Last year it was the biggest utility in Europe, E.ON, outlining how it was going to adapt to a carbon-lite electricity grid. This year, it is NRG, the biggest generation company in the US, giving its take on the future.

E.ON announced dramatic plans to effectively dump its conventional, centralised fossil fuel generation assets in a separate company, and focus instead on distributed generation, including solar, storage, and micro-grids.

NRG’s approach is slightly different structural approach, but it’s embrace of new technologies is just as comprehensive. It is not considering divesting fossil fuels any time soon, but it is putting its growth prospects in the hands of distributed generation, and those very same technologies – solar, storage, and micro grids, and throwing in electric vehicles for good measure.

At a day-long analysts briefing late last week the key message of its (highly progressive) CEO David Crane was this: the company accepts that sooner or later it will be operating in a carbon-constrained world. That will either come from regulatory mandate or from consumer sentiment. More likely a mixture of both.

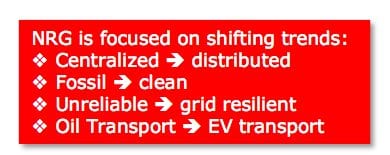

As this table from its presentation explains, NRG is moving away from the main themes that dominated the industry – centralised, fossil fuelled, unreliable and oil dependent for transport, to decentralised, clean energy, resilient, and electrified transport.

As this table from its presentation explains, NRG is moving away from the main themes that dominated the industry – centralised, fossil fuelled, unreliable and oil dependent for transport, to decentralised, clean energy, resilient, and electrified transport.

And solar is the big opportunity, and it will be the younger generation that embraces it to its full extent.

“Everyone is beginning to believe that residential solar is this trillion-dollar market that currently has about 1 percent market penetration,” Crane told the analysts.

“Winning in the future is more complex than “ploughing full steam into the past like our peer group.” Crane says. “We are trying to protect our investors from future shock.”

Crane told the briefing that dramatic change was inevitable and the that the same rules that created massive wealth to innovators in the internet and telecom booms, – and which destroyed wealth of those that didn’t adopt – will apply to the electricity industry.

“It is imprudent to assume that energy consumers will not embrace transformative technological change.” And there is little that regulatory constraints could do to stop it, he adds.

Indeed, NRG is targeting the post-retirement baby boomers – which it will target through traditional marketing outlets such as department stores, and the so-called “millennial generation”, who will account for most of household spending power over the next decade, and which will be targeted through the internet and virtual presentations.

Indeed, NRG is targeting the post-retirement baby boomers – which it will target through traditional marketing outlets such as department stores, and the so-called “millennial generation”, who will account for most of household spending power over the next decade, and which will be targeted through the internet and virtual presentations.

These millennials, Crane notes, will reach one third of the adult population by 2020; 91 per cent of them see climate change and rising sea levels as serious environmental problems, and their spending power in 2018 is estimated to be $US3.4 trillion, eclipsing that of the baby boomers. One third of them are likely to buy smart energy applications in the near term.

Crane says the history of the telecoms industry tells us that the incumbent who fully embraces the future technology while continuing to compete aggressively to win in the present industry paradigm will be best positioned.

The experience of AT&T and Verizon in the US tell us that most of the value creation occurred during the “high” transformational period. And Crane says that period is now.

He says that while the electricity system that has operated for the past century was well designed for the 20th Century …. “but no system that generates around 60 per cent waste is going to survive unscathed and untouched by technology through the 21st century.”

The industry, he notes, is plagued with an overabundance of natural gas, wind, solar, coal and, increasingly, oil. But, he says, in the era of energy surplus, the value pendulum is swinging decisively to the end use energy consumer

Hence the focus on the distributed energy market.

NRG plans to transform its existing commercial and industrial business into a full service, high margin energy provider, using demand side management, fuel cells and on site generation and microgrids. That business is expected to grow profits four fold to nearly $500 million by 2022.

As part of this plan, it plans to shift its utility-scale renewables business to the commercial and industrial solar market, striking deals with the likes of Starwood, Unilver and a California health care provider. It sees 2,500MW of commercial and industry solar by 2022.

In the home business, NRG sees itself as a marketing company that happens to be selling power, with a focus on distributed solar, storage and smart energy systems. The Home solar division is aiming to boost its capacity from 75MW now to 2,400MW in 2022. It expects the cost of installed solar to come down by another 20 per cent in coming years.

This graph below gives an insight in the size of the addressable market in the US, and that “trillion dollar opportunity” mentioned earlier in the article.

NRG continues to expand its network of electric vehicle charging stations, dubbed eVgo. It hopes to boost its customer share from 10 per cent of the available EVs to 50 per cent within next three years. And the utility-scale renewables division will be focused around micro-grids.

It is investing heavily with Japan JX Nippon in a carbon capture project, initially to use CO2 for enhanced oil recovery, and ultimately to help position the balance of NRG’s Texas coal units for the future. If the technology proves economic.