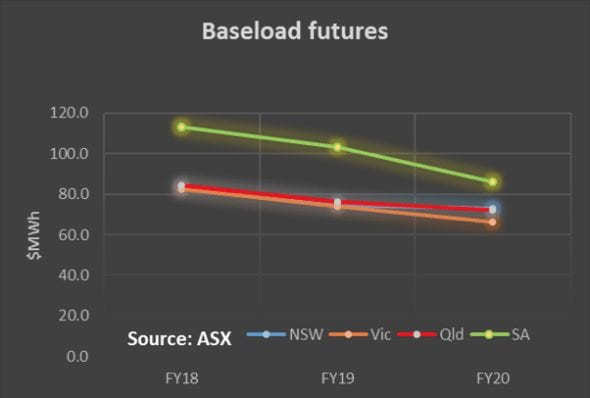

- Future prices took a breather this week but remain vastly elevated compared to a year ago. The post Hazelwood closure and startup of Portland remain uncertainties. The push by the coal mining lobby to get more coal fired generation built is a reminder that predicting the future is very hard. This time a year ago there was speculation that Portland smelter was uneconomic (correct) and would therefore close (incorrect). Hazelwood was not thought likely to close in 2018 (incorrect) and demand was expected to stay relatively soft (half correct).

- Spot electricity prices are more or less double those of last year. Prices are up 118% in Victoria over last year despite the sharp reduction in consumption. This shows the interconnected nature of the NEM and is why we think the Hazelwood closure is going to have such a big impact in other states

- REC prices were unchanged

- Gas prices: The STTM gas price in QLD averaged $10 GJ during the week due to a combination of demand from the gas fired electricity generation sector and the LNG market. Gas prices of $10 GJ are not incompatible with affordable gas fired electricity.

- Utility share prices were largely unchanged during the week. Unfortunately for AGL its fantastic exposure to rising baseload futures prices has had to be diluted with a below market contract to help out Portland Smelter. However there is every chance that over the next couple of years it should be able to reprice about 20TWh of baseload power by say $10-$20/MWh. This will have a big impact on cash flows for a few years. The Tomago smelter contract in NSW is the next big item on AGL’s agenda as far as we know, and then we are already thinking about how really likely it is the company will close its Liddell power station in 2022.

- Industry news: We are entering corporate reporting season and early reports are starting to trickle out. Of the stocks we cover ORE reported its December quarter production. The quarter was unexciting but in our view doesn’t impact on the ORE “medium term story” of rising demand for lithium and supply lagging.

Redflow [RFX] shares have been weak for some time although they remain up 12% on PCP. For us the issue has always been about how a relatively small, market cap <$200 m, company using a non mainstream technology was going to compete with the vast river of lithium battery suppliers coming down the river. Not saying it can’t be done, but we are saying its difficult. Today the company released its “Appendix 4C” which contained the following statement:

“Redflow continues to monitor its working capital requirements closely and considers that there is a reasonable basis to believe that it will secure additional funding for its operations should that become appropriate or necessary to support the next stages of the delivery of its products to market.”

RFX also issued a non financial strategic update and observed that external consultants are reviewing operations to provide inter alia “revised cash flow projections and capital requirements modelled for multiple operating scenarios”. Flex the company’s manufacturer, supplied 84 batteries in the Dec quarter and has committed to 270 batteries for the March quarter.

Genex [GNX] also issued its Quarterly 3C report which showed cash balance of $12.5 mn and a net operating cash flow “burn” that is spend of $1.7 m for the quarter. GNX future depends on how its Kidston pumped storage project goes in Central QLD. That project is still a long way from being operational.

Share Prices

Volumes

Base Load Futures

Gas Prices

David Leitch is principal of ITK. He was formerly a Utility Analyst for leading investment banks over the past 30 years. The views expressed are his own. Please note our new section, Energy Markets, which will include analysis from Leitch on the energy markets and broader energy issues. And also note our live generation widget, and the APVI solar contribution.