July 1, 2014, marks the second anniversary of Australia’s carbon laws – the Clean Energy Act and other laws that price and reduce pollution, invest in renewable energy and support households and business in the shift to a cleaner economy.

The laws are working and have delivered impressive results in their first two years: Australia’s pollution is down; economic growth is up; unemployment and inflation remains under control; and solar and wind energy has soared.

The carbon laws have worked with the renewable energy target and economic changes to achieve these results.

The Abbott Government intends to repeal the carbon laws, aiming to replace them with still uncertain policies that shift the burden of pollution reduction from big polluters to taxpayers, threaten the Renewable Energy Target, and may or may not place limits on our biggest polluters.

The Abbott Government intends to repeal the carbon laws, aiming to replace them with still uncertain policies that shift the burden of pollution reduction from big polluters to taxpayers, threaten the Renewable Energy Target, and may or may not place limits on our biggest polluters.

No independent assessment to date[i] supports the ability of these policies to achieve 2020 pollution reduction targets of at least 5 per cent below 2000 levels. By contrast, the default mechanisms in the carbon laws will achieve at least 15 per cent reductions. Australia continues to have international commitments of 5 to 25 per cent reductions – a pre-election promise of the Abbott Government.

Pollution is down

Total emissions from electricity consumption in the National Electricity Market (NEM) are down by 5.3 million tonnes in the 12 months to May 2014[ii]. This means emissions from electricity generation have fallen by 17.2 million tonnes or 10.3 per cent since carbon pricing was introduced.

The latest Australian Greenhouse Gas Inventory has shown that national emissions continue to drop and the Abbott Government’s own assessments estimate the carbon laws will decrease national pollution by 40 million tonnes[iii].

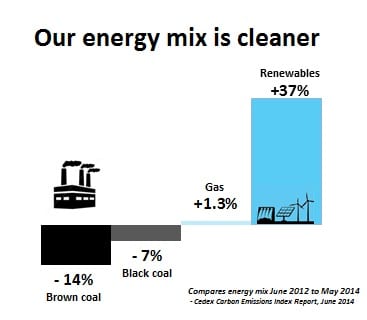

Our energy mix is cleaner

Current policies are also driving increased uptake of renewable energy like wind and solar, with electricity from renewables rising by around 37 per cent and natural gas by 1.3 per cent since June 2012. At the same time, the use of brown coal has fallen by 14 per cent and black coal by 7 per cent[iv].

Current policies are also driving increased uptake of renewable energy like wind and solar, with electricity from renewables rising by around 37 per cent and natural gas by 1.3 per cent since June 2012. At the same time, the use of brown coal has fallen by 14 per cent and black coal by 7 per cent[iv].

Australia now has a cleaner electricity generation sector with carbon pollution per megawatt-hour down from 0.87 to 0.82 tonnes per unit of output, or 5.7 per cent since carbon pricing was introduced.

The Australian economy continues to grow and inflation impacts were minimal

The Australian economy remains strong. In fact growth was higher than expected (1.1 per cent) in the March quarter, with an annual growth rate of 3.5 per cent. Unemployment remains below 6 per cent and jobs in the renewable energy sector continue to grow.

Price impacts from the carbon laws have been as expected[v] or less and have had minimal impact on the Consumer Price Index. Latest figures show a 2.9 per cent rise in the year to March 2014, a rate that is within the Reserve Bank of Australia’s target range.

The Abbott Government’s December MYEFO highlighted the minimal inflationary impact of carbon pricing by predicting its removal would “lower headline and underlying inflation by less than ¼ of a percentage point in 2014-15”[vi].

The carbon price has not impacted on the nation’s overall economic performance. It has certainly not has resulted in the catastrophic impacts predicted by opponents of the carbon laws.

The carbon laws default mechanisms will reduce pollution by at least 15 per cent by 2020

From 1 July 2015, the carbon laws set not just a price but a limit on carbon pollution. The default mechanism in the laws automatically reduces that limit by 12 million tonnes per year.

The independent Climate Change Authority estimated this would help reduce Australian pollution levels to 15 per cent below 2000 levels by 2020[vii]. Estimates supported by the Parliamentary Library put this figure higher than 18 per cent[viii].

