As debate reignites over the economic and environmental viability of developing new mega-coal mine projects in Queensland’s Galilee Basin, a new report out of Oxford University has identified the world’s coal-fired power stations most at risk of becoming ‘stranded assets’. On many levels, the result is not good news for Australia.

The Stranded Assets Programme report, released on Friday by Oxford’s Smith School of Enterprise and the Environment, identifies the world’s least efficient and most polluting ‘subcritical’ coal-fired power stations.

It offers the information gathered in the 70-page report as advice for policy-makers concerned about economics and climate, and as more evidence in a “strong case” for financial institutions to evaluate the risk of investing in the companies that hold these assets, and then to “screen, engage, or divest.”

As the report tells us, subcritical coal is the least efficient and most polluting form of coal-fired generation, with the average subcritical coal-fired power station (SCPS) emitting 75 per cent more carbon pollution than an average advanced ultracritical – the most up-to-date form of coal-fired power station – and using 67 per cent more water to generate the same amount of energy.

“Subcritical plants are typically older and more expensive to operate,” said Ben Caldecott, lead author of the report and Director of the Stranded Assets Programme.

“Consequently, closing these plants down may represent a sound choice for budget-constrained policymakers looking for cost-effective ways of tackling pollution.”

(Remember that, according to IEA estimates, to limit global emissions to a level consistent with a 2°C future, it will be necessary to close around a quarter of all subcritical coal-fired power stations worldwide by 2020.)

It is food for thought for Australia, then, that the Oxford report has declared it owner of “by far” the most carbon-intensive sub-critical fleet in the world (followed by India and Indonesia), with a whopping 90 per cent of its total 29GW of coal-fired generation capacity coming from 23 subcritical plants.

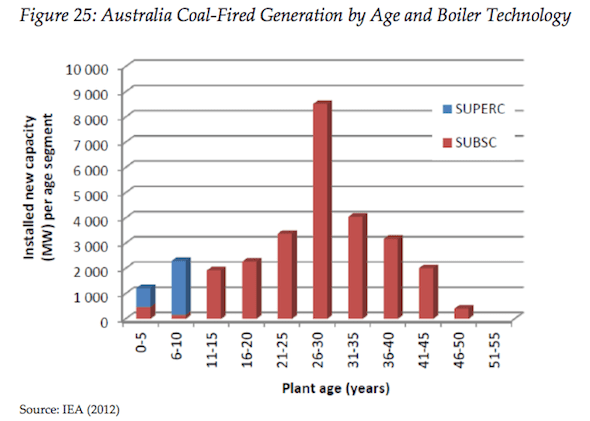

As the table below shows, 82 per cent of Australia’s subcritical coal-fired generation is also more than 15 years old, while nearly 20 per cent of it is older than 35 years.

Further, the research shows that Australia is home 21 companies with subcritical coal power station assets, four of which rank in the top 100 companies with the largest SCPS holdings – half of which are government owned.

Of Australia’s big gentailers, AGL Energy is the only one to crack the top 20, ranking number 19 in the world’s largest SCPC portfolios – by generation – from just four aging plants.

This will not come as a surprise to RenewEconomy readers, who will recall that AGL has in recent years gone from being the greenest of Australia’s big power retailers, with the lowest emissions intensity, to the biggest owner of heavy-emitting coal-fired generation in the country, after buying 4.6GW of coal-fired generators in the Hunter Valley and the 2.2GW Loy Yang A brown coal generator in Victoria – Australia’s biggest single greenhouse gas emitter.

Perhaps even more worrying for Australia, though, is the state of things in China and India; two of the biggest markets for Australian coal exports, and in particular for the huge amounts of poor quality coal that would be dug up and shipped out from the proposed Galilee mines.

“The outlook for the Chinese SCPS fleet is poor,” says the report, with regulatory regimes around coal-fired power generation tightening, both for emissions and for water use.

“Given the young age of Chinese SCPSs and enormous size of the SCPS s tock in northeastern China, this may well create a significant number of stranded SCPS assets through forced closure and impairment of profitability,” it says.

In India, meanwhile, the report points to the serious and worsening water-related risks that threaten its SCPS fleet, with 33 per cent of generators currently located in areas of extremely high water stress.

Since 2010, the report notes, “water scarcity has forced significant plant suspensions, which greatly impact plant profitability and lead to rolling blackouts.”