At least 480MW of large-scale solar projects are certain to go ahead in the new year after all 12 winners from the big solar tender held by the Australian Renewable Energy Agency deposited bonds with the federal agency.

RenewEconomy understands that $5.6 million has been deposited by the winning projects, indicating their confidence in obtaining finance for their more than $1 billion in projects by the end of January and beginning construction early in 2017.

The projects will more than treble the amount of big solar in Australia, and will likely be accompanied by other big solar projects that will take advantage of the availability of finance, the falling cost of modules, and high renewable energy certificate prices.

The bidding rules of the funding round required all successful projects to lodge bid bonds in the form of cash or bank guarantees by October 10. The winning bidders had to deposit $20,000 per MW capacity of their proposed projects, or a maximum of $500,000.

If projects do not reach financial close within the required timeframe of 31 January 2017, the bid bonds will be forfeited to ARENA. Projects may be granted an extension of up to 100 days on request and at ARENA’s discretion.

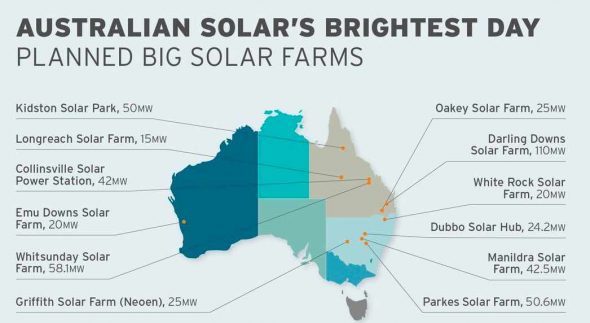

French renewable energy developer Neoen secured three projects – all in NSW – while Canadian Solar had two projects. Other winners were Infigen Energy, Solar Choice, APA Group, Genex, Goldwind and Ratch.

The largest was Origin Energy’s 110MW Darling Downs project. Talk at the recent All-Energy Australia conference was that Origin is keen to start construction as soon as possible to take advantage of the high LGC price, which has been trading at around $90/MWh.

This is just short of the penalty price. The LGC prices have jumped, ironically, because of the lack of projects built in recent years, partly because the major retailers have been unwilling to offer long-term power purchase agreements, making it difficult for developers to obtain bank finance.

But the dynamics of the market are beginning to change. The ARENA process has been credited with bringing down bids by at least 40 per cent as developers found ways to reduce costs.

But the fall in module prices – with some predicting a 30-40 per cent reduction in the next year – and the high LGC price are inspiring some projects to “go merchant” and rely on the spot price for electricity and LGCs.

One such project has been announced by UK developer Eco Energy World, which recently won approval for a 140MW solar project in Queensland, while Sun Brilliance is proposing to build a 100MW solar plant in Western Australia.

Both those projects, and most of the ARENA winners, will use tracking technology that will maximise the output of the solar farms by following the sun from east to west during the day.