Coal generation may have a future in Australia’s energy grid, as prime minister Malcolm Turnbull would have us believe, but it may not be a long one.

It is now clearly recognised, away from the imaginary world of the fossil fuel lobby, that the cheapest form of new generation in Australia – and most other places in the world – is wind and solar, and certainly not coal and gas (or nuclear).

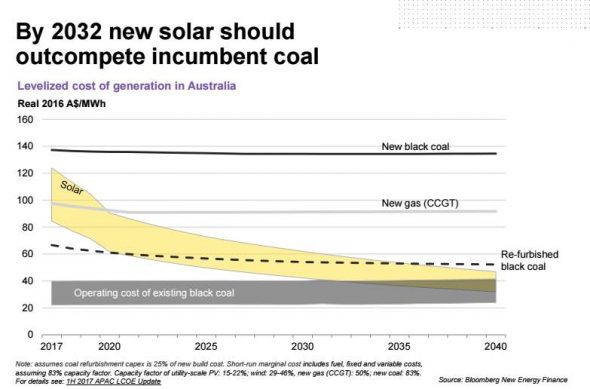

Recently, Bloomberg New Energy Finance predicted that the cost of new wind and solar would soon beat the cost of refurbished coal plants.

Now BNEF predicts that solar will beat the cost of existing, fully depreciated and unrefurbished coal plants by 2032. And wind will follow soon after.

“Solar is going to beat the cost of existing coal power by 2032,” BNEF’s senior analyst in Australia Kobad Bhavnagri says.

“At that point it will be cheaper to build solar than it is to shovel coal into fully depreciated coal-fired power station.

“That is going to be a critical changing point in energy economics. It is one that was previously unthinkable, it was on no one’s horizon.”

And this is a prediction that will affect not just Australia. It will occur in just about every country in the world, including in China, also in the 2030s, with a stunning impact in energy markets across the globe.

The result of this, Bhavnagri says, will be a shift from the concept of “baseload” to a new concept that BNEF describes as “base-cost renewables.”

Under this system, renewables such as wind and solar will generate at the lowest possible price, and this “base cost” capacity will then be supplemented by more expensive dispatchable generation to fill in the gaps. Overall, however, there will be a much lower wholesale price.

“We are heading towards a completely different operating paradigm one,” Bhavnagri says.

The baseload system that is often touted around “cheap coal” is a bit misleading, because it has always depended on more expensive gas to top up the system demand and meet system peaks. The gas sets the price of generation, and this can be increased by market bidding behaviour.

The new system has cheap renewables meeting demand much of the time, but storage – delivered through batteries and pumped hydro, and other dispatchable generation, as well as demand management and increased efficiency, will fill in the gaps, but at a much cheaper cost than gas.

A recent ANU study put the combined cost of wind and solar and dispatchable generation (in their case mostly pumped hydro) at around $75/MWh, significantly cheaper than current wholesale prices in the market set by gas.

This will have significant benefits to Australia, because as Ross Garnaut has predicted, Australia’s excellent wind and solar resources will mean that it will regain its position as the country with the cheapest cost of energy, which will be a plus for its manufacturing.

“Australia will match China and India in having the lowest cost renewables,” Bhavnagri says. “Australia will again become a focus for heavy industry and energy intensive industry.

And, he suggests, Australia will have significantly more renewable energy than contemplated in the Finkel Review, with