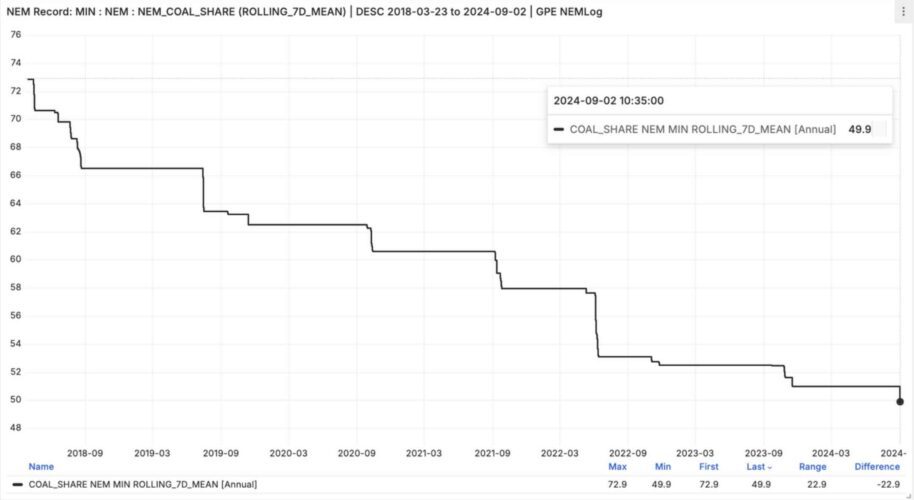

The share of coal power – traditionally the biggest source of generation in Australia’s main grid – has fallen below 50 per cent, averaged over a whole week, for the first time in what industry observers are hailing as a “turning point.”

The share of coal has remained stubbornly high over the past decade, and still remains at more than 56 per cent over the last 12 months, albeit down from its peaks of nearly 90 per cent in the early 2000s.

But over the past week, in the midst of strong winds across the south of Australia and the continuing growth of rooftop solar, the average share of coal generation in serving native demand on the main grid fell to 49.9 per cent, according to industry observer Geoff Eldridge, of GPE NEMLog.

“On Monday, September 2, the National Electricity Market (NEM) reached a significant halfway point, with coal’s share (of underlying or native Demand) dropping below 50% in the rolling 7-day (weekly) mean for the first time,” Eldridge wrote on LinkedIn.

“This moment marks a turning point in the NEM, with coal’s share at the halfway mark and renewables continuing their rise. Whether viewed as a glass half full or half empty, it’s clear that the energy landscape in Australia is undergoing significant change.”

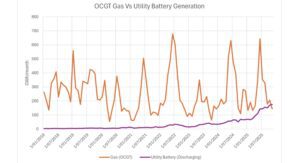

Eldridge also noted that wind – courtesy of the extraordinary weather conditions of the past week – posted a new high average star for the week of 25 per cent. Overall, renewables contributed 47.5 per cent over the week, also a record, while gas provided the remainder.

The Australian Energy Market Operator expects all coal generators to be closed by the late 2030s, and its energy roadmap, the Integrated System Plan, models an 82 per cent renewable share by 2030 which has been adopted by the federal Labor government as its target.

It is not the only remarkable event of the past week, with wholesale prices also tumbling, and delivering negative average prices in key renewable energy markets such as South Australia and Victoria, and also delivering record levels of curtailment, with large scale solar the worst affected.

Many solar projects are obliged, under the terms of their contracts, to switch off when prices go negative. Others choose to to avoid negative prices so they don’t have to “pay” to generator.

Most coal fired generators are prepared to do this because it is cheaper and less impactful to their assets to bid negative prices rather than to switch off completely, and they are not very good at flexing or ramping quickly.

Some analysts noted that the share of renewable energy consistently hit instantaneous peaks of around 70 per cent, about the maximum that can be allowed given that coal plants’ minimum generation limits.

They suggested that later in spring, when some coal plants will close down for maintenance, will see records fall for instantaneous renewable share – which currently stands at 72.1 per cent (on a 30 minute interval) according to AEMO.

There have already been times when “potential” wind and solar and other renewables could have supplied all the demand, but because of economic curtailment and grid congestions, and because AEMO has yet to put into place all the engineering protocols needed to switch off all wind and coal, that is unlikely to happen for a while.