The continuing rapid uptake of rooftop solar by energy consumers, and the mass investment in some of the country’s biggest batteries, has helped relieve reliability concerns for the market operator in Western Australia.

The W.A. grid – regarded as the biggest standalone grid in the world – is in the early stages of an energy transition that could be even more spectacular than its big brother, the National Electricity Market, that covers much of the eastern states.

W.A. has been a laggard in the uptake of renewables – apart from rooftop solar – but it now envisions mass investment in wind, solar and storage to support the global demand for zero emission products, the emergence of the green hydrogen industry, and the electrification of homes, industry and transport.

Its first hurdle is to ease out the remaining ageing coal fired power generators, now reduced to a small pocket of resistance around the town of Collie, and which are expected to close by the end of the decade. Will the state have enough renewables and dispatchable power to keep the lights on?

The latest Electricity Statement of Opportunities, a 10-year demand and supply forecast for the W.A. grid, issued on Tuesday by the Australian Energy Market Operator, says the picture has improved significantly since last year.

There are two key reasons for this.

One is that rooftop solar uptake continues to rise at a faster rate than forecast, with households and businesses putting in bigger systems. The amount of rooftop and distributed solar is expected to leap to 6.5 gigawatts (GW) in a decade, more than double its current capacity of around 2.6 GW.

The second reason is the big investment in battery storage. The state switched on the first big battery in its main grid just a year ago, but it now has multiple projects – including two sized at more than 2,000 MWh, including the country’s biggest – that will add more than 1.4 GW and 5,600 MWh of new storage capacity in the next few years.

Most of these new projects have been given a specific task in coming years, to soak up the excess rooftop solar and shift it into the evening peak, easing the stress on other dispatchable generation, such as gas, to meet periods of peak demand.

“The near-term supply-demand balance has improved significantly since the 2023 WEM ESOO, but substantial and sustained investment in new generation, storage, DSP and transmission capacity is still needed, particularly for the period from 2027 onwards,” the document says.

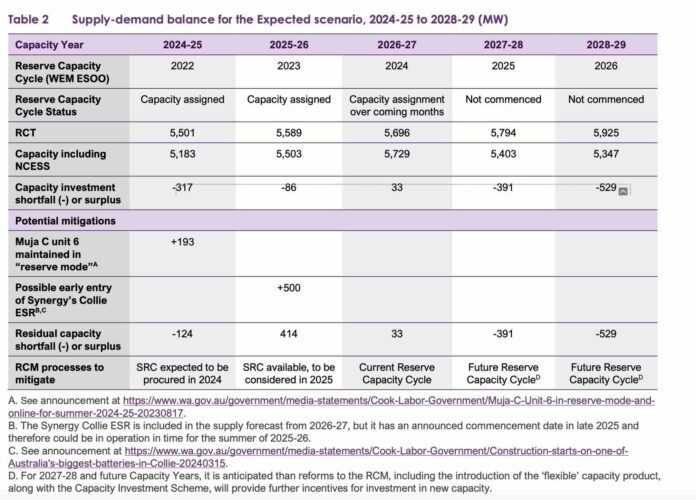

This table above summarises the key part of the improved outlook. A shortfall this year is expected to be covered by keeping one of the Muja coal units in Collie in “reserve mode” (something the state government can easily do because it owns the facility), and through a tender for reserve capacity.

A smaller shortfall is expected next year, but this is likely to be covered by the new 500 MW, 2000 MWh Synergy battery at Collie, which the ESOO conservatively expects to be complete in 2026, but is likely to be operating by late next year.

Future shortfalls out to 2028/29 should be covered by other new capacity, including that brought on by the first WA component of the federal Capacity Investment Scheme that will seek at least 500 MW of four hour battery storage.

Longer term, the state needs a lot more wind, solar and storage, particularly as demand increases along with the expected increase in electrification and green hydrogen.

In fact, the annual energy consumption is predicted to jump by 60 per cent, and the peak by nearly 50 per cent, and this is despite dialling back some of the initial expectations about the pace of uptake in EVs and green hydrogen.

One of the interesting things about this demand growth is that the peak is likely to shift from its current position in the summer early evenings to the middle of winter as homes use more electric heaters.

That in turn, requires more effort on orchestrating or co-ordinating distributed energy, something the state is seeking to achieve through its “Project Symphony.”

“As the energy transition progresses and adoption of rooftop solar and other distributed energy resources grows, coordination of these resources can play an important role in delivering value for individual customers and supporting a secure and reliable electricity supply for all consumers,” AEMO’s head in WA Kate Ryan said in a statement.

W.A. is also looking at introducing what it calls a “flexible capacity” product along with the Capacity Investment Scheme, that will provide further incentives for investment in new capacity.

Of the long term supply needs, amplified by the retirement of the state’s last coal generators, AEMO does not seem particularly concerned, as long as new transmission is built.

“AEMO is aware of a substantial pipeline of projects, including wind and solar generation, as well as battery storage, which could be developed in response to this investment opportunity,” it says.

“Timely delivery of capacity and transmission projects will be essential to maintaining reliable supply … AEMO is monitoring the progress of committed projects and encourages proponents to take early actions to mitigate any potential delays.”