It has one of the most stunning weeks on Australia’s rapidly accelerating green energy transition – a pledge by the country’s most coal dependent state to close all its coal generators by 2035, quickly followed by another pledge by the country’s biggest polluter to do exactly the same thing.

The new timelines outlined by the state of Queensland and utility AGL Energy should not be surprising. They are more or less in line with the most likely scenario laid out by the Australian Energy Market Operator, and the assumptions behind the federal Labor government’s 2030 emissions reduction target.

But it is one thing for scenarios to be made and another for plans to be enacted. That is the game-changing situation in Australia – freed of the yoke of Coalition energy dogma and policy bollards – state governments and private companies and investors are now getting on with the job.

The pledges by Queensland and AGL were preceded in the same week by the announcement from the Victoria state Labor government of Australia’s first big energy storage target, and a first-in-the-world contract to use “advanced inverters” from a big battery to supply system strength.

That battery contract is actually quite significant, because it forges a path to run a grid without any need for coal generation to provide grid services, and rapidly advances the complex task of switching from a grid dependent on spinning machines to one relying on inverter based technologies.

Not even the biggest industrial users want coal any more: Not the Tomago smelter, not the Boyne Island smelter, and not the Sun Metals refinery. They want it gone within a decade. The energy world really has changed.

Here are five things to note about the announcements in the past week

Queensland’s big flip from coal to green energy

The Queensland Labor government has given itself just 13 years to flip from 80 per cent fossil fuels in 2022 to 80 per cent renewables by 2035.

That’s a remarkably quick turnaround – particularly for a state government whose heart did not seem to be in it, and which had done comparatively little since touting its initial 50 per cent renewables target in 2015.

What it does do is catch up with reality: the rapid technology change, the insistence from consumers that they don’t want fossil fuels any more and the hunger for big new renewable projects. And it is in line with AEMO’s “step change” scenario that is laid out in its 30-year blueprint to a renewables dominated grid.

But two things should be noted: First, impressive as it it, it is not as world leading or even as nation leading as the state premier would have you believe.

South Australia is well ahead, of course, and another coal dependent state, NSW is going just as quick, if not quicker, with its own transition from coal to renewables. It has more coal fired power and a bigger grid, but its infrastructure road map assumes that all of the state’s coal fired generators could be gone in a decade.

The only difference with Queensland is that NSW hasn’t set a specific renewables target, but NSW has no shortage of potential projects, and this week will see the opening of its first tender for the first renewable energy zone.

The second thing to note is that Queensland’s plan is heavily back ended. After a flurry of activity in the next couple of years, mostly projects already under construction, the roadmap assumes just 3,600MW of new wind and solar between 2024 and 2028, before a rush of more than 16GW in the next seven years.

One of the reasons for this is that they need to wait for new transmission infrastructure to be built, including the Copperstring link in the north between Townsville and Mt Isa that will unlock huge renewable and mineral resources. It could and should have been built a decade ago.

AGL’s new timetable for Loy Yang A closure still trails the ISP

AGL, a decade on from its bizarre decision to invest in coal so it could fund its growth in renewables (no, really, that’s what they said at the time), has now bowed to reality – thanks also to the urging of activist shareholders like Mike Cannon-Brookes – and committed to the closure of its last coal generator by 2035.

It won’t be a surprise to anyone. The timeline for the Loy Yang A generator closure in Victoria is slower than the AEMO “step change” scenario that suggest all brown coal generators will be gone by 2032.

Whether LYA ends up being being closed by 2032 or 2035 might not matter much in the great scheme of things. It will entirely depend on how much replacement capacity can be built or contracted in the interim, and there should be no shortage of projects to choose from

The NSW government fully expects all its coal generators could be gone within a decade, which means the end for the newly sold Vales Point, AGL’s Bayswater and Energy Australia’s Mt Piper.

Which leaves only a few coal generators in the grid unaccounted for – Alinta’s Loy Yang B in Victoria, and the Milmerran and rebuilt Callide C generators in Queensland. Alinta hasn’t said as much, but appears ready to accept an early closure, while Queensland has made it clear even private generators should be gone by 2035.

Big week for pumped hydro

One of the more interesting political decisions of the Queensland government deal was the commitment to two big new pumped hydro projects, including what it says is the world’s biggest (by capacity) of 5GW, with 24 hours of storage.

The politics are interesting because the state likes big things, and in north Queensland they have been talking about big dams for years. And pumped hydro kind of looks like the energy technology that they are used to.

