The Australian government – and ministers Greg Hunt and Ian Macfarlane in particular, like to tell everyone how much they support renewable energy. But they seem to be doing their level best to trash the industry in Australia.

Key data released late last week underlines the disastrous state of the large-scale renewable sector: for all intents and purposes, it doesn’t exist.

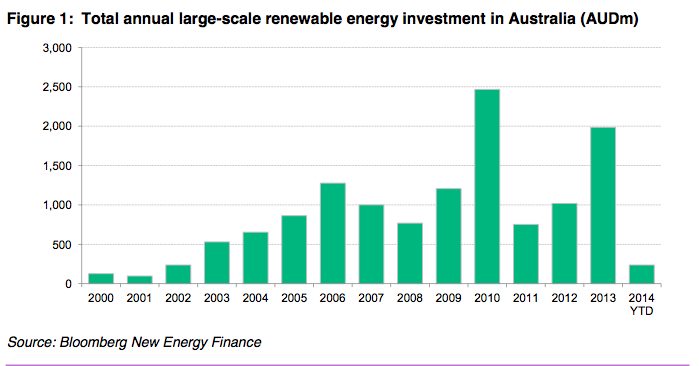

Bloomberg New Energy Finance data shows that Australia is on track to record its lowest level of asset financing for large-scale renewables since 2002 – as just $193 million was committed in the third quarter of the year. From ranking No 11, in the world in 2013, Australia has fallen behind Algeria and even Myanmar.

Australia, which should be one of the world’s leaders in the industry, is seeing its industry collapse. The three biggest Australian investors in renewable energy are in deep trouble.

Industry Funds Management is being forced to write down the value of Pacific Hydro, the largest specialised investor in renewables in the country, by $685 million, according to the Australian Financial Review. This from a business that was to have been floated a year or so ago with a value of more than $2 billion.

Infigen Energy, the largest listed investor in renewables, has said it is facing massive writedowns, and potentially taking dramatic action to protect shareholder funds. It has brought Australian investments to a halt. So has Silex Systems, which has effectively abandoned the solar industry.

International investors have also made clear that their investment in Australia will end soon un less policy stability is restored. These include First Solar, Chinese wind turbine leader Goldwind, and numerous others. The US-based Recurrent Energy has already packed its bags, Spanish based FRV has said its $1.5 billion pipeline is at risk.

The reason for this? Despite the protestations of the Abbott government, it is the uncertainty they have created. Each of the private companies has cited uncertainty about the RET, a situation that Hunt and Macfarlane know only too well because they kept complaining about it in opposition when the RET legislation was delayed in 2009 and 2010.

IFM CEO Brett Hinbury said the two biggest factors affecting the company was the fall in energy demand – and the uncertainty around the current laws.

As BNEF explains:

“The severe downturn in investment – and total freeze in private investment – has been caused by the Abbott government’s review of the Renewable Energy Target,” it writes.

“Its controversial review panel recommended scrapping the target or radically diminishing it in August, but the government is yet to announce its position and faces blockage in the Senate to changes.

“Private investment is likely to remain frozen until the government’s position is clarified, which is expected in the coming months. However the hiatus in investment will continue for several years if the recommendations of the review panel are not rejected.”

Of course, it makes an absolute nonsense of the claims by Macfarlane and Hunt that the government supports the industry. They understand full well the impact of their decision to appoint a group of climate science deniers and fossil fuel lobbyists to “review” the RET under the tutelage of Dick Warburton, and of comments by Treasurer Joe Hockey that he finds wind turbines “absolutely offensive” and from Prime Minister Tony Abbott, who complains about cost impact.

This is despite the findings of the Warburton review that the target could be met, and would deliver cost savings to consumers. Still, it recommended the RET be stopped in its tracks or halted, for fear of a “transfer of wealth” from fossil fuel generators to consumers.

The irony is that even the paltry $193 of new finance in the third quarter came from initiatives put in place by the previous Labor government, and by institutions that the Abbott government wants to shut down.

A total of 7 projects have been financed since the start of the calendar year – all are the subject of government funding through the Australian Renewable Energy Agency, Clean Energy Finance Corporation or state governments. None were backed by non-government lenders or investors.

In the first two quarters of the year, there was just $45 million of financing.

This contrasts with the continuing surge in rooftop solar – mostly for the purposes of self consumption – and the growing boom in renewables investment across the world.

Globally, clean energy investment in the first three quarters of this year was 16 per cent ahead of the same period of 2013, at $175.1billion.

The highlight of the third quarter was a leap in Chinese solar investment to a new record of $12.2 billion. China is building a large number of utility-scale photovoltaic projects linked to its main transmission grid.

In Japan, investment grew 17 per cen to $8.6 billion, with solar again the dominant renewable energy source. Other countries showing a bounce in investment in the latest quarter were Canada, France and India, while there were significant projects financed in a number of new markets, including Myanmar and Sri Lanka.

Michael Liebreich, chairman of the advisory board at BNEF said the figures were heartening, but still not enough to herald the “rapid transformation of the power systems” that is required. That would require investment of $200 billion and $300 billion a year.

The third quarter figures showed that global investment in wind farms, solar parks and geothermal plants reached $33.3 billion, a slight rise on year earlier figures, while investment in small-scale projects such as rooftop solar was $18.3 billion, up nearly a third from a year earlier.

Of course, there is a way that Hunt and Macfarlane can deliver on their claim that they really do want the best for the Australian renewable energy industry. That is to quickly reach a deal with the Labor Party and the industry on the way forward.

The Labor Party has indicated it may be prepared to defer the target to 2022, the Clean Energy Council has indicated it could accept an exemption for the aluminium industry. All the Coalition government has to do is to drop the ideological nonsense from the Warburton Review, and accept that Australia has to follow the rest of the world and put in place a rapid de-carbonisation of its electricity industry.