- Volumes shot up this week on the back of colder weather to be 5% above last year on both 7 and 30 day moving total basis. Across the National Electricity Market (NEM) volumes are up 2.3% on a calendar year to date (CYTD) basis and even in Victoria volumes CYTD are up 1.3%

- Spot and future prices: Spot prices for the week were basically at 3X last year’s level across the board. Buying out of the pool was costing $80 MWh or more in every State except QLD. As much as anything we think these prices are being driven by the high price of gas and the lack of alternative flexible generation to pick up the slack when the wind isn’t blowing. Futures prices in Victoria for the next two years rose 4% in a week, and in NSW 1-2%.

- REC prices were flat on the week, but at $83 participants probably hope they stay flat to 2030. It’s electricity consumers who are paying the high prices and its business customers that will feel it the most.

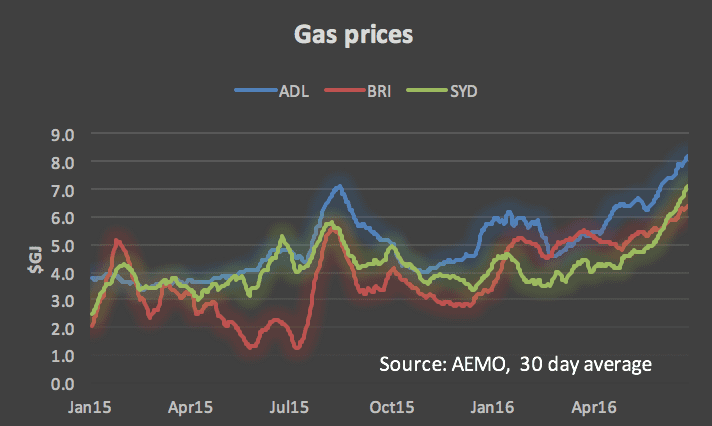

- Gas prices were strongly up hitting $15 GJ on Friday in Adelaide and $9.40 GJ in Sydney. Prices will mostly be higher in winter and will be higher next winter once the two remaining LNG plants in QLD start up.

- Share prices: were weak pretty much across the board driven down by Brexit on Friday. The markets new “risk off” or flight to safety has seen yield driven shares like DUE, AST and SKI perform well. The APA share price has performed OK but less spectacularly than in recent years. We look briefly at gas flow to South Australia and NSW and note the increasing demands on Bass Strait gas to supply the domestic market. A breakdown at Longford would absolutely cruel the domestic gas and electricity market.

Share prices

Volumes

Base load futures

Gas prices

As Winter struck NSW and Adelaide gas prices are really putting a bite on particularly in South Australia where the ex post price on Friday was $15 GJ and $9.40 in Sydney. The 30 day moving average price in Adelaide is now over $8.

If we look at gas flows we can see that NSW is now getting the vast majority of gas from Victoria, as the flow from Moomba to NSW has declined sharply. Gas from Moomba is still going down to Adelaide but even there the Moomba Adelaide pipe [MAPS] is struggling to hold market share with the competing Victorian supplied SEAGAS pipeline.

The pipeline charts we show are aggregate numbers. As APA has built up its East Coast transmission network gas during the Summer months was actually flowing up from Victoria to NSW and then onto Moomba. It may well have been going into storage there in preparation for the Winter seasonal peak.

The Longford gas plant has been producing a bit more gas this year, but actually the Moomba plant has picked up its output quite considerably in recent months. However we think more of that gas is going to QLD. Once again we caution that the gas market is not yet in equilibrium with two LNG plants still to start up surely putting more strain on gas supply across the board. One thing’s for sure if Adelaide is paying $14 gj for gas or even $10 the electricity produced is going to be very expensive.

David Leitch is principal of ITK. He was formerly a Utility Analyst for leading investment banks over the past 30 years. The views expressed are his own. Please note our new section, Energy Markets, which will include analysis from Leitch on the energy markets and broader energy issues. And also note our live generation widget, and the APVI solar contribution.