The Australian solar PV market could tip the 10,000 mewagatt (10 gigawatt) mark as early as 2017, and could reach the “saturation” levels for owner-occupied houses in many areas in coming years, according to a new report.

The five-year forecast prepared by leading market analysts Sunwiz and Solar Business Services says that the Australian solar PV market – currently at 2.5GW – will likely grow to between 6GW and 10GW by 2017.

The actual outcome will depend on the speed of the growth in the largely untapped commercial sector, the pace of large, utility-scale solar farms, and the industry’s ability to penetrate more challenging parts of the residential sector.

One of the most extraordinary findings of the report is that many parts of Australia could reach “saturation” point in the owner-occupied residential solar market. The analysis shows that the national average penetration rate is running around 20 per cent, many areas are at greater than 35 per cent, and some localities are already at 90 per cent. (see separate story). It concludes that penetration rates in the range of 50 per cent and 75 per cent are “entirely probable.”

The owner-occupied sector forms the largest part of the residential market, and it should be noted that “overall “ penetration levels, which includes all homes, including apartments, is running at around 10 per cent in Australia, although close to 20 per cent in South Australia. The Sunwiz and Solar Business Service analysis suggests that the solar industry will have to target the more challenging sectors – the rental market, the high-rise markets and those homes with “difficult” locations.

The analysis says the withdrawal of feed-in tariffs will remove the “boom-bust scenarios” of recent years. Its forecasts for the current year range between a 25 per cent fall from last year’s installations of around 1GW, to a 15 per cent rise, with the commercial market being the big swing factor.

In 2014, the commercial market could be between 150MW and 350MW. At the top end, that would be the same size as the entire solar market in Australia in 2010, but much will depend on how utilities react to the impending “solar juggernaut,” and whether they will impose higher standing charges that will reduce the attractiveness of solar to commercial enterprises. If it takes off, the commercial market could play a significant role in the Renewable Energy Target, they suggest.

“The entire electricity market is at the cusp of a radical evolution which will change the fundamental dynamics of energy generation, ownership, profit structure, competition and pricing – and the role of solar is highly significant,” the authors note. “This issue could be a major stumbling block – or opportunity – for our market, echoing International trends and issues.”

The forecasts for the Australian market are broadly consistent with other country markets where tariffs have been wound back significantly and which are now entering what analysts at UBS, Macquarie and Deutsche Bank have described as a “sustainable market” – one that does not rely on subsidies.

US-based research firm NPD SolarBuzz overnight released its global forecasts, predicting a growth in the international market to 31GW from 29GW in 2012. It predicts the European market, where subsidies have been wound back, to fall by 26 per cent in 2013 to around 15GW. Sunwiz and Solar Business Services predict a similar fall in their “low case scenario” for Australia, as does Green Energy Markets.

NPD SolarBuzz says that Australia – along with Japan, Germany, Italy, and the UK, will account for three-quarters of all residential PV installations in 2013. But while NPD SolarBuzz predicts that almost 45 per cent of the global solar PV installations in the current year will likely be in ground-mounted facilities, Australia will continue to rely heavily on its residential solar market.

As this graph above illustrates, the residential market will likely account for two-thirds of the market even in 2017, despite the growth in large utility-scale installations,such as the 20MW Royalla solar farm in the ACT, and the 159MW solar farm to be built by AGL Energy near Broken Hill and Nyngan.

However, the Australian authors say the local market faces challenges because much of the “low-hanging fruit” has already been picked. “Massive price reductions in PV have dramatically slowed, rebates are all but gone and the pressure just doesn’t exist for consumers to get in before incentives are wound back,” said Sunwiz’s Warwick Johnston.

However, the report says that Australia is now witnessing the emergence of a healthy underlying market; one free from the distortion of government incentives. “Australia has taken on strategic importance internationally, as being the first market to sustain large volumes of PV without preferential subsidies; indeed our net metering is more challenging than that of the USA, and yet we’re miles ahead when it comes to residential PV,” says co-author Nigel Morris, from Solar Business Services.

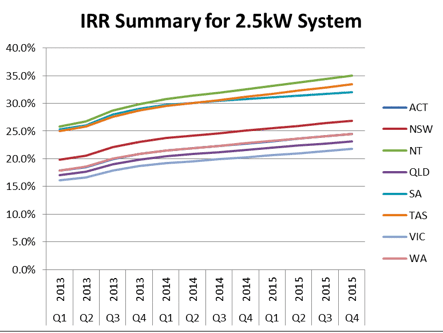

Part of the reason is the anticipated returns for homeowners investing in solar. This graph below shows the anticipated returns in Australian states and territories, based on their current state-based tariffs. Tasmania and the two territories lead because they have more favourable tariffs.

Some other trends highlighted in the report include:

- A flight to quality, larger system sizes and removal of solar multiplier distortion.

- Those (solar) companies who are solely residential focused will fight over a shrinking market with the second challenge of how to maintain revenue from a price-decreasing commodity.

- The issue of both suitable rooftop and network penetration has emerged to become a defining characteristic of future growth scenarios.

Warwick Johnston is the managing director of SunWiz, and Nigel Morris is the managing director of Solar Business Services. SunWiz and Solar Business Services individually provide a range of strategic services to the Australian solar industry, and since 2009 have collaborated on producing the most insightful forecast for Australian and international solar companies. The Australian PV Market Forecast 2012-2017 can be ordered from Sunwiz and Solar Business Services.