When analysts look at the challenges facing the energy utility business and the emergence of solar and storage and other distributed technologies, the common refrain is that the utility business is about to face its “Kodak” moment.

That’s the reference to Kodak’s inability to embrace the digital technology it had helped develop and its decision to put most of its eggs in the traditional film business.

But perhaps the best comparison of what awaits the utility business is what happened to fixed line telephony with the introduction of wireless technology and mobile phones.

But what can energy utilities learn from this? It is one of the aspects picked up by Morgan Stanley analysts in their report on the threat of solar and storage that we reported on earlier this week. See also out story on how Tesla batteries could help to take customers off grid.

Morgan Stanley notes that those telecom companies that survived did so because they re-invented themselves. The industry was deregulated, incumbent local exchange carriers were forced to allow competitors to access their equipment, and to provide local and long distance service.

With the rise and fall of competition, the remaining wireline operators reconsolidated and now use their existing infrastructure to provide broadband to residential customers and various services to Enterprise customers.

Grid operators and distribution networks in the electricity industry face a similar threat, as do retailers.

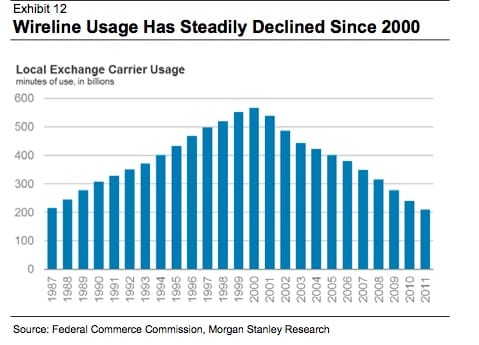

As the Morgan Stanley report notes, fixed line (wireline in the tables) telephony revenues and usage have steadily declined since 2000, and copper wires could be fossilised (redundant) by 2020 if carriers have their way.

The report notes that revenues have declined 20 per cent since 2000 and usage has declined even further – 63 per cent – since that date. (note increase in margins).

By 2020, Morgan Stanley, suggests, more than 50 per cent of US households will have a wireless-only service by 2017.

This next graph shows how many households are connected to fixed line telephony, how many rely on VOIP only, and how many have both. The comparison with the electricity grid, the link to the network, the installation of solar and the potential for storage to make that disconnection are striking.

Both telephone service providers and electric utilities offer products that in the US are deemed essential services, because their reliability remains a critical public interest.

However, in an effort to exit the copper wire business, and escape the massive sunk costs of those investments – Morgan Stanley says telecom companies have formally requested regulatory relief from the Federal Communication Commission (FCC) rule requiring them to provide local exchange service.

The FCC is still evaluating the proposal, and has allowed carriers to begin testing alternative technology. “As the telecom industry continues its transition to wireless and broadband, we believe electric utilities could suffer a similar fate if cost effective off-grid solutions materialise,” Morgan Stanley writes.

And, according to their report, those off grid solutions are getting closer.

It’s interesting to note that this is becoming mainstream thinking in the US, even in Australia. David Crane, the CEO of generation giant NRG, recently wondered why the US would continue with an electricity network of 120 million power poles. His insights into the new business paradigm are compulsory reading.

Even in Australia, utility executives privately admit that their business model is approaching its use-by date.They are just in the process of extracting as much profit as they can from the old paradigm, by using the power of incumbency, market dominance and regulatory fiat.

But how might they evolve and capture a profitable business under the new technology paradigm?

Morgan Stanley gave this scenario, which is not dissimilar to what the CSIRO laid out in its future grid report.

“Utilities take steps to enhance the ability to integrate large amounts of renewables onto the grid. The idea would be to ensure solar customers stay on the grid and contribute to the cost of maintaining the grid, rather than lose solar customers to off-grid business models.”

That may work in US states where grid charges are relatively low and sun conditions are not as favorable as in the West/Southwest.

However, Morgan Stanley notes that in the sun-rich, higher rate Western and Southwest states (as is the case in Australia), grid charges are high, solar resources are excellent, and the penetration levels of solar could grow to be extremely high.

“A “tipping point” would be reached in which remaining grid customers would have very high bills relative to solar customers, and the customer incentives to go fully off-grid could be high.”

We’ll leave the final word to Crane, and a piece he published on his company’s website this week.

“And for the customer, business or individual who simply wants nothing to do with the grid, the centralized control it represents and the inhibition of individual choice and restriction of personal freedom that is implicit in being “inter-tied” to the grid, there is the post-grid future — a future that is driven by renewables, incorporating both energy storage and sophisticated localized automation to balance production and load.

“There will be systems that harness thermal and electric synergies and across not only clean energy, but also fresh water production, waste disposal and electrified transportation to create a virtuous circle of civil sustainability.”

Just like the mobile phone.