“Those who would lead should walk behind”

Lau Tzu

Comment – Follow the industry, don’t push it

As we have said several times, the electricity industry is largely united on the way forward.

Drawing on overseas experience in many markets, including several in the USA and in Europe, the industry will move to an increasingly renewable future firmed up by dispatchable generation and demand response and with strong transmission links.

“Renewables with Australian characteristics” will have a bigger emphasis on behind the meter share of the business than in some other countries. Even networks are moving in this direction.

These days there is little or no doubt about this future. Every report points in the same direction. Every speech by industry and its thought leaders points in the same direction. The investment dollars flow that way. There was enthusiastic support for the Finkel report that broadly pointed in the same direction.

This future is completely unstoppable as well as entirely necessary, but that doesn’t mean some are not worried or scared by it.

Their fears are reinforced and amplified by vested interests and selfish, small-minded losers who try to slow it down. They, in turn, are supported by their equally ill-intentioned media cheer squad. Ask not so much what they say but why they say it. It’s these losers with their negativity that drive up prices not the electricity industry.

The industry is far, far from perfect and certainly will exploit its market power to maximise profit, but is nevertheless willing, ready and able to move forward.

The federal government has been offered an olive branch on this issue by the Opposition. No doubt there is hemlock in the olives but nevertheless its an olive branch.

If the federal leadership can’t overcome the pockets of ill educated, selfish and just plain dumb reactionary elements in its own party to get a credible CET target passed, then it likely will lose office.

It’s not just the federal government. The decision to subsidise the Portland aluminium smelter has a tremendous cost in the short term and should at a minimum have led to an acceleration of Victoria’s renenewable plans.

The AEMO and particularly the AEMC could and should have progressed transmission and interconnectors far more vigorously. The NSW Government could and should certainly do more.

NSW is a net importer with a very old generation fleet and yet doesn’t have any significant policy to incentivize new generation. It’s hard to imagine Mike Baird would have sat around doing nothing.

Policy can provide energy security by driving new investment but its unlikely to lead to a substantial fall in prices until there is a considerable amount of new supply in Victoria and NSW and some of that supply has to be firming supply.

That’s because right now the cost of any form of dispatchable energy remains at or above the futures prices. We turn to those.

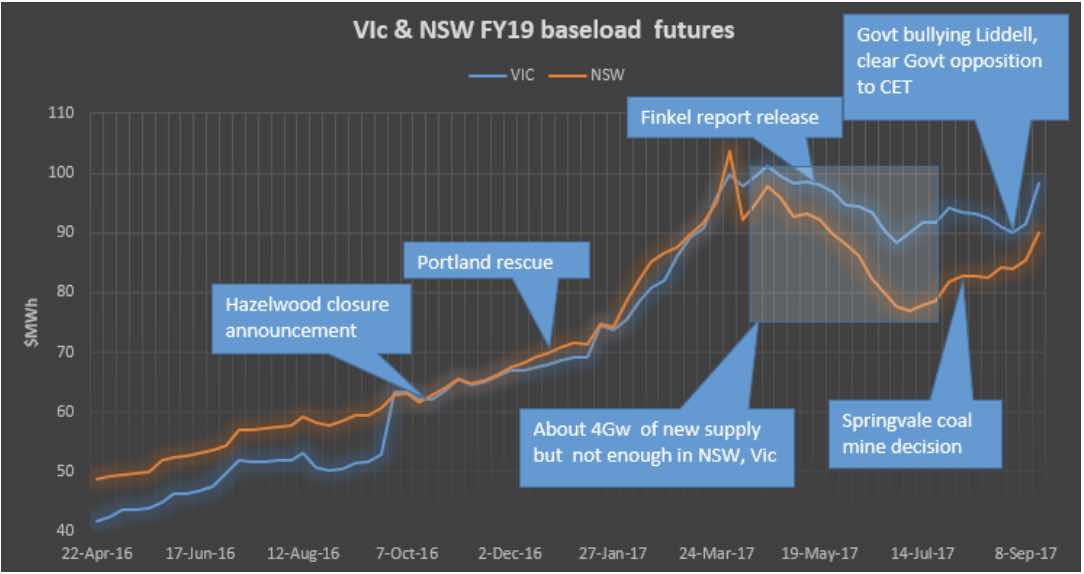

Futures prices nearly back to previous peaks

The NSW FY19 futures price rose from about $48/MWh in April, 2016 to a peak of $93/MWh in May 2017. It then fell back to $77/MWh in early July. Today, however, it is at $90/MWh – virtually back to its previous peak.

