“Don’t know much about history

Don’t know much about biology

Don’t know much about a science book

Don’t know much about the French I took”

(Sam Cooke 1960)

Briefly

The 2GW Liddell coal fired power generator will close in a few years. As yet not nearly enough new supply has been started in NSW to replace it.

Even assuming that enough new wind and solar PV is built between now and then it’s still fair to say that there will be more volatility in the resulting availability of generation. That’s particularly the case if we considered the combined Victorian and NSW market.

There is therefore going to be an emerging need, a market if you will, for dispatchability or reliability. A price signal for this will emerge in the spot market, but it will probably emerge too late, in the nature of these things, for anyone to do anything about it if we wait until then.

We already know that if Snowy 2 goes ahead, as seems likely, it will require more transmission – $2 bn has been mentioned for transmission just for that. Snowy 2 and transmission will both take a long time to get done, years and years. So early action on the transmission side should arguably at the top of the new Energy Security Board’s agenda.

There is way, way more to say about learnings from this year’s excellent Clean Energy Summit conference and we’ll explore a few that have struck this analyst going forward (and in our weekly podcast).

AGL has given us 5 years notice on Liddell – what it will take to replace it

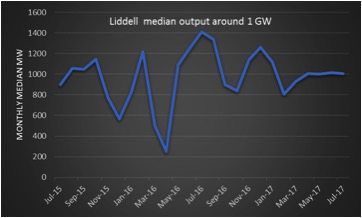

Liddell has 2GW of nominal capacity but median output is around 1GW.

AGL has said Liddell will close in 2022, just five short years away. It is true that in business management is free to change its mind but we think its far better to take AGL at its word.

If we look at Liddell by time of day we get perhaps a more revealing picture of its role in the NSW system. (BTW you have to compliment Microsoft for the charts it lets you make these days)

The data shows that Liddell has a flat (ok, yes baseload) output profile. Its capable of flexing up to 1800 MW but even in this February’s peak didn’t get to its nominal rated capacity of 2000 MW.

The standard deviation for most of the half hours is about 300 MW.

So, it’s output isn’t really that steady. Capacity utilization on average is 50%, but dispatchability is probably quite high when its working.

If we assume an average combined capacity factor for wind & pv of say 30%.

This is a conservative number but doesn’t have much impact on the thrust of this note, we estimate it takes about 3.3 GW of renewables in energy terms to replace Liddell and that’s about 660 MW a year between now and 2022.

Alternatives to new renewables include more exports from QLD and higher output from Eraring. Our guess is that Eraring might be there for power purposes but probably won’t lift energy output that much.

Transmission and network connections will be one bottleneck

We’ve already argued, and we think there is considerable support for the view, that a broader and more committed view of transmission needs to be taken than we have so far seen.

Virtually every renewable developer and contractor we have spoken to cites connection to the distribution and transmission network as their no 1 issue.

We want to stress that word commitment.

Transmission takes longer to build than wind or pv mainly because of the planning and easement, environmental considerations.

Arguably there are also deeper commitment questions about whether a new ultra high voltage DC transmission is required, such as China is installing, or whether more standard technology is best.

The point is building the transmission in front of the generation requires commitment to a vision of the future and the will to make the investment happen. It only requires a small amount of commitment and vision to start with.

We argue that $1 bn of transmission spending in NSW would have a minor impact on bills, but would enable lots of renewable generation. It almost falls into the current buzz of “no regrets” investment.

As NSW is a net importer of electricity and sits in the middle of the NEM it just seems an obvious thing to do.

The NEM has replaced Hazelwoord but Victoria hasn’t

The NEM has replaced Hazelwoord but Victoria hasn’t

As previously discussed the closure of Hazelwood has lead to open cycle gas setting the price in Victoria most of the time.

This is very unsatisfactory. QLD electricity prices are now typically $65 MWh other than at peak and this flows through to NSW.

But in Victoria prices are $100 MWh most of the time. Our view is that not enough new renewables have been started in Victoria.

As Victoria has relatively weaker insolation it seems likes its more wind that’s required.

As an aside we don’t think the Politicians or even Company management are keeping up with the supply pipeline all that well.

We heard Don Harwin proudly say that NSW is adding more than other States, but we don’t think that is correct on either a MW or TWh basis. Even Frank Calabria was only talking of 3 GW of new supply. But we can identify 4.7GW of committed projects.

I guess it all depends on the starting point and what you call committed.

Included in Victoria is the massive, by renewable standards, 0.5 GW Stockyard Hill windfarm. It won’t be up and running for a while yet.

We don’t believe the industry has yet come to terms with the impact of this project or how it has reset price expectations.

We think that the scale of the project and the fact that Goldwind is the turbine manufacturer has allowed Goldwind to take seemingly well judged risks that others could not take.

An example might be electrical contracting where Goldwind might assume the principal contracting role itself.

But in any event as Goldwind has another 300MW almost sure to get the go ahead in Victoria we think the industry needs to sharpen the pencils (again).

The scale and vertically integrated supply chain synergies have other implications.

For instance some other regions, eg Tasmania, might have a better wind resource but may not be able to achieve the same scale benefits.

The same goes for WACC. Someone like a Goldwind just has a lower WACC than most of the other players.

Goldwind has a low WACC not just because of its access to capital but because it can couple that capital with specific knowledge of supply chain costs and risks.

Reverse auctions with State Govts enable smaller developers to access that same low cost of capital and enable the State Govt. through the auction process to discover the developer with the overall lowest cost project.

We still don’t think that the policy makers, including Finkel, paid enough attention to the State targets and advantages.

They are just regarded as a “nuisance factor” typically dismissed in a paragraph or two or as a footnote.

However the States can play a central role if they are so minded.