One of the big talking points after the explosion of the Callide coal generator in Queensland in late May was whether a Queensland big battery or two would have stemmed the cascading failures and mass outages that follows.

It remains a moot point, even though the state government has since announced a “big battery blitz” and fast tracked a bunch of different projects. One thing, however, is certain: The event, and what followed, would have delivered a big windfall for any battery that was operating at the time.

The latest Quarterly Energy Dynamics report from the Australian Energy Market Operator says that frequency control and ancillary services in the second quarter totalled $142 million, the second highest on record.

Most of this ($95 million) came from contingency market (relating to major disruptions such as Wivenhoe), with some $87 million sourced from “high priced events”, and 84 per cent of this occurring in Queensland.

The chances are that any big battery would have snapped up a healthy share of this market, given that many of the state’s big coal generators were sidelined at the time.

As it is, Queensland does not have a big battery, and its first – a 100MW/150MWh installation at Wandoan South, won’t be on line till later this year.

The first big batteries in South Australia and Victoria have snapped up healthy shares of the FCAS markets in those states, and would be presumed to do so in Queensland.

And, as they did in South Australia (see: Tesla big battery is already bringing Australia’s gas cartel to heel), local batteries might prevent some of the market spikes seen in Queensland, where AEMO had to administer a price cap. FCAS costs jumped to $26 million in one day alone in June.

As it was, it was the state’s only big storage facility, the Wivenhoe pumped hydro power station now owned by CleanCo, that was the biggest beneficiary of the huge price increases that followed the Callide coal explosion.

Queensland had the highest prices in the country in the second quarter, following the explosion at the Callide coal generator in late May, and it presented the perfect opportunity for Wivenhoe to cash in, as this graph below, illustrating prices and its actions on the day of the explosion, illustrates.

AEMO says net revenue in the quarter from the pumped hydro spot market ballooned 10-fold to $35 million, up from $3.5 million in the same quarter last year, thanks to the soaring wholesale prices in Queensland and NSW.

Almost all of this – 99 per cent – went to Wivenhoe, mostly because Origin’s Shoalhaven pumped hydro facility was out of action from April 18, and it would appear Snowy’s Tumut facility was rarely used.

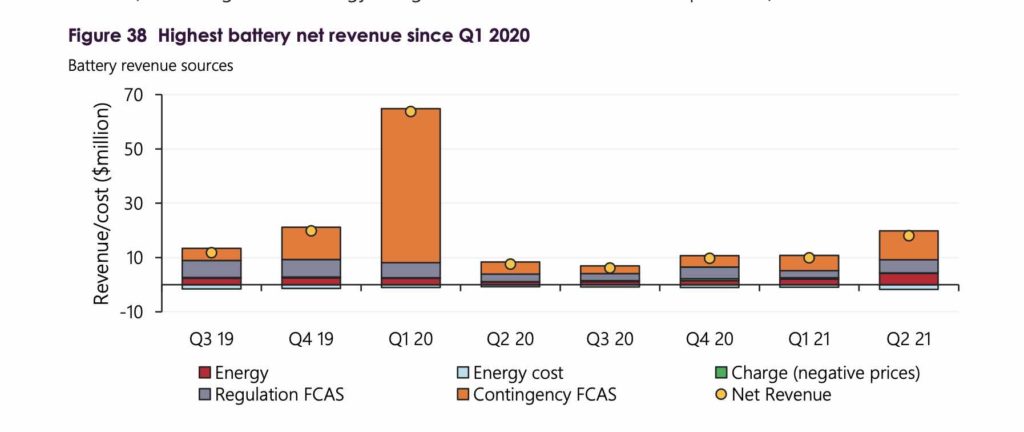

It meant that pumped hydro reversed, at least temporarily, a recent trend and landed more revenue that battery storage in the quarter. AEMO says battery market revenues for the six operating installations in South Australia and Victoria totalled $18 million in the quarter, the third highest.

Most of it came from the FCAS remained the primary source of battery revenue, contributing 78% of the total, although more energy market volatility delivered higher returns from energy price arbitrage, even if most battery installations remained focused on FCAS and not focusing on the arbitrage market.