A group of prominent critics of what they label as the country’s most expensive transmission project have produced a “Plan B” – what they say is a shorter and cheaper circuit that mostly uses existing easements and will deliver more renewable power to the state of Victoria.

The VNI-West transmission project – a new 500 kV double circuit transmission line that will start on the north west outskirts of Melbourne and stretch over 800 kms to Wagga Wagga in the south west of NSW, via Bulgana, Kerang and Dinawan in Victoria – is one of the most hotly contested in the country.

Critics led by Victoria Energy Policy Centre head Bruce Mountain, transmission industry veteran Simon Bartlett, and farmers’ representative Darren Edwards, argue that VNI-West is ill-conceived, too costly, will restrict renewable investment and will hinder Victoria’s ambitious 95 per cent renewables target.

They have described the Australian Energy Market Operator’s attachment to VNI-West as a “monumental mistake.”

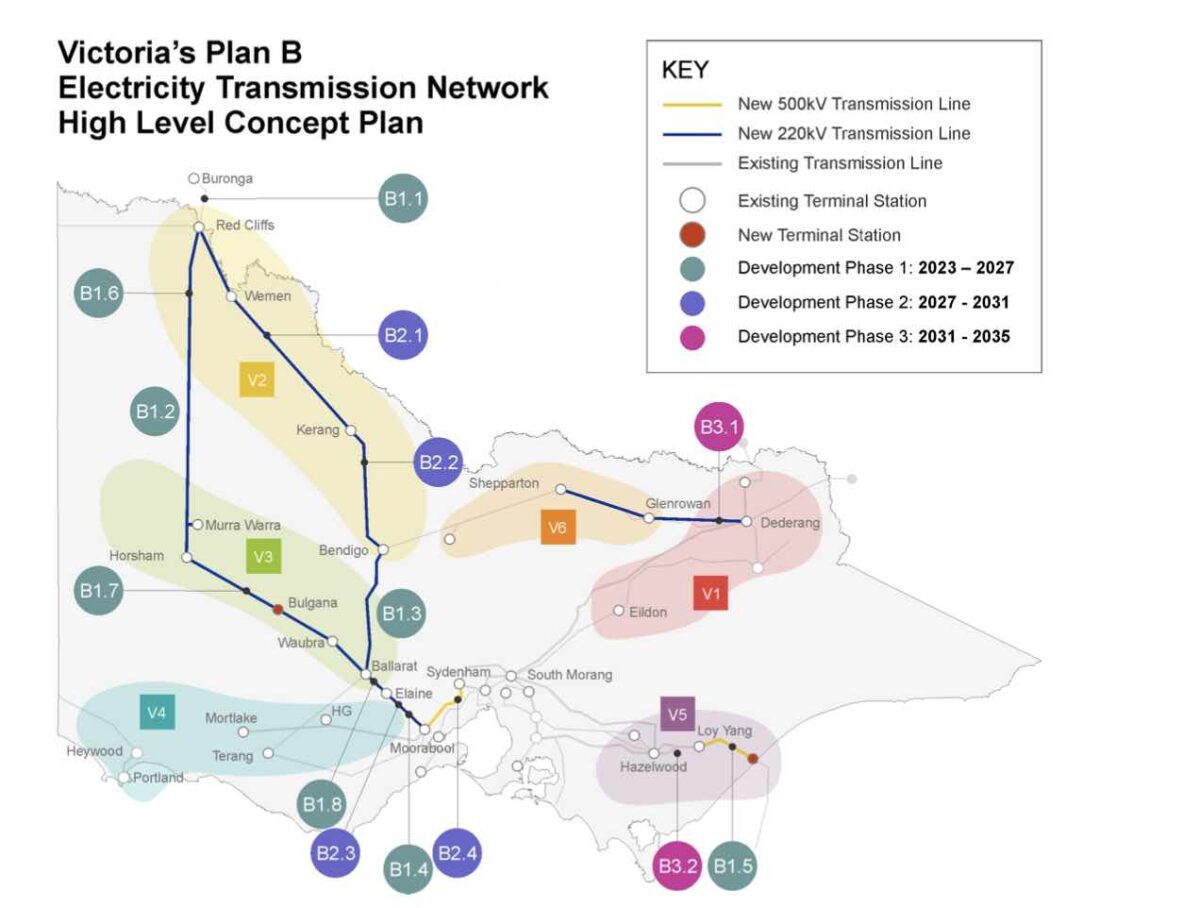

Now, after months of criticism – including here and here on these pages, and the response – Mountain and Bartlett have produced a new study that suggests an alternative for VNI-West, a Plan B, to be delivered over three stages.

The 83-page document, titled No longer lost in Transmission, argues that Plan B is significantly cheaper – $6 billion versus the estimated $11 billion for VNI West and its associated projects – and will therefore avoid a more than doubling of transmission charges in consumer bills.

The authors argue that Plan B is shorter (1,452 kms vs 1,659 kms), will unlock more renewables (16.8GW vs 14.4GW), result in less curtailment (13 per cent vs more than 20 per cent), and use more existing easements (1300 kms vs 130 kms).

