Australia’s biggest transmission company has warned that it is in a race to secure sufficient critical system services in the grid needed to pave the way for the closure of coal fired power stations, and to meet the country’s 82 per cent renewable energy target.

Transgrid, which operates the main transmission lines in NSW, has completed a major review of the technology options to provide these essential services, which it describes as the “heartbeat of the grid”, to support the transition away from large spinning machines (coal and gas) to technologies such as wind, solar and battery storage.

The challenge is a complex one, already hard enough for engineers coming to grips with the pace of the energy transition and the emergence of new technologies, but made more difficult by the country’s stultifying regulatory processes which struggle to keep up with the pace of change.

And it’s highly significant for Australia, and for the governments seeking to accelerate the green energy transition. The market operator has warned that without enough system strength in the grid, it will not allow the grid to reach 100 per cent instantaneous renewables, something it had hoped to achieve in the next few years.

And without reaching times of 100 per cent renewables, the grid will struggle to reach the average of 82 per cent renewables over a year that forms the centrepiece of its Integrated System Plan, and the renewable targets of federal and state governments.

“There are so many moving pieces in our energy puzzle and no single solution can meet the (system strength) need – in fact, dozens of solutions across NSW will be required at any one time to keep the system operating securely,” says Marie Jordan, the head of network at Transgrid.

Transgrid is the first transmission provider in Australia to launch a comprehensive program to safeguard system strength. New rules mean that from late 2025 it will be their responsibility to keep the grid heartbeat ticking over.

It has just released a detailed document called a Project Assessment Draft Report (PADR) – part of the laborious regulatory process – that outlines its options to address the concerns about system strength and other grid services.

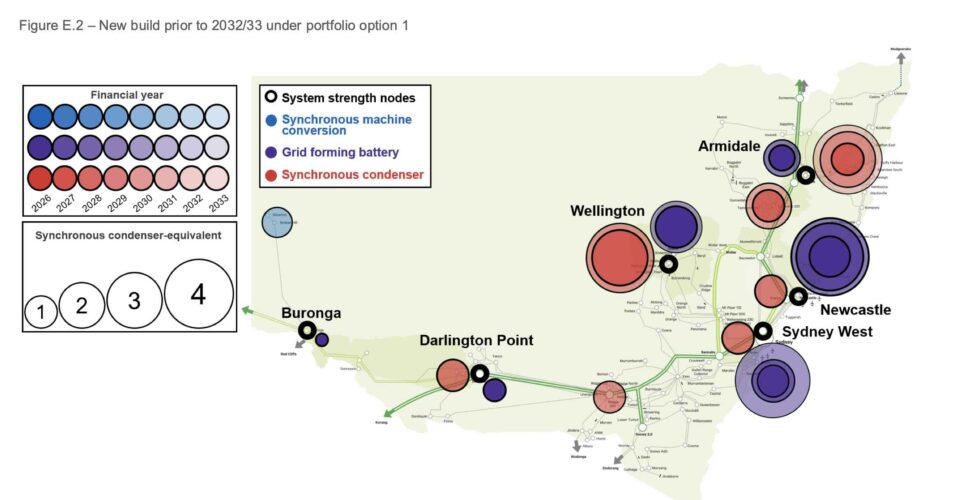

It put out a call to technology providers and received more than 100 submissions, 40 of them based around network options and 60 “non network.” The usual suspects emerge – synchronous condensers (large spinning spinning machines that do not burn fuel), and so called “grid firming” battery storage will do the bulk of the work.

Other technologies and solutions – including storage technologies such as pumped hydro and compressed air – will also play a role, as well as the spinning machines of existing hydro, coal or gas generators to fill gaps where necessary.

According to Transgrid, NSW will need 8 and 14 synchronous condensers to replace system strength that comes from retiring coal assets and unlock additional renewable generation as well as around 4 gigawatts (the storage duration is not relevant for this service) of batteries with “grid forming” capabilities.

It says also modifications will be needed for a number of synchronous hydro generators and to the planned compressed-air energy storage facility in Broken Hill, which will need the addition of a clutch, and contracts that will need to be signed with existing hydro, gas and coal generators to operate in synchronous condenser mode.

“We are acting to ensure the lights stay on,” Jordan says. “The future power system must be capable of operating at up to 100 per cent instantaneous renewable energy in the coming decade. To support the amount of wind, solar and hydro required we must invest in a diverse range of options to keep the system strong.”

But there are other complications. One is the regulatory investment test (RIT-T), a relic of the legacy system that can take up to three years to get approval for network investments, including transmission lines and for services such as these.

The problem here is that technologies and the markets are moving far more quickly than regulatory reviews. It is generally expected that grid forming batteries will be able to provide the bulk of the system services needed, but they are still relatively new and not yet deployed in large numbers.

While many of the new massive batteries being built now will have grid forming inverters, the biggest battery actually using them is the 150 MW Hornsdale Power Reserve, the original Tesla big battery.

That means there is not enough “real life” experience for the grid operators to be absolutely certain that they can deliver what is written on the box.

Transgrid hired energy consultancy Aurecon to look at the issue, and while it was satisfied grid-forming batteries could provide stable voltage waveforms, it says there is insufficient evidence they could support minimum fault level requirements, although it is likely in a few years.

Which basically means, because of the nature of the regulatory system and the fact that the decision basically has to be made now – or very soon – the transmission company is obliged to go with the proven option.

And this leads to the second problem. Everyone in the world is now in the market for synchronous condensers – including in the US, Europe and China – and the waiting list is growing, and so are the asking prices.

Transgrid has also identified another issue – a potential shortfall in 2027/28 – that it is scrambling to fill, either with an accelerated roll out of syncons, if it can find them, or a mixture of technology options. But here’s the rub, it needs to do this before it gets the regulatory tick for spending.

The risk here is that they spend a lot of money (each syncon costs around $100 million at current prices) and that spending then gets rejected – at a later by the regulator. It is now trying to seek solutions to address that issue.

“The earliest timing that synchronous condensers could be commissioned is in 2028/29,” the report says. “Acceleration (to 2027/28) is expected to only be feasible if we commence procurement of synchronous condensers prior to the conclusion of the RIT-T and AER’s approval of a contingent project application.

There is another “confidential” option that has been proposed to it, but it is not yet convinced of its feasibility. In the meantime it will try and “resolve the uncertainties associated with the possible acceleration of synchronous condensers and the technical feasibility of the confidential proposal.”