Snowy Hydro, the massive energy utility that is about to be 100 per cent owned by the federal government, is seeking to boost its renewable energy portfolio by contracting 800MW of wind and solar capacity.

A formal expression of interest document (EOI) was published last Friday, inviting proposals – including location and potential price – by June 19. Snowy Hydro wants to conclude contract negotiations by mid September.

“The initial aim is to procure 400MW of wind and 400MW of solar off takes,” the document states, although the company may change its mind on the 50/50 split between wind and solar depending on the offers made.

“Snowy Hydro’s goal is to construct a portfolio of wind and solar offtakes such that the resulting portfolio benefits from diversification of fuel sources (wind / sun), geography (across NEM States, latitude and longitude) and supply profile (intra-day, week, month and season).”

The call for 800MW of capacity comes as Snowy works on its final feasibility study for the massive Snowy 2.0 pumped hydro scheme, which is likely to cost upwards of $6.5 billion, depending on its final engineering studies.

The Snowy 2.0 project is being criticised by some conservatives who argue that the money would be better spent on new coal generators.

Snowy itself says that the project is clearly “cheaper than coal”, while also arguing that it is better for renewables than it is for existing coal generators.

However, some say the project makes little financial or environmental sense if there is not a majority of renewables in the main grid, but its soon-to-be sole shareholder, the Coalition government, argues that any such target would be “reckless”.

So, this call for expressions of interest is an interesting and major step forward for Snowy Hydro, as it will increase its exposure to wind and solar farms significantly.

To date, the only contracts it has made are with the 100MW solar farm at Tailem Bend in South Australia and with the first stage of the 212MW Lincoln Gap wind farm near Port Augusta. Both are under construction.

But during testimony to a Senate Estimates hearing last week, Snowy Hydro CEO Paul Broad – apart from saying that pumped hydro could clearly outperform a new coal plant – gave some indication of the sort of prices the company expected to see in the tender.

“The price that we’re getting for wind and solar has come down by an order of magnitude,” he said. “We’re now getting prices in the 40s, 45s to 50s (dollars per megawatt hour).”

Broad also indicated that the wind and solar plants contracted by Snowy Hydro could be used to create new “firming” contracts, as other retailers are doing.

“On that firming product we have wind at about $40, and with a firming product of around $40 as well—around $80. Those costs are coming down rapidly.”

These estimates are backed up by new documents released by Snowy Hydro that suggests wind (including a price premium for firming) is approx $70 – $80/MWh, and solar with a price premium for firming is about $77 – $99 per MWh.

This compares to the price of new coal plants of $78 – $120/MWh depending on capacity factor, and the cost of gas, assuming sufficient quantities can be sourced on existing infrastructure, of $100-$125/MWh.

RenewEconomy understands that some retailers are demanding PPAs for wind or solar in the $30s/MWh, although there is no indication that they are getting that.

The lowest that has been revealed has been a contract in low $50s/MWh, by Origin Energy for the Stockyard Hill wind farm in Victoria, which at 530MW will be Australia’s largest.

Snowy Hydro will offer contracts, known as power purchase agreements (PAA) for 15 years to the wind and solar farms in its tender, and will consider energy only, energy plus LGCs, fixed price, or escalating at 65 per cent of the CPI.

Recent PPAs struck for other wind and solar farms by other retailers have attributed zero or little value to the LGCs, the certificates generated under the renewable energy target.

Contracts awarded to existing wind or solar farms will be applicable from January 1, 2019, while contracts for new facilities will be in place once they are completed.

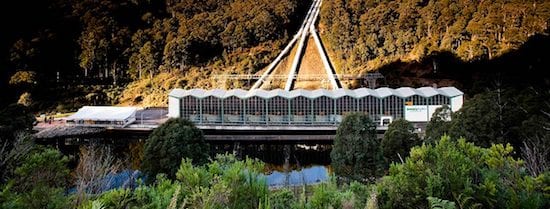

In its EOI documents, Snowy Hydro notes that it owns and operates the 4,100MW Snowy Mountains Scheme, the 300MW Valley Power gas-fired power station, the 320MW Laverton North gas-fired power station and the 667MW gas-fired generator at Colongra in NSW.

It also owns and operates diesel fired peakers in South Australia, and since the purchase of Lumo Energy (to add to Red Energy), it has become the fourth biggest energy retailer in the National Electricity Market.

Note: The formal transfer of ownership of the NSW and Victoria government stakes in Snowy Hydro to 100 per cent owned by federal government will take place from July 1.