The solar PV cost reduction spiral reached its lowest point yet at an auction in Chile last week where Spanish developer Solarpack Tecnologica won contracts to sell power from a solar plant high in the Andes for $29.10/MWh. The 120MW plant to be built in Chile’s sunny Atacama desert surpassed the previous record-low for solar PV brokered in Dubai in May, and was priced at almost half the cost of coal power in the same event.

Overall, Chile’s latest auction contracted 12.4TWh of new generation with 52% awarded to renewables at an average price of $45.1/MWh, according to BNEF estimates. The 20-year contracts paid in Chilean pesos were awarded to 11 companies, including Mainstream Renewable Power and Endesa Chile – a subsidiary of Enel.

Yet some power-market players doubt the projects can deliver, given the auction’s record-low power purchase agreements, because project owners in Chile are exposed “substantially to fluctuating power prices”, according to Ana Verena Barreto Lima, a Sao Paulo-based BNEF analyst, in a BNEF Analyst Reaction. Low power demand in remote regions and discrepancies in selling power at different points in the distribution network can mean that “even projects with contracts secured in the regulated market are exposed to spot price fluctuations,” Lima wrote.

In the US, the Obama administration’s final push to champion renewable energy could see red tape get cut on environmental planning regulation. A new rule, set to be imposed within the next few weeks, would see developers encouraged to bid on government-selected tracts of land with good renewable energy potential that have been pre-cleared of major environmental conflicts.

The proposal would mirror the competitive bidding process already used to sell oil and gas rights on public lands and would provide greater protection for developers like First Solar and Berkshire Hathaway Energy that have expressed interest in the taxpayer-owned land. The measure would also be a boon to Hillary Clinton’s vow to increase renewable power on public land by ten-fold in the next decade, were the Democrat nominee to win the vote in the upcoming Presidential election.

Deepwater Wind made waves last week completing the US’s first offshore wind farm. The $300m project off the US East Coast near Rhode Island has a capacity of 30MW and will begin commercial operation in November.

The budding growth market for offshore wind in the US and the implications of Massachusetts’ new energy Bill, which creates a market for as much as 1.6GW of offshore wind farms in the state, is discussed further in this BNEF note.

The potential for offshore wind on the country’s west coast is also coming to the attention of policymakers, with the US Bureau of Ocean Energy Management issuing a request for interest in a lease area of California’s coast for floating wind last week. Trident Winds has already proposed building a 765MW floating wind farm some 33 miles off the coast, intending to transmit power back to a PG&E substation. The outcome of the request will determine whether the Trident lease is awarded on a non-competitive or competitive bases, the bureau said.

In European offshore wind, the value of China Three Gorges’ acquisition of WindMW – the owner of one of Germany’s largest offshore wind farms – was announced last week at EUR 645.4m ($731m). Blackstone Group’s agreed to sell its 80% interest in the project company, which owns a 288MW offshore wind farm in Germany, to the Chinese utility in the presence of Li Keqiang, China’s state Premier, and Angela Merkel, Chancellor of Germany, at Merkel’s state visit to the Asian nation in June.

China’s acquisition “drive into European waters is largely due to government policy mandating an increase in cross boarder investment,” said Keegan Kruger, a wind analyst at BNEF. Chinese utilities are “gearing up to diversify their asset portfolios” and increase their exposure to offshore wind in anticipation of a weakening Yuan, he said.

Wind power was also under discussion in India last week, as the country prepares to auction some 10GW of wind power by 2019 in an effort to meet Prime Minister Narendra Modi’s goal to increase clean energy almost fourfold by 2022. The first 1GW tender is planned for October and India will encourage bids by increasing the clean energy quota that utilities are required to purchase, according to Varsha Joshi, joint secretary at India’s Ministry of New and Renewable Power. The auctions will be designed to allow wind-poor states to source clean energy from windier regions, she said.

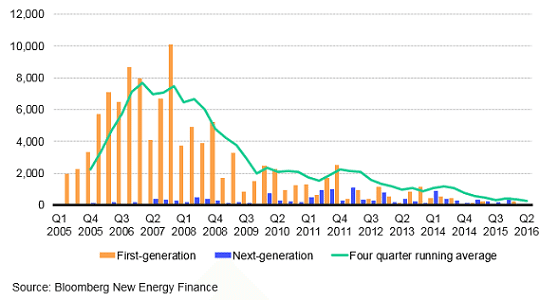

Total new biofuels investment in Q2 2016 stood at $11m — the lowest-ever recorded by BNEF in a single quarter. The majority of this can be accounted for by a $9.5m secondary share placement by biobutanol producer on the NASDAQ exchange. Gevo’s bio-jet fuel was used for the first time Gevo in commercial flights carried out by Alaska Airlines. Read more in this BNEF Insight note.

Source: Bloomberg New Energy Finance. Reproduced with permission.