Investment in clean energy in the first three months of 2012 was subdued, in the face of uncertainty over future policy support in Europe and the US.

Last week, there were signs from Italy and Poland, at least, that policy-makers are starting to respond to this problem. Meanwhile, in Spain and the US, ambitious plans were hatched for future renewable power deployment – without subsidies.

Figures from the Bloomberg New Energy Finance database of deals and projects show that new financial investment in clean energy worldwide in the first quarter of this year was USD 27bn, down 22% from the same quarter of 2011.

In fact, Q1 2012 was the weakest quarter for new financial investment – which consists of asset finance for utility-scale projects such as wind farms, solar parks and biofuel plants, plus venture capital, private equity and public market equity-raising by specialist clean energy companies – since Q1 2009, in the depths of the financial crisis.

Asset finance of USD 24.2bn was 30% down from the fourth quarter and 13% below that in the first quarter of 2011. Among the big projects financed were the 396MW Marena Wind Portfolio in Mexico for USD 961m, the 100MW KVK Chinnu solar thermal plant in India for approximately USD 400m, and the 201MW Post Rock Wind farm in Kansas, US, for an estimated USD 376m.

The largest projects financed in Europe in Q1 – in the face of a difficult market for bank lending – were the 150MW Monsson Pantelina wind farm in Romania at USD 317m, and the 60.4MW SunEdison Karadzhalovo solar PV plant in Bulgaria at USD 248m.

Venture capital and private equity investment in clean energy companies was resilient at USD 1.9bn worldwide in Q1, close to the figures for Q4 and Q1 2011, but public markets investment was down 12% from Q4 and 87% from Q1 2011, at just USD 601m.

This was not surprising given the poor performance of clean energy shares over the last few quarters. The WilderHill New Energy Global Innovation Index, or NEX, which tracks the movements of 97 clean energy shares worldwide, fell 40% in 2011 and clawed back just 7% in the first quarter of 2012 as world stock markets rebounded.

The central problem for clean energy investors remains policy uncertainty in European countries, and in the US. In the former, feed-in tariffs are being cut back but in some cases, there is also a lack of clarity over how big those cuts will be and how much new tariff-eligible capacity governments will allow. In the US, the loan guarantee and Treasury grant programmes expired last year, and the other key incentive, the Production Tax Credit for wind projects, is due to expire at the end of 2012 – unless Congress can agree to extend it.

Last week, the Italian government said it planned to revise incentives by as much as 36% for new solar projects and introduce a lower overall spending cap, of EUR 6.5bn-a-year, instead of the limit of EUR 7bn stated in the current law.

The legislation includes further measures to prioritise small installations and limit the number of large plants, adding to those introduced in the previous rules from May 2011. Projects larger than 5MW must win competitive tenders to be eligible for feed-in tariffs, and all plants with more than 12kW must register to seek incentives, the government said. Smaller installations will be exempt from registration – and it is in this small, mainly rooftop, segment that Bloomberg New Energy Finance expects to see the bulk of PV activity in Italy in coming months.

In Poland, the government said it would amend a proposed renewable energy law. Investors had protested over a December draft that would have reduced support for onshore wind farms, boosted subsidies for costlier technologies and scrapped an obligation for utilities to buy fixed-rate power from renewable sources.

“We are going to restore the obligation to buy energy from renewable sources at a guaranteed price, based on a formula set by the market regulator,” said Janusz Pilitowski, director of the Economy Ministry’s renewables department. The government said it now planned to keep subsidies for current and planned wind farms unchanged for 15 years after commissioning.

This development in Poland received a positive reaction from the clean energy sector last week. In Spain and the US, there is no comparable policy cheer at the moment, but at least ambitious plans for new projects are being hatched.

The US Air Force said last Wednesday that it aims to develop 1GW of renewable power capacity by 2016, four years before the Navy and Army are likely to achieve this figure. The USAF currently generates 6% of its power from renewables. A mandate decrees that US military bases must source 25% of their power from renewables by 2025.

Meanwhile, two German solar energy developers are planning to build giant PV plants in southern Spain that will earn a return without government subsidies.

Wurth Solar intends to build a 287MW plant in the Murcia area for EUR 277m, according to the regional authority, and Gehrlicher Solar said it plans to develop a 250MW park in Extremadura for about EUR 250m. These projects, if built, would be about three times larger than any current European solar plant.

EU CARBON GETS BOOST FROM SET-ASIDE TALK

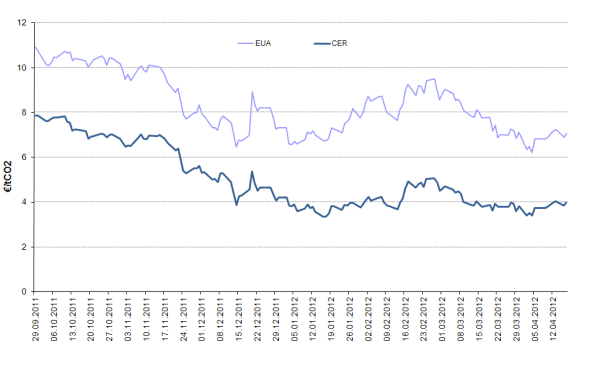

European carbon gained 6.5% last week, after the region’s Parliament and member states discussed a planned energy efficiency law that may include an option to hold some emission allowances back from the market. European Union allowances (EUAs) for December 2012 ended Friday’s session at EUR 7.25/t, compared with EUR 6.81/t at the close of the previous week. EUAs rose from a weekly low of EUR 6.54/t on 10 April amid speculation about a set-aside of allowances. United Nations Certified Emission Reduction (CERs) for December 2012 jumped 8% last week to EUR 4.04/t.