The collapse in global oil prices to 5 year lows is causing a lot of speculation about what this means for climate change, and clean energy. High fuel costs, it is said, encourages the use of alternative fuels. Low fuel costs, on the other hand, simply encourages more consumption of conventional fuels.

True, but only up to a point. The price of the fuel as a commodity will also influence how much money is invested in oil projects – needed to maintain supply – and where the trillions of dollars in global capital will flow. In the case of oil, extraction is getting more and more expensive and the oil majors have struggled to find new oil reserves that make economic sense.

The fall in the oil price makes that even more difficult. So, from the point of view of the climate, that is a good thing, because that capital will likely flow to alternatives such as solar and wind and other renewables and technologies – the inevitable result, Alliance Bernstein warned early this year – of energy price deflation.

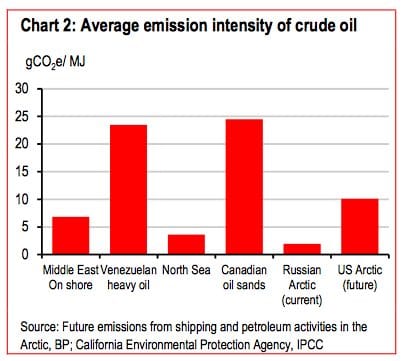

A report from HSBC highlights the dilemma for the oil industry. Many of the new reserves, such as tar sands in Canada and proposed fields in the Arctic, don’t make economic sense. (See table above). And that is before the cost of refining and delivery.

“Lower oil prices should be beneficial for climate because the economics of higher cost projects are less compelling, meaning less production,” the HSBC economists write in the analysis. And to prove its theory, oil giant Chevron overnight put its proposed drilling program in the Arctic Sea on hold “indefinitely.”

At these prices, drilling in the Arctic simply makes no sense. Doug Matthews, an analyst and former oil and gas director with the Northwest Territories government, said: “With the price of oil down by 40 per cent since June companies all over the world are starting to pull in their horns.”

And high cost oil fields usually – but not always – equate to high carbon emitting fields. This next graph shows that oil sands is amazingly polluting, and the Arctic reserves would be twice as polluting as the main fields currently in production.

But that still doesn’t tell the whole story. The energy analysts at HSNC also looked at the national accounts of middle east oil producers.

They calculated that the break-even oil prices in the context of what oil price is necessary to fund public spending and leave the government with a zero budget balance is significantly higher than the production cost of oil.

In Saudi Arabia for instance (a country using 1.5m barrels oil a day for desalination to satisfy water needs in 2012), an oil price of $US20/barrel would have balanced the budget in 2003, but in 2015 an oil price of $US90/b is required to cover increased levels of spending.

That explains why Saudi Arabia is so keen to invest in renewables, particularly solar, to satisfy its domestic energy needs. And has earmarked more than $40 billion to do so.

“On balance from a climate perspective, we think that lower oil prices are beneficial because the deteriorating economics for higher cost of extraction projects push back production volumes, thus lowering CO2 which is needed to extend the carbon budget,” the HSBC economists write.

“Also here we have only looked at the carbon intensity of production and tranpsort, but once other factors are taken into account, such as refining, finished fuel transport and fuel combustion, the carbon intensities are obviously much higher. Lower production now prolongues the carbon budget.”

As Mark Lewis, from French firm Kepler Chevreux noted this week, there are broader signals showing that a global energy transition is already underway. He listed 7 such signals.

As Mark Lewis, from French firm Kepler Chevreux noted this week, there are broader signals showing that a global energy transition is already underway. He listed 7 such signals.

1. One of the proposals discussed at Lima, and still an option for the Paris climate change talks, is the complete phasing out of fossil fuels by 2050, or allowing such fuels to be used but only if the emissions from burning them could be entirely offset. “Barring an extremely disruptive technological breakthrough neither of these options would appear realistic today,” Lewis writes, “but the fact that they were raised at all is indicative of an emerging mindset, and this should be of huge concern to fossil-fuel companies.”

2. Saudi Arabia’s chief climate negotiator, Khalid Abuleif, was quoted as saying in Lima that “climate-change policy will affect our future and we are working very hard to raise our resilience”. He went on to say that “inevitably, oil producers are going to face huge liabilities if the implementation of the convention is advocating a move away from fossil fuels”. As Lewis noted: “If even Saudi Arabia – the world’s lowest-cost producer of oil – is concerned about the implications for its future of the ongoing UNFCCC negotiations and a deal in Paris next year, then how much more worried should the publicly quoted oil majors be given that they, by contrast, are increasingly producing the highest-cost barrels of oil at the upper end of the industry cost curve?

3. Just as the COP in Lima was about to begin, the Governor of the Bank of England announced that his institution would examine the risks to financial stability posed by “unburnable carbon”, the idea first put forward by Carbon Tracker in its 2011 study of the same name. Lewis again: “In our view this constitutes a very significant development, as it shows that the debate over the future of fossil fuels now encompasses not only climate change but also global financial stability.”

4. At the beginning of the second week of the Lima COP, the Institutional Investors Group on Climate Change published a study entitled Investor Expectations: Oil and Gas Company Strategy. Lewis’ take: “This study is designed to investors engage with fossil-fuel companies on carbon-asset risk, and is another sign of how closely many of the world’s largest institutional investors are now monitoring the strategies and capex plans of fossil-fuel corporations.”

5. Ed Davey, the UK Minister for Energy and Climate Change, said in Lima that there might be a case for requiring all institutional investors, insurers, banks and other financial institutions to disclose their holdings of fossil-fuel investments.

6. While the Lima COP has been in progress, the oil price has continued its precipitous drop. Lewis again: “This is putting huge pressure on the industry, not least on the oil majors, and in our view the majors should see this sharp drop as a wake-up call regarding the potential longer-term price consequences of a global climate deal.”

7. Finally, the decision by E.ON to split itself into two companies from 2016 announced on 30 November, one concentrating on the legacy business of fossil fuels and nuclear, the other on the growth business of renewables and energy services, shows that some companies are not waiting for a global climate deal to be struck before taking action but have decided to start adapting to the new energy reality now.

“In our view, all of these developments are important indications of a major transformational shift in the global energy system, a shift that is being driven by a combination of policy measures on the one hand, and economic and technological forces on the other,” Lewis writes.

Conclusion: Fossil-fuel companies can no longer ignore the signs of change.

“The risk to fossil-fuel companies in future will come not only from ever tighter climate policies, but also from broader financial, economic and technological forces. In our view, these forces will only become more prevalent in coming months and years, and all fossil-fuel companies should therefore be thinking about how they deal with the challenge of the structural shift now underway in the world’s energy system before it is too late.”

Rod Day, writing for Greentech Media, says it could be that some of that capital simply does not get deployed because of the economic uncertainty that a fall in the oil price creates. But not for long. He noted the plunging price of solar, of LED lighting, and now battery storage.

“The point is, while collapsing oil prices will result in many generalist investors remaining on the sidelines, key tipping points are being breached across multiple clean energy technology opportunities,” Day writes.

“Cost declines march forward, new channels and financing platforms are being launched, and market acceptance via peer influence is overcoming reticence around what used to be curiosities. If you’re a fan of investing into high-growth markets, it’s a great time to be jumping in. Because not even today’s oil market turmoil will be able to hold back these market inflection points for long.”