Key Takeaways

- Tesla’s white paper argues that grid-forming battery inverters can provide critical grid services at a lower cost than traditional spinning machines.

- Grid-forming batteries are capable of delivering reliable inertial responses and are a cleaner alternative to legacy synchronous machines.

- Tesla emphasised the need for performance-based assessments of advanced inverter technologies rather than replicating characteristics of older technologies.

Battery and electric vehicle giant Tesla has released a new white paper focusing on the Australian green energy transition, in which it argues that battery inverters can deliver critical grid services at a much lower cost than spinning machines.

The Tesla white paper says grid forming battery inverters – which the company has pioneered in Australia at its original Hornsdale battery – offer a “clean and adaptable alternative” to traditional rotating machinery, and a solution to the challenges of grid stability.

“This white paper presents evidence that grid-forming batteries are technically capable of delivering reliable inertial responses in the National Electricity Market (NEM),” it writes.

“It also advocates for performance-based technical assessments of advanced inverter-based technologies, rather than requiring replication of the physical characteristics of legacy synchronous machines.”

The white paper comes amid an intense debate in engineering circles about the system needs for a grid dominated by inverter-based electricity sources such as wind and solar, backed up largely by battery storage.

Most of the public debate is focused on what happens “when the sun don’t shine and the wind don’t blow”, which refers to the supply of electricity and the need for storage and “firm” power to fill the gaps.

But behind the scenes the focus is as much on energy “security”, which relates to the need for critical system services such as inertia and “system strength” that are traditionally provided by spinning machines.

The Australian Energy Market Operator – and the state-based transmission companies responsible for maintaining these services – accept that grid-forming inverters (now deployed in nearly every new battery project) can deliver most of these services.

First of its kind contract

But the transmission companies are not yet convinced they can deliver all of these services – even though AEMO ha written a first of its kind contract with the Koorangie battery to supply system strength in Victoria. The battery, owned by Edify Energy, uses Tesla grid forming battery inverters.

Because of this, the state-based transmission companies have committed to installing dozens of giant synchronous condensers, spinning machines that do not burn fuel, at a cost of many billions of dollars, particularly in areas of high renewables.

Tesla – among others – has been arguing that this is the wrong way to go, and that grid-forming battery inverters are better at the job, and significantly cheaper, than the syncons that are to be rolled out over the coming five to 10 years.

“Grid-forming batteries provide a more reliable and resilient source of synthetic inertia than synchronous condensers, which rely on mechanical components and can experience a total loss if taken offline for maintenance due to even minor faults,” Tesla writes.

“The modular architecture of batteries allow them to continue operating even when individual units fail, maintaining inertia provision without disruption.

“As the NEM transitions to higher proportion of variable renewable energy, the flexibility, scalability, and rapid response of batteries make them a more suitable solution for grid stability, with the average availability rate of batteries exceeding 99%”

It says syncons may also be subject to equipment obsolescence and limited vendor maintenance support.

The white paper provides numerous reports and analyses of how grid forming battery inverters can respond to system faults and issues.

But the fundamental problem identified by Tesla is that most testing is done through the prism of old technologies and soon-to-be redundant system designs.

“While grid-forming batteries can be tuned to provide similar responses to syncons, it’s important to recognise that they are different technologies,” Tesla writes.

“Technical assessments should focus on power system outcomes, rather than replicating the characteristics of legacy synchronous sources of inertia.”

Tesla, like other suppliers, is frustrated by the restrictions of the current GPS (generator performance standards), which are notoriously challenging in Australia, and Tesla argues are too restrictive.

“As more technologies deliver inertia and system services, their implementation should focus on enabling optimal grid outcomes – not mimicking legacy dynamics,” Tesla writes.

“AEMO’s staged Access Standard Reform has made some progress in streamlining grid-forming battery connections. However, Clause 5.3.4A(b1) of the National Electricity Rules remains outside the review’s scope.

“It requires proponents to aim for the Automatic Access Standard, prioritising performance metrics over grid stability. As a result, grid-forming batteries are assessed against standards designed for grid-following batteries, creating a major barrier to their adoption.

Tesla wants a rule change

“Tesla recommends that issue is addressed through a rule change through the AEMC, or to be addressed by the upcoming grid-forming specific access standard reforms.”

Along those lines, Tesla also includes a whole section debunking what it says are the “myths” around grid forming inverters, including the assumption that it cannot provide “fault current”, a key element of system strength.

“Historically, fault current was used as a proxy for system strength because it was directly tied to the physical characteristics of synchronous machines,” it writes.

“However, this relationship no longer holds with grid-forming batteries, which can provide system strength without needing to produce high fault currents. As a result, fault current is no longer a necessary metric for providing network support services.”

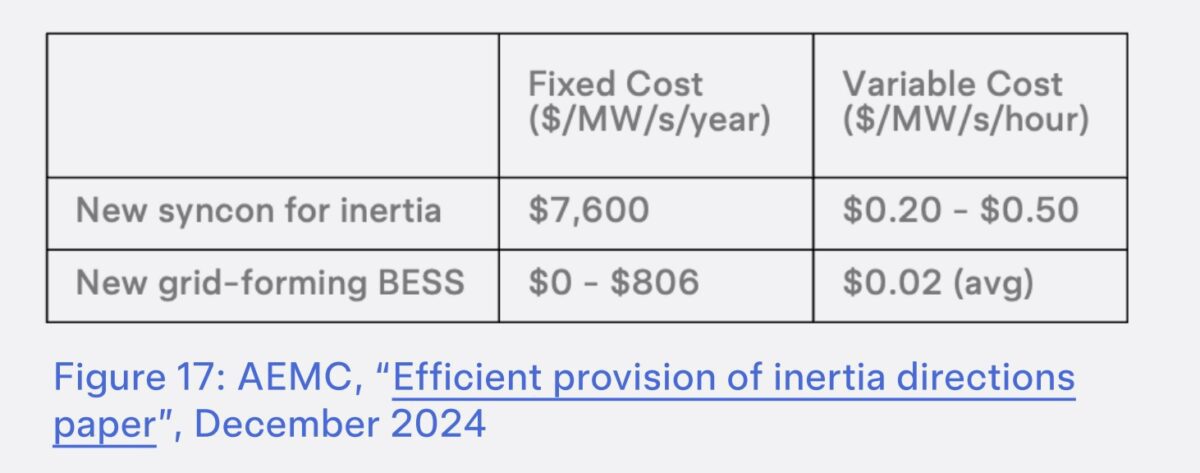

Finally, it also argues that it can provide these services at a fraction of the cost of syncons, and they can be built a lot quicker. The lower cost comes because batteries can do multiple things, so providing system strength is a marginal addition to their array of services, rather than a single focus in the case of syncons.

“Grid-forming batteries are multi-use assets that can value stack across a range of market services such as energy, frequency, bilateral contracts, as well as inertial and system strength contributions,” it writes.

“Unlike single-use assets, they can recover their cost through other marketfacing activities while still providing reliable inertia contributions when needed. Grid-forming batteries are also able to be flexible based on market signals and can evolve their services as system needs change.”

It says while battery costs continue to fall, syncon lead times and costs are increasing, and even adding a “clutch” to existing synchronous generators to allow them to operate as syncons without burning fuel faces long lead times.

It pointed to an Australian Energy Market Commission’s Directions Paper on the Efficient Provision of Inertia, which placed the fixed and variable costs of new syncons as both being multiples larger than supplying inertia from inverter-based resources (See table above).