Two of the key metrics that will be watched closely in the global solar industry reporting season that has just commenced are the price of panels sold, and the cost of manufacture. The difference is what the industry calls the margin.

For the past few years, the surplus of capacity meant that margins were mostly negative, but the rebalancing of the market, as some manufacturers go out of business, and the Chinese, Japanese and US markets drive strong growth, mean most manufacturers are in positive territory.

One of the most misunderstood aspects of the solar industry is that once the market is re-balanced, then prices of solar modules will rebound, and the recent lows will never be seen again.

That assumes that the price fall was driven only by over-capacity, but what is clear from most manufacturers is that the cost of manufacture of solar modules will also continue to fall, and in some cases quite dramatically.

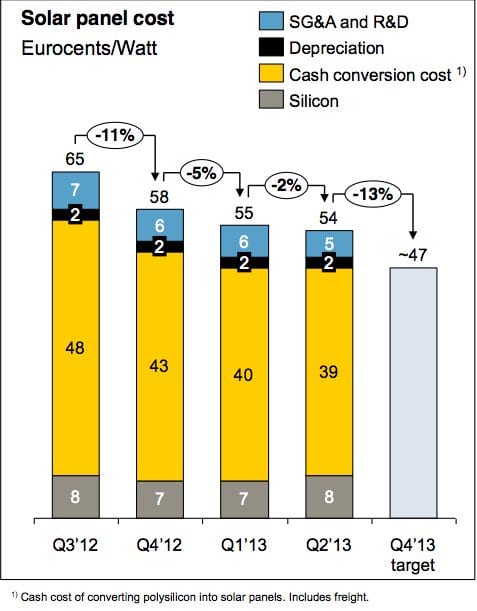

REC Solar, one of the leading European solar companies produced these two graph in its results last week.

The first is the price of solar modules, which shows a rebound. The second is the crucial one for the future of the industry, and its ability to undercut fossil fuels over the long term, because it shows that the cost of manufacture of a solar module will fall around 20 per cent over the year – despite the 60-80 per cent falls achieved over the previous three to four years. The same story is expected to be repeated among many other manufacturers.

As Tim Buckley, asset manager with ArkX noted: The economies of increasing scale and technology gains continue.