Where Does Capacity Factor Fit Into Things?

Now, before moving on to the focus of this article, here’s one more thing to note:

Clean energy haters love to talk about capacity factor because it’s clearly a metric wind, solar, and hydro don’t win at (though, geothermal and biopower actually do very well). However, capacity factor by itself is really not that important. What’s important is the total cost of producing electricity. In the energy field, levelized cost of energy (LCOE) is one of the most important metrics. This is “an estimate of total electricity cost including payback of initial investment and operating costs,” as NREL writes.

Capacity factor plays a role in LCOE, of course, but so does free fuel (i.e. wind and sunshine). (In a perfect market, LCOE should also include the cost of pollution, which is not the case at all in the US today.)

Even without the cost of pollution figured in, if you look at NREL’s LCOE tab, onshore wind energy has a median of $0.05/kWh. The only energy source that beats that is hydropower ($0.03).

So, the point is, onshore wind energy is already essentially the cheapest option for new electricity (new hydro is not so cheap — that low figure is based on very old dams), even with NREL’s median capacity factor of 40.35%.

But…

Technology Changes

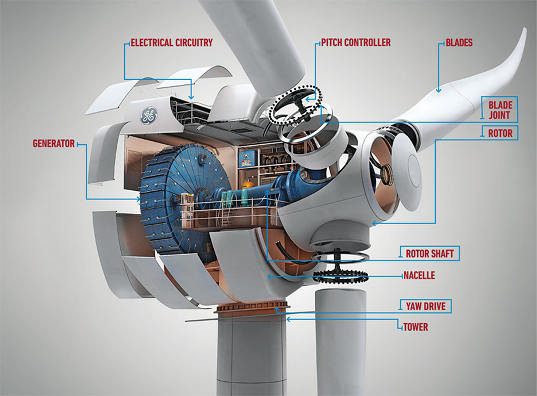

Wind power is still a relatively new electricity option. The technology is still improving, becoming more and more efficient. And, as a part of that, there has been what is essentially a breakthrough in net capacity factor of various turbines in just the last two years.

Chris Varrone of Riverview Consulting, a friend of ours and true expert in this arena, recently noted in an email to me that this is due to a “proliferation of ’stretch rotor’ machines like the GE 100-1.6MW and the V100-1.8MW and V112-3.0MW…. such machines can often hit 50% capacity factor onshore.”

In other words, new wind turbines are regularly hitting 50% capacity factor, much better than that antiquated 20-30% clean energy haters love to throw around!

More from Chris: “this contrasts with low 30s for the last generation of rotors (e.g., V80-2.0MW) — it is changing the game.”

NREL’s minimum of 24% is old news, old technology. Even turbines in the 30s are old technology now. And the median is being brought down by these older turbines.

New wind turbines are more efficient. And, thus, new wind power is even cheaper. It is now at an all-time low, in fact.

One more note from Chris: “LCOE has declined by 33-45% in the past 3 years in the US!”

Next Time You’re in a Conversation with a Wind Energy Hater

What are the takeaway points?

- Wind turbine capacity factors are often 50% these days.

- Wind LCOE is 33-45% lower than it was about 3 years ago.

- Wind energy is the cheapest option for new electricity in many a location now.

Are you taking anything else away from this? (There are some other key benefits from these improvements…. I’ll mention them in the comments if no one else picks up on them.)

![]() Clean Technica (http://s.tt/1j7w4) – Reproduced with permission.

Clean Technica (http://s.tt/1j7w4) – Reproduced with permission.