Whether it ends up being built at the scale foreshadowed remains to be seen, and whether it ends up playing the grid security role envisaged is also open to debate.

Battery technology is improving quickly. But in flagging the massive investment in pumped hydro, the labor government has most likely short-circuited some of the biggest fears about the transition to green energy.

Big week for batteries

It has also been a big week for battery storage. Four new big batteries were unveiled by the Victorian and Queensland governments, including the ground-breaking Koorangie battery to be built by Edify Energy.

It is not the first battery to have advanced grid inverters, or to have the ability to provide system strength. But it is the first in the world to win an open contract to provide those services. And from a technology point of view, it is a major step into the future for the market operator.

The other battery in the state will be built in the south-west town of Terang, a 100MW/200MWh battery from FRV, also with grid forming inverters but without a specific contract.

Queensland, meanwhile, focused on huge pumped hydro projects that will be built in the north of the state and the previously announced Borumba Dam. At the same time, it quietly announced two new big batteries – the Swanbank battery to be operated by CleanCo, and the Stanwell battery to be operated by Stanwell Corp.

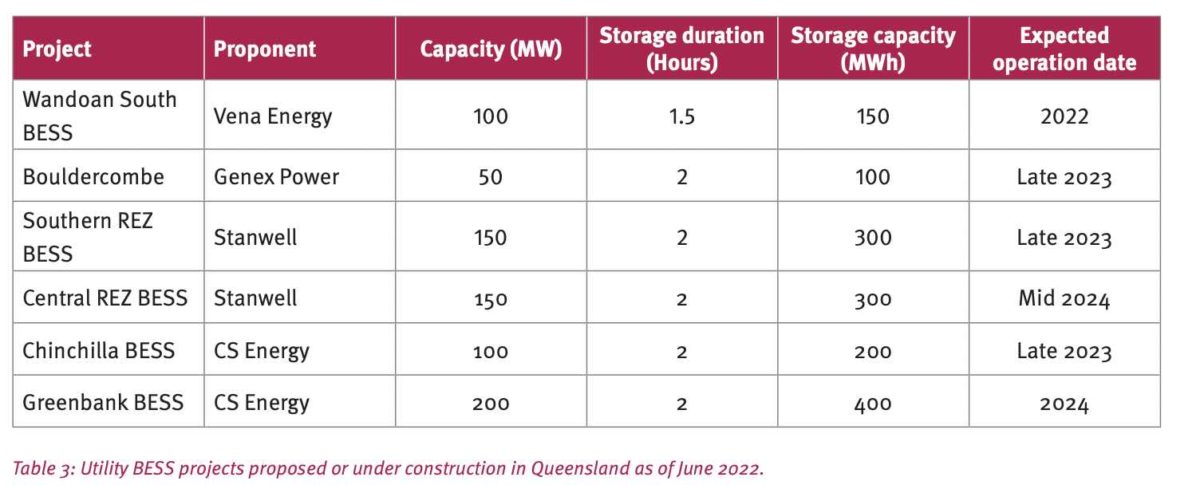

Not much else was said about that, but it takes the number of big batteries built, under construction or committed in the state to six – Wandoan (operating), Bouldercombe and Chinchilla (all under construction), along with Swanbank, Tarong and Greenbank. There are many others proposed or in the pipeline.

The big difference between Victoria and Queensland is that the latter appears determines to rely on conventional technology (spinning machines in old coal plants to provide system strength) rather than the battery inverters in the south.

Gas industry holds federal Labor and the country to ransom

While all this was going on, the gas industry reinforced its rampant greed and total loss of social licence with a domestic supply deal with the federal Labor government that has all the hallmarks of a ransom note.

According the terms unveiled by Labour resources minister Madeleine King, Labor has agreed to pay the gas industry up to $70/gigajoule for gas to ensure that the industry guarantees enough supply to Australian consumers rather than sending everything overseas.

The AI Group called it “crushingly disappointing” and says the deal means high prices will be locked in, because they will also flow through to electricity markets.

Frankly, the deal beggars belief, although it is typical of an industry that is battling to protect its network of pipes and been playing havoc on the wholesale electricity markets, and a party unwilling to take it on.

The price agreed by Labor in no way reflects the cost of extraction and the only hope is that the gas industry has just signed its death notice at the same time. The AI Group says it will have no choice but to find alternatives. Coal is being shut down and fossil gas just invited the same outcome.

See also: Energy Insiders: De Brenni on Queensland’s flip to renewables