The assumed cost savings mostly come from Plan B’s use of more 220kV lines instead of 500kV lines, which mostly need smaller towers (48m vs 80m), and which they say will be less prone to supply chain constraints, skilled labour shortages, insufficient competent contractors, and social licence challenges.

“AEMO’s plan will place a large burden on affected land-holders, the environment, existing and future renewable generators and consumers,” they write.

“The ills we expect are avoidable and we propose a transmission expansion plan that avoids them. The essence of our “Plan B” is to upgrade Victoria’s existing 220 kV networks, using existing towers and easements as far as possible to expand the hosting capacity of renewable generation around Victoria.”

They want the newly created VicGrid to conduct a serious study into their alternative, but the very proposal is facing resistance from the Australian Energy Market Operator, which sees VNI-West as a key part of its 30-year planning blueprint, and others in the industry.

The authors also want a wholesale review of the regulatory arrangements about transmission investment, and the narrow focus of “one-at-a-time” assessment methodologies. “The failure of transmission expansion planning is systemic,” they say.

Debates rage across the energy industry in Australia – not surprising given the speed of the transition from a centralised fossil fuel system built around spinning machines to a distributed grid based around wind, solar and battery storage and inverter-based technologies that no one has done before at scale.

There are intense disputes over developments, planning, connection rules, engineering principles, system needs, storage requirements, market design, energy policy, regulatory powers, the lack of competition, and social licence. And, yes, transmission planning and regulatory oversight.

Many of these disputes rage largely behind closed doors, but it would be fair to say that – given the need to move quickly and the delays around transmission building as a whole – few if any disputes have caused as much discomfort to the industry as the one about VNI West.

And it has become a highly public dispute – with some landowners along the route are openly and visibly hostile to the very idea of new transmission lines coming across their property.

In the days leading up to the embargoed release of Plan B, the Climate Media Centre mustered a group of nearly a dozen energy experts, analysts and other stakeholders who expressed their support for AEMO’s VNI West Plan – although it was unclear if they had seen the details of the Plan B document.

AEMO had seen it, and issued a detailed rebuttal, contesting Mountain and Bartlett’s claims that it would result in increased renewables, and suggesting the opposite, particularly in the wind and solar rich north and west of the state.

It also suggested Plan B would likely require the acquisition of people’s homes on the outskirts of Ballarat and Bendigo, and would result in long periods of power system disruption.

AEMO said it was difficult to expand transmission lines within existing easements. It has already proposed adjusting key parts of the VNI transmission route to deal with landowners concerns and to get closer to more renewable capacity.

Of course, it is not possible for RenewEconomy to be judge and jury over this matter, apart from observing that there are intense debates in the industry over key aspects of the transition, including over the competition between transmission lines and non-network alternatives.

The nature of many of these debates is evolving because of the rapid developments in technologies and engineering, and they will continue to do so.

“Co-located storage will help to reduce curtailment and improve the utilisation of transmission but will not obviate the need for significant expansion of the transmission system,” they write.

“A credible transmission expansion plan that is accepted by affected communities, taxpayers, consumers, and renewables investors is now a critical factor not just in the transition to renewable electricity but also in keeping the lights on.”

The main issue in Victoria is how to unlock the rich wind and solar resources in state’s north and west, which are currently served by a weak network dubbed the “rhombus of regret” because of the large levels of curtailment to wind and solar farms already built in the area.

If there is a fundamental difference between the two parties it appears to be in the need for these renewable superhighways to provide added links between Victoria and other states.

Mountain and Bartlett say it is not needed and the focus should be on unlocking the state’s renewable capacity. “There is no reason to believe that this (interconnection) is valuable and so we have not pursued interconnection as a design objective,” they write.

“If Victoria and NSW wish to pursue stronger interconnection for other reasons, this is of course a matter for the respective governments. If so, this should be stated and explained and the design objectives of such interconnection clearly stated so that suitable options may be proposed.”

AEMO sees these new superhighways as an essential part of its national blueprint. “A central part of any investment case is the ability to export energy to other states when Victoria is generating more electricity than it needs,” says AEMO’s Merryn York. And vice versa when Victoria is not generating enough.

York – who incidentally worked with Bartlett in senior roles at Queensland transmission company Powerlink – says that that assessment is not based on any particular philosophy, but on the analysis within the ISP that it is the least cost path to a net zero grid.

York says that AEMO has already taken into account the recent price spikes that have plagued the industry in its May regulatory filing on the project. It should be noted that AEMO’s newly released Inputs, Assumptions and Scenarios report for the next ISP flags a 30 per cent jump in transmission costs.

Much of the rest of the debate between AEMO and the VNI West critics appears centred around detail. Mountain and Bartlett, for instance, say the AEMO plan for VNI-West leaves more than 1,000 single points of failures.

AEMO says that is not true. It also dispute the ability to locate new lines within existing easements without massive disruption to existing power supplies. It says non network alternatives suggested by Mountain and Bartlett have been investigated, and it disputes the claims of increased capacity.

“Based on AEMO’s initial assessment, Plan B will only harness half the renewable generation claimed,” York said.