“Direct Action” will struggle to achieve even 5 per cent reductions

Independent modelling from Sinclair Knight Merz and Monash University of Coalition’s “Direct Action” plans showed that plan would increase pollution levels by 9 per cent by 2020, rather than decrease it[ix].

This included generous assessments including maintenance of the renewable energy target (now under review) and the expenditure of the promised $2.55 billion over the forward estimates from its Emissions Reduction Fund (ERF).

The Budget contained new estimates from Treasury that just $1.15 billion would be expended in that time meaning potentially higher increases in pollution levels[x]. Separate industry analysis released on 12 June estimates the ERF will purchase just 30 per cent of emission reductions needed to meet the 2020 target[xi].

Australian support for climate action is rebounding

Polling released by the Lowy Institute in early June shows support for climate action rebounding and that almost two-thirds of Australians think the government should take a global leadership role. Only 28 per cent believe we should wait for international consensus – often a proxy for inaction. Just 7 per cent think Australia should do nothing[xii].

International action, carbon pricing and pollution limits are becoming common practice

Inaction by major emitters like the United States and China has long been used by the Coalition as a reason to hold back on efforts here. But both countries are now embarked on ambitious plans to control pollution, invest in clean energy and to help negotiations on a global framework agreement in 2015.

The US has committed to reduce national emissions by 17 per cent below 2005 levels by 2020. This equals 21 per cent below their 2000 levels by 2020. If Australia was to keep pace with the US commitment of 17 per cent below 2005 levels by 2020 this would equal a 12 per cent reduction off our 2000 levels.

The US has just announced new rules to reduce carbon pollution from American coal and gas power plants. The new rules add to existing federal regulations, state based carbon markets and renewable energy target schemes which are in place in 29 American states.

China has committed to reducing its carbon emissions per unit of GDP by 40-45 per cent by 2020. China is also ramping up efforts to clean up its energy supply and improve energy efficiency.

Last year China launched five regional carbon markets, invested $54 billion in renewable energy, and set limits on coal use. It is moving to establish a national carbon market by 2020. Other countries which have introduced, or are planning, market based emissions trading schemes and carbon taxes include South Africa, South Korea, New Zealand, the UK, Germany, Italy and France.

John Connor is CEO of The Climate Institute

[i] Coalition Climate Policy and the National Climate Interest, Climate Institute, August 2013 – www.climateinstitute.org.au/verve/_resources/TCI_CoalitionClimatePolicyandtheNationalClimateInterest_15August2013.pdf

[ii] Cedex Carbon Emissions Index report, June 2014 – www.pittsh.com.au/assets/files/Cedex/CEDEX%20June%202014.pdf

[iii] Australia’s Abatement Task and 2013 Emissions Projections, Department of the Environment – www.environment.gov.au/system/files/resources/51b72a94-7c7a-48c4-887a-02c7b7d2bd4c/files/abatement-task-summary-report_1.pdf

[iv] National Electricity Market Review, May 2013. (Renewables includes ‘intermittent’ sources, as defined by AEMO)

[v] E.g. Colebatch .T Carbon Tax Inflation Fears Evaporate, http://www.smh.com.au/business/the-economy/carbon-tax-inflation-fears-evaporate-20130724-2qj4q.html

[vi] Mid Year Economic and Fiscal Outlook, p12, http://www.budget.gov.au/2013-14/content/myefo/download/2013_14_MYEFO.pdf

[vii] http://climatechangeauthority.gov.au/node/201/

[viii] www.smh.com.au/environment/climate-change/australias-emissions-cut-target-triples-overnight-thanks-to-failure-to-repeal-carbon-tax-20140602-39esv.html

[ix] Coalition Climate Policy and the National Climate Interest, Climate Institute, August 2013 – www.climateinstitute.org.au/verve/_resources/TCI_CoalitionClimatePolicyandtheNationalClimateInterest_15August2013.pdf

[x] www.climateinstitute.org.au/articles/media-releases/governments-pollution-policy-teeters-on-budget-insights-new-analysis.html

[xi] Reputex www.reputex.com/media-centre/media-release-emissions-reduction-fund-to-be-undersupplied-reputex/

[xii] http://www.lowyinstitute.org/publications/lowy-institute-poll-2014