MHC’s latest research demonstrates that if all the customers with a premium feed-in-tariff (PFiT) subsidy used the residual value of that subsidy to purchase a battery storage system, Australia could have a 960MW virtual power plant, at no additional cost to customers.

In fact, costs to the residual customer base will be reduced, the ability of the power system to transition to a low carbon future is improved immensely, there would be specific network security benefits and the timeframe for implementation is only limited by the market’s ability to respond to customer demand.

Approximately one third of Australia’s solar PV installations (approximately 500,000 customers) currently benefit from a state-level PFiT.

Electricity consumers in these states have financial liabilities of about $5.4bn over the coming decade to pay for these premium feed-in-tariff policies. What if this value could be ‘cashed out’ (at a discount) by PV owners as a subsidy for distributed battery storage?

We believe that, if given the choice, many PFiT consumers would be willing to convert their residual PFiT subsidy into a battery storage subsidy (BSS) – an up-front lump sum to offset all or part of the cost of a battery storage system. And, they would be willing to accept that battery subsidy at a discount to the estimated full value of their PFiT subsidy to secure and enjoy more benefit upfront.

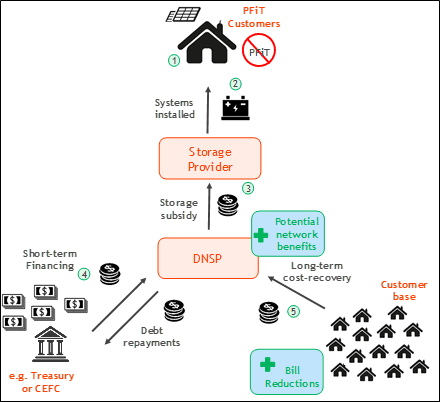

Figure 1 and the below guidance show how distributed storage could be delivered.

The process would work as follows:

- A customer chooses to convert the residual value of their PFiT subsidy, at a discount[1], into a subsidy to put towards a battery storage system. The BSS may cover the full cost of the battery and installation, or the customer can choose to co-invest in a system[2].

- An eligible storage system – all of which are “VPP enabled” – is installed by an accredited installer.

- The storage provider receives the lump sum subsidy from the DNSP and passes the saving onto the customer in the form of a discount off the listed price.

- The DNSP covers the upfront cost of the BSS via a financing agreement at a low interest rate (possibly via State Treasuries or the Clean Energy Financing Corporation, alternately via other national or international sources of low-cost clean energy dedicated finance).

- The DNSP recovers the cost of the BSS from the customer base via their network charges over the life of the scheme[3].

If individuals chose to supplement the value of the BSS with additional funds to purchase a larger sized battery storage system commensurate with their solar PV specifications, the scale of the distributed storage could rise to 1.24GW.

The introduction of a BSS would also enable the state government to define the minimum standards for eligibility – ensuring high quality systems and installation. Eligibility would also be contingent upon the battery storage system being integrated into a virtual power plant. This would provide additional benefit for the system owner, as they could access value streams from external markets and additional benefits for the remaining customer base from aggregated demand response at critical peak periods, improved local power quality and reduced network augmentation costs.

If the discount accepted by the customer on the residual value of their PFiT is greater than the financing and administration costs of the BSS, then the cost passed through to the customer base of the BSS is less than the PFiT subsidy. The power system benefits are extensive and include more distributed storage, increased system stability, lower cross-subsidies and bills for consumers, more certainty for existing PFiT customers, and so on.

We think this is win-win for the sector and will enforce Australia’s position at the vanguard of distributed energy policies and technologies.

However, we are conscious there are some specific consequences that need to be analysed and mitigated, including:

- The risk of poor quality products and installations creating commercial and physical risks for customers

- The domestic storage and installation industry not being prepared for the rapid increase in demand

- The risk of an increase in network prices due to the increase in self-consumption

- Exploitation of scheme by customers e.g. customers intending to move house receive a windfall gain, customers with a faulty PV system receiving a benefit

For more information, as well as the potential VPP size by state, please see our Finkel submission.

Ryan Wavish is CEO and Principal Consultant of Marchment Hill Consulting.