A newly announced reboot of Victoria’s energy transition plan is undersizing proposed renewable energy zones and limiting proposed transmission build, and risks delivering “too little too late” to replace coal, a major industry group says.

The VicGrid proposals were released in its Draft Victorian Transmission Plan (VTP) in May, seeking to ensure that Victoria’s plan to close its remaining brown coal generators, and build enough wind, solar and storage capacity to reach its 2035 target of 95 per cent renewables could remain on track.

But in a newly released submission, the Clean Energy Council (CEC) says it is concerned that many solar, wind and storage projects “currently in flight” now find themselves outside of – or precluded from – the seven proposed development zones.

“Many well advanced projects find themselves suddenly inside a REZ, or across a REZ boundary, or outside a REZ, with little clarity as to how this will affect their project,” the CEC submission says.

“While most developers are currently adopting a wait and see attitude, an overly punitive approach to grandfathering will send a clear signal to future investors that Victoria is not open to new development.”

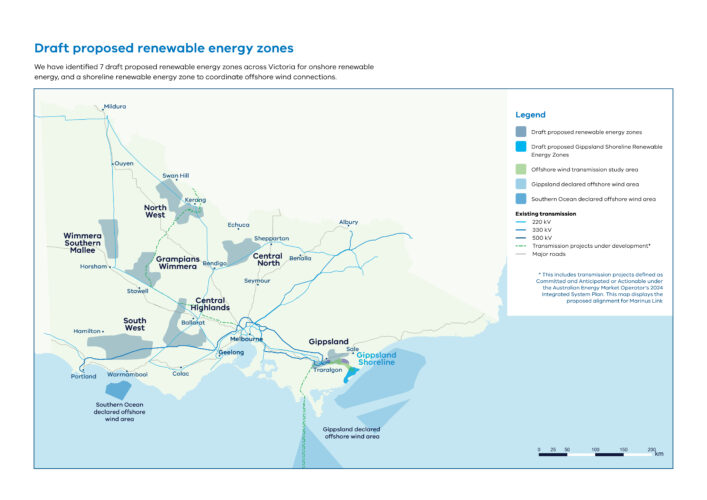

The seven renewable energy zones (REZs) proposed by VicGrid in the draft VTP – and illustrated on the map below – include Central Highlands, Central North, Gippsland, North West, South West, Grampians Wimmera and Wimmera Southern Mallee.

The seven proposed REZs are described in the draft VTP report as “relatively small areas” – particularly in comparison to what have become known not-so affectionately as the “blobs” initially proposed for Victoria by AEMO.

Alistair Parker, the CEO of VicGrid, said in May that the new plan aims to minimise impacts on regional and rural communities, landholders and First Peoples and keep costs low for consumers, while giving industry the certainty it needs to invest.

The CEC says feedback from its members, including major renewable energy developers, have included specific recommendations that REZ boundaries be extended, or otherwise be amended, to factor in projects that sit outside a REZ, but are “willing to fund private network infrastructure” to connect.

“Increasing the size of the REZs to include projects with high-quality wind resources, low population, modified land uses, reduced environmental risk and initial positive stakeholder sentiment should be considered,” the submission says.

“Areas not included in REZs solely because of the distance to transmission should be given consideration. The financial viability of longer connection assets is a matter for proponents to address and projects still need to compete for connection capacity.

“VicGrid may need to assess projects with marginally higher costs, but with significantly better stakeholder outcomes through reduced cumulative impacts and highly competitive community partnership regimes.”

The CEC also raises concerns about the proposed Gippsland REZ, which is not designed to host any new onshore wind or solar projects, but instead focuses on supporting infrastructure for offshore wind.

Gippsland, which is home to Victoria’s coal power centre, the Latrobe Valley, is also host to some of the state’s major dairy farming centres, which VicGrid has made a concerted effort to avoid in its new REZ design process.

But the CEC argues that ruling it out for new onshore wind projects is problematic, particularly for the “number of developers” whose projects are already well progressed in the region.

Those developers include Octopus Investments, whose 417 megawatt (MW) Giffard wind farm and battery (400 MW/800 MWh) is being proposed for near to the town of the same name, to co-exist with agricultural activities on the site.

“While the CEC appreciates the driver of managing access for offshore wind developments, we encourage VicGrid to consider how advanced developments in this onshore REZ can be progressed in a manner that is complementary to offshore developments,” the CEC says.

Octopus Investments told Renew Economy on Thursday its Giffard project is currently in early-stage development and, as such, would not be as materially impacted as other projects in the Gippsland REZ that are at a more advanced stage.

But it agrees that developers are keen for more information on how the proposed new REZ designs – as well as the proposed Grid Impact Assessment (GIA) process – might affect existing projects. The GIA is a tool proposed by VicGrid to ensure orderly development of new generation and storage capacity outside of REZs.

“At this point, VicGrid has not provided clarity on how projects located outside the newly defined REZs will be treated,” Octopus Investments said in an emailed statement.

“In particular, the treatment of non-REZ projects through either the GIA process or future REZ access rights frameworks remains uncertain. This is especially relevant for hybrid projects and standalone batteries, where the classification and eligibility pathways are still under development.

“We would welcome greater guidance from VicGrid and remain supportive of a coordinated approach to transmission investment in Victoria,” Octopus Investments says.

More broadly, the CEC says the draft VTP fails to “effectively capture the full suite of potential future outcomes” that Victoria could face in its transition away from fossil fuels, which targets a 65% share of renewables by 2030 and 95% by 2035.

“[The draft VTP’s Optimal Development Path] does not effectively account for key risks and uncertainties, such as earlier than expected coal exit, higher than expected demand growth, the effects of different degrees of CER orchestration or delayed development of transmission infrastructure that may in turn result in delays to the development of offshore wind,” the submission says.

“The CEC considers the net effect of this is an inefficient level of onshore transmission development and an undersizing of renewable energy zones (REZs) hosting capacity.

“We consider the small amounts of new generation enabled by this limited transmission build will be insufficient to maintain reliability and keep costs down, in all but the most optimistic scenarios.

“System planners should always consider the ‘asymmetry of risk’ related to the build of network infrastructure. Put another way, the costs of building transmission ‘too little / too late’ far outweigh the costs of building ‘a little too much /a little too soon’.”

The CEC also calls on VicGrid to use more “realistic” wind energy capacity factor assumptions and to reflect capex drivers and scale economies that tend toward GW scale wind farm developments. On solar, it says the VTP has not taken account of the trend towards solar-battery hybrids.

“These technologies are being adopted across the NEM and have the potential to reduce the total cost of meeting Victorian demand for energy,” the submission says.

“The CEC recommends that VicGrid reassess its capital costs assumptions and approach to the market modelling – for hybrids in particular – to ensure these technologies are effectively captured in the VTP.”