Greenhouse gas emissions across Australia’s National Electricity Market (NEM) have fallen to a ten year low due to increased competition in the power generation sector, as thin demand and increased supply of renewables squeezes out coal generation.

Coal generation is at its lowest level in 10 years, contributing 74.8% of all generation, down 11% from 85.8% in 2008-09. Renewables output has inversely reached record levels, with wind and hydro generation reaching 12.5% across the NEM.

Gas generation (12.7%), Hydro (8.7%), and Wind (3.8%) are all at record high generation levels, with the full commissioning of Macarthur’s 420MW of wind capacity to further increase wind generation going forward.

Coal generation has felt the impact of thin demand in the NEM, and increased output from other fuel sources, notably wind and hydro.

Gas, hydro, and wind have all increased their output, with hydro’s gains dominating the energy mix behind strong output from Tasmanian Hydro and Snowy Hydro. Since its inception, the carbon price has nearly doubled wholesale electricity prices, resulting in large profits for hydro generators that have been able to out-compete gas-fired peaking generation.

Coal generation nationally continues its bumpy ride, with generation reductions in NSW turning around as smaller generators pick up the slack left from the closure of half of Wallerawang C. Fall in demand has resulted in a reduction in supply to NSW from QLD and VIC, which reverses the trend from H1 FY12-13 where QLD generation largely displaced NSW output.

Victorian brown coal generation continues to fall, with reduced generation from brown coal-fired generators Loy Yang A, Loy Yang B, Yallourn, and Hazelwood.

While coal still generates the lion’s share of NEM electricity consumption, the downturn in output has driven Australian power emissions to record lows.

Demand and low carbon price to support coal generation through to 2020

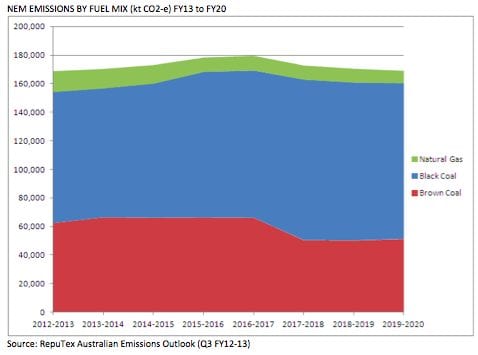

In the short-term we forecast resumed net growth in electricity demand due to the energy sector in NSW and Queensland, which is expected to bring relief to coal-fired generators, in-turn driving emissions up through to FY17, before falling marginally by FY20.

The return of brown coal is reinforced by a weak carbon price in FY16 (refer to RepuTex Carbon Price Outlook, April) and carbon compensation for brown coal generators. After FY17 brown-coal generation will be particularly vulnerable to competition due the expiration of carbon pricing compensation.

The increased rate of build for new renewable generation is expected to eventually outstrip the pace of electricity demand growth across the NEM, as the market seeks to meet the Large-scale Renewable Energy Target (LRET).

As brown coal generation slows post FY17, NSW and Queensland will eventually replace Victoria as the state with the highest CO2 emissions. South Australia and Tasmania will continue to decrease their emissions as coal- and gas-fired generation is displaced by more on shore wind generation.

LNG Processing to drive emissions – and carbon price – through to 2020

Although the Australian power sector dominates CPM emissions, and will continue to do so, the sector is forecast to continue to become cleaner in the long-term as renewable generation begins to displace coal output.

Across all CPM industries, the energy sector, in particular LNG processing, is forecast to see rapid growth in emissions from 2014 through 2018 as its large pipeline of LNG greenfield projects come online. Browse (Woodside), Wheatstone (Chevron), Gorgon (Chevron), Australia Pacific LNG (ConocoPhillips) and Icthys (INPEX) are forecast to become the sector’s five largest emitting plants once fully operational. Between them they are forecast to emit just under 29mt, representing around 40% of the entire Australian energy sector’s emissions by 2020.

The sizable liability of the energy sector is forecast to play a key role in determining the Australian carbon price as auctioning commences in 2014, with the magnitude and timing energy sector growth to hinge on the number of LNG trains constructed.

Hugh Grossman is Executive Director, Energy and Carbon Markets, at RepuTex Advisory