Details of the long-awaited proposals to reform Australia’s main electricity market are finally public, and while most attention has been focused on the “capacity market” or “Coalkeeper subsidy”, another proposal may be even more problematic for new wind and solar projects.

As part of its post-2025 energy market re-design proposals, the Energy Security Board has recommended the creation of a new “congestion management model” (CMM) that would impose new charges on new generators connecting to the grid outside of designated renewable energy zones.

The “congestion management model” effectively amounts to a rebranded and reheated version of the “coordination of generation and transmission investment” (COGATI) proposal that was widely panned by clean energy investors.

While there have been some widely acknowledged challenges to connect new wind and solar projects – especially in areas where investments in new network infrastructure have lagged – clean energy investors have raised concerns about proposals that would lump new wind and solar projects with the costs of necessary upgrades.

In its final reform package, the ESB has recommended a new CMM that it says could be designed to avoid situations where generators with low operational costs – generally applying to wind and solar generators that do not face fuel costs – continue to push power into parts of the grid that may struggle to accommodate them.

To do this, the proposed CMM would impose a charge on generators that reflects the level of congestion in the part of the grid where they connect.

“It creates a market design that incentivises generators to bid more closely to their true costs of generation based on their location (that is they bid in line with their short run marginal cost),” the ESB says.

“Better incentives to drive operational behaviour means congestion across the grid is managed efficiently and maximises the value derived from new transmission investments. These better operational incentives also create new business opportunities for batteries and other types of storage to be paid to alleviate transmission congestion.”

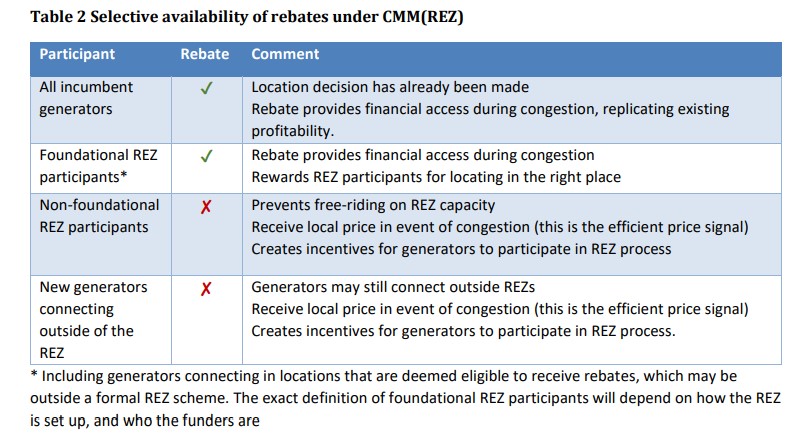

Under an “enhanced model”, referred to as “CCM(REZ)”, incumbent generators and new generation projects fortunate enough to secure grid access through dedicated renewable energy zones could end up financially better off, as they could have their congestion fees refunded by others.

“All scheduled and semi-scheduled generators would face a congestion charge, calculated each dispatch interval on a $/MWh basis reflecting the generator’s impact on congestion in the dispatch interval,” the ESB’s recommendations says.

“Eligible scheduled and semi-scheduled generators would receive a congestion rebate, calculated each dispatch interval, funded from the collective revenue received from the congestion management charges. The size of the rebate would be determined in accordance with a pre-determined allocation metric, such as availability.”

The ESB has proposed restricting eligibility for these rebates to existing generators and those being built as part of planned Renewable Energy Zones.

New generators being built outside new renewable energy zones, or being added to renewable energy zones after they have already been established, would miss out on the rebates and leave them bearing the full costs of the new congestion charges.

The ESB argues that such a mechanism would incentivise the construction of new wind and solar projects in parts of the grid with low or no network congestion.

But there are fears that the mechanism will unfairly target new wind and solar projects, and the model overall would ultimately increase the perceived risk of new renewable energy projects, increasing investment costs and reducing their viability.

“The Clean Energy Investor Group does not support the CMM model as it is currently proposed,” CEO of the investor group, Simon Corbell, told RenewEconomy. “The reason for that is that it does not address investor concern about revenue certainty,” .

“Locational marginal pricing is a short-term price signal. That model does not give investors any visibility on long-term revenue and does not let investors project revenue with any certainty.”

“It makes it very hard to predict revenues for new projects when you have a moving regulatory environment, and that will very significant, and negatively, impact on investor confidence” Corbell added.

The Clean Energy Council said the reform could significantly increase investment uncertainty for new wind and solar projects – while not incentivising investments in new transmission infrastructure that could alleviate the congestion issues.

“This proposal would significantly change the nature of access to the electricity grid in a way that creates additional risk and uncertainty for investors and customers,” the Clean Energy Council said in a statement.

“Most disappointingly, the CMM proposal will do nothing to deliver much-needed investment in transmission that is becoming a major barrier to a reliable and clean energy system.”

“The increasing risks and anxiety facing investors have been further compounded by the politicisation of the ESB’s final report, with the Federal Government disappointingly releasing the report’s details to media first. In contrast, investors remained in the dark and confidence continues to erode,” the CEC added.

The ESB stopped short of prescribing the final design details of how a congestion management model might work, leaving it to energy ministers to work through the final details, including through comprehensive consultation with stakeholders. The final reform could still be years away.