Whats interesting at the moment

This week three things caught our eye.

- The increasing interest that investors are putting into, at the very least, climate change reporting. We have already noted the Financial Stability Board’s new recommended policy, but credit ratings agencies, Standard & Poors and Moodys, both of big importance to investors in utility stocks, have increased focus in this area.

- Is the rise in global oil prices from $50 b to US$60/b over the past month. This means the export parity price of gas has gone up about 20% and some of this will flow through to domestic gas prices.

- Elections both federal and state. Queensland voters seemingly can’t lose, with the Coalition talking about cutting the regulated asset base (RAB) of the state-owned distribution companies, but also hoping to build a new coal station. The ALP policies in Queensland are very important to the renewable energy industry. Betting odds are perhaps no better than opinion polls, but they are an alternative. A summary of the odds for the outcome of the next federal and state elections is shown below.

Turning to the weekly action

The week was marked by very soft electricity volumes in Queensland and Victoria. Queensland down 9 per cent on PCP and Victoria 5 per cent. This drove NEM wide consumption to its lowest point in the past three years for this time of year, and we suspect close to an all time low.

Equally notable, spot pool prices in NSW $72 MWh and QLD $65 MWh weekly averages were actually below 2016 levels. From here to Christmas, though, we should see both volumes and prices increasing in a seasonal fashion with the exact outcome dependent on the weather.

As far as we know, most of the major volume adjustments in Victoria and South Australia – for example the Portland smelter recovery, the wind-down of the auto industry – have happened now. Queensland is still impacted by LNG train starts ups and shut downs. The trains on Gladstone Island aren’t particularly electricity intensive but the upstream part of the industry, for examlpe the wells and the compressor stations, are. Major flooding in the Darling Downs, for instance, would likely cause a sharp drop in consumption.

Gas prices were largely unchanged and similarly REC prices didn’t move.

Share Prices

Volumes

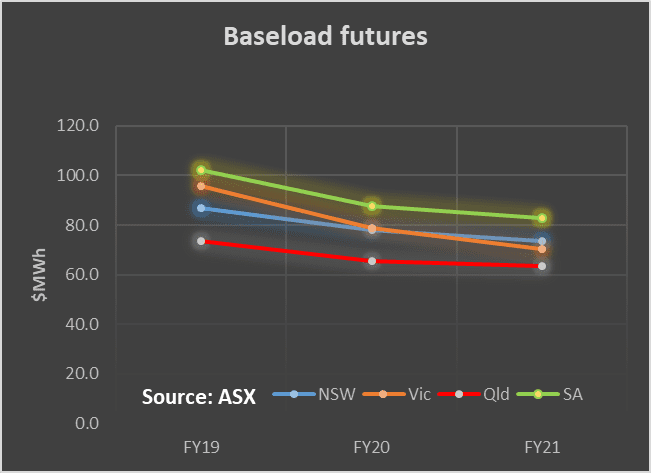

Base Load Futures, $MWH

Gas Prices

David Leitch is principal of ITK. He was formerly a Utility Analyst for leading investment banks over the past 30 years. The views expressed are his own. Please note our new section, Energy Markets, which will include analysis from Leitch on the energy markets and broader energy issues. And also note our live generation widget, and the APVI solar contribution.