Prime Minister Tony Abbott’s repeal of the carbon price continues to deliver for the Australian coal industry, with the share of brown coal generation surging to its highest level in three years, taking a substantial increase in electricity emissions with it.

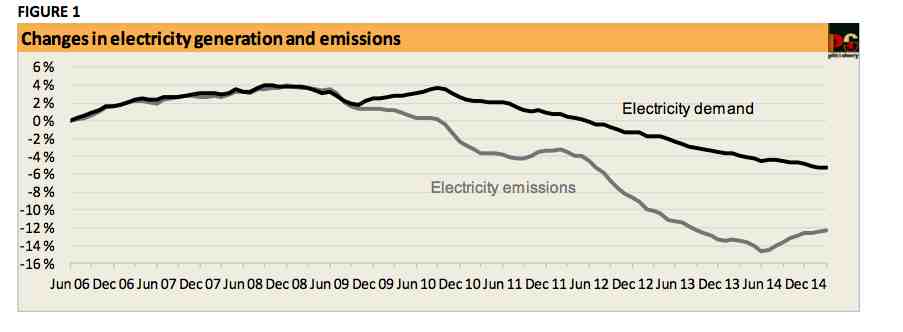

According to the latest survey by Pitt & Sherry in its Cedex series, Australian electricity emissions have jumped 2.8 per cent since last June, when the carbon price was repealed, and the emissions intensity of the national grid has jumped by 4 per cent over the same period.

Brown coal generators have profited mostly from the carbon tax repeal. Pitt & Sherry’s Hugh Saddler said the five Victorian brown coal generators supplied 31.9 per cent of total coal generation in March, making a total coal share of 75 per cent over the previous 12 months, up from 72.9 per cent in the year to June 2014.

The revival of high polluting brown coal generators has more than offset any gains from wind energy, which made its largest contribution in a 12-month period (9,000GWh or 5.16 per cent), and the growing impact of rooftop solar and energy efficiency.

Abbott’s Direct Action plan will now invite bids in the emissions reduction fund, where coal-fired generators will seek to receive taxpayer funds to reduce their emissions. And under the guidelines released last week, there will be no penalty if they continue to raise them.

Abbott’s Direct Action plan will now invite bids in the emissions reduction fund, where coal-fired generators will seek to receive taxpayer funds to reduce their emissions. And under the guidelines released last week, there will be no penalty if they continue to raise them.

For the first time, average demand is also showing a rebound, with two exceptions: Victoria and South Australia. Saddler suggests in the case of Victoria it could be due to the closure of the Point Henry aluminium smelter, while in South Australia it is likely to be the impact of the highest penetration of rooftop solar in the country.

A couple of other notable developments were the share of gas-fired generation. This rose in Queensland because of cheap “ramp gas” which is being produced ahead of the start of LNG exports from that state.

Gas generation was steady in NSW and Victoria, but in South Australia its share decreased because of the growth in wind generation, flowing from the completion during 2014 of most of the wind farm projects in the construction pipeline. Saddler says this has displaced higher cost gas.

And there was the introduction of large-scale solar on to the national grid. The first 25MW to be completed at the Nyngan power plant came on line in late March, and contributed 0.13 per cent of electricity supplied to the NEM in NSW, or 0.04 per cent supplied to the whole NEM, over the same period.

“This of course is much smaller than the energy supplied by small-scale rooftop PV, estimated by AEMO to currently be around 2.5 per cent, but it is a start,” Saddler notes.

Nyngan will be built out to 102MW, making it much bigger than Australia’s other operating solar farm, at Royalla near Canberra, which has a capacity of 20MW. This has been generating since last August, but is embedded within the local ActewAGL distribution network, and thus not part of the NEM dispatch and trading system.

Hydro generation continues to fall. Saddler says Snowy hydro storage levels are now at average long-term levels, but Hydro Tasmania’s storages are down to levels almost as low as those at the height of the drought, in early 2009. Since Tasmania normally provides at least 60 per cent of Australia’s total hydro generation, it may be some time, depending on rainfall in Tasmania over coming months, before hydro generation in the NEM gets back to its long-term average levels.

And peak demand levels are also down – continuing the trend which makes a nonsense of the justification to expand the grids and build more gas and coal plants over the last 10 years.

Saddler says the fall in peak demand in NSW and Queensland, which had the most extreme fears of peak demand (their networks were owned by the state governments), is particularly notable. Part of it is reduced manufacturing demand, part of it an absence of heat waves. “But it is hard to avoid the conclusion that increased household energy efficiency and modified energy-consuming behaviour have also played a part in moderating demand peaks,” Saddler says.