More or less the same story is true in Victoria.

It is always easier to write history than to predict the future. And of course there are many factors that drive price expectations, primarily supply and demand but many others can be directly or indirectly important.

The Figure below shows some of the events that we think are important.

Timeline commentary

In November the Hazelwood closure was confirmed. Its our view that many market participants didn’t understand the problems Hazelwood had including safety related capex and increased coal royalties. As prices were already rising less well informed market participants assumed Hazelwood would emphasise short run revenues.

In January the Victorian Govt announced support to keep Portland going. This caught many, including your analyst, totally off guard. We wrote at the time that the true cost was not the direct subsidy but the increase in electricity prices that would be paid by all consumers large and small, not just in Victoria but in other States. We said $5 MWh but in truth it was more like $30 MWh.

The high prices worked, along with the RET ratchet, as theory suggests, to encourage new investment and between late January and July many new projects reached FID [Final Investment Decision]. A lot of these projects were also driven by the ongoing 30% fall in the capital cost of utility-scale PV. As QLD has high irradiance [lots of sun] and a 50% renewable target that was the place to go.

Victoria had a 40% renewable target but, it seems to us, a delay in legislating that caused participants to temporarily hold off their investment decisions. The Victorian market was given a big boost by the Stockyard Hill deal which together with earlier Silverton project in NSW and later Coopers Ridge project in Qld also showed that wind PPA prices had also fallen dramatically in Australia in the past couple of years.

In June the Finkel report was released. The report had 41 recommendations several of which are very important to the longer term “bones” of NEM 2.0.

Of course the only recommendation the media was interested in was the proposed Clean Energy Target. All the participants at the COAG meeting and all of the observers at the meeting expressed a high degree of optimism that this report was the start of a new era of cooperation.

The one fly in the ointment was the Federal Govt which pleaded for time.

By July it had become clear that not much new renewable supply was confirmed in NSW.

In July the warm glow of the Finkel report faded.

In early August 4Nature was successful in the Court of Appeal invalidating the Springvale Coal Mine’s license. Springvale supplies coal to Mt Piper Power Station in NSW. Mt Piper supplies about 7% of the combined NSW/Victoria demand.

In September two things happened.

Firstly The Federal Govt, acting without any real legal or even moral authority, attempted to bully AGL into keeping the Liddell Power station open between 2022, is scheduled closing date and at least 2027. In our view this contributed to an increase in FY19 futures because:

- It forced AGL to reveal just how bad the State of Liddell is, therefore contributing to heightened risk perceptions;

- It contributed to sense that the Federal Govt had no long term policy and was therefore resorting to bullying, so that it could be seen to be doing something.

Secondly, it became clear that elements of the Federal Govt (seemingly mostly backbenchers) were totally opposed to the CET target as proposed by Finkel. Although the CET would not have commenced until 2020 if implemented it may have seen the current LRET scheme merged in, lots of investment confidence and more investment, some of which could easily have impacted 2019 prices.

Gas prices are flat but increased gas generation is still a driver of electricity generation price

Contrary to some public statements gas prices, as measured by the short term trading market [STTM] are actually well above last year in this the shoulder season. We didn’t see the rationing prices in Winter that we saw last year but neither have we seen the falls in prices that we saw last year in Spring.

Gas prices haven’t fallen in the shoulder season because of the increased need for gas generation. In addition gas companies are no doubt madly trying to get storage facilities as full as possible for the December – March potential crisis phase.

Gas fuelled electricity consumption is up 28% across the NEM for the April-August period compared to previous corresponding period [PCP] and that’s despite a decline in Qld. Figure 3 clearly shows the increase in both South Australia and in Victoria.

We focus on that time period because it’s the post Hazelwood comparison. If there is any good news in Figure 3 it’s that there is some surplus gas generation capacity in NSW that can supply some of the demand this Summer.

David Leitch is principal of ITK. He was formerly a Utility Analyst for leading investment banks over the past 30 years. The views expressed are his own. Please note our new section, Energy Markets, which will include analysis from Leitch on the energy markets and broader energy issues. And also note our live generation widget, and the APVI solar contribution.