The Australian Energy Regulator has some new wholesale electricity price spikes to investigate, after a surge in activity in South Australia this week left some in the market with mouths agape.

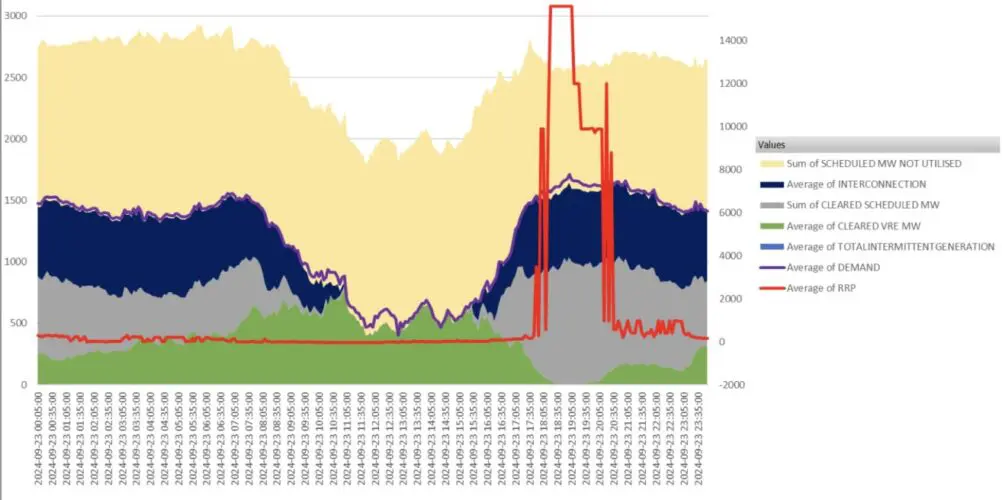

The price in South Australia surged to nearly $16,000 a megawatt hour (MWh) for long periods on Monday evening, some 30 to 50 times more than the plausibly highest cost of generation at the time.

Normally such price spikes occur because the reserves of supply are nearly exhausted, and scarcity commands a steep price. But as the AER discovered when investigating equally dramatic price spikes in NSW in May this year, that is not always the case. It is often the big players toying with the market.

Some in the industry are wondering if this is once again the case in South Australia, where demand was not particularly high on Monday, and where there appeared to be ample amounts of generation that were not dispatched.

The players involved in the bidding on that evening will presumably have to account for themselves to the regulator, which is obliged to investigate price spikes above $5,000/MWh.

Some of that unused capacity may have been constrained by network issues. But some of the smaller players in the market were not impressed. “It’s pretty disappointing behaviour,” said one participant, who declined to be named.

And they are right. One of the biggest tests of the green energy transition is to lower prices. The theory is fine: The more wind, solar and storage brought into the market should lower prices, as long as the market power of the incumbent players and their fossil fuel generators can be challenged.

Right now, that is proving difficult. During the day, the abundance of solar, particularly rooftop PV, is taking the pricing power out of their hands.

But they seek revenge and compensation in the evening peaks, particularly in small grids like South Australia where there is still not enough competition, a situation that inspired the state’s early push into renewables.

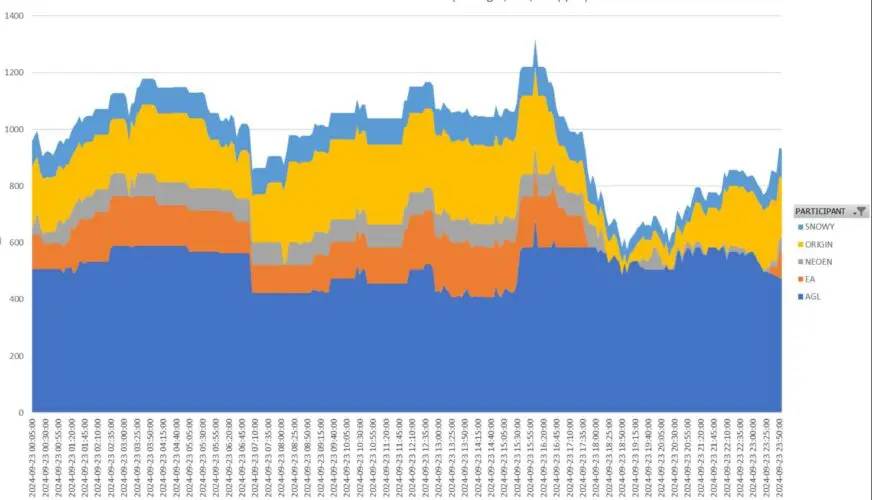

Despite the renewable share that averages more than 70 per cent – and is headed towards 100 per cent net renewables by 2027 – the big players there still reign supreme, when they can. AGL has a dominant share, and Origin Energy and the federal government owned Snowy Hydro also have significant pricing power.

The NSW price spike investigation provided some insight into those practices. The AER noted how the big players took advantage of a market situation, some outages, and “technical issues”, and cashed in on the situation with some “re-bidding” and testing the legal limits of slow ramping.

“While rebidding to maximise profits is permissible under the National Electricity Rules, the behaviour may not have been in the best interests of energy consumers,” the AER noted in its compliance report.

Indeed, without those price spikes, wholesale electricity prices in NSW would have fallen in the second quarter as a reward for the increasing amount of renewables. But not when the fossil fuel generators are able to have their way.

And so, as it turned out, the average price went up, giving oxygen to the misleading claims pushed by conservatives and the Coalition and their media choristers that renewables are pushing prices up, when it is the bidding behaviour of the fossil fuel generators that are clearly responsible.

Battery storage offered hope that the pricing cartels could be easily smashed. That was the case with the frequency control market in South Australia and the first Tesla big battery (pictured above), but the incumbents learned their lesson and have since regrouped and rethought their tactics.

The legacy utilities are now the dominant owners or operators of Australia’s rapidly growing fleet of battery storage installations, so they have kept the pricing power in their own hands. And being good corporates with their fiduciary duties in mind, it’s all about the money.

AGL, for instance, now owns the biggest battery in South Australia, the Torrens Island installation, and EnergyAustralia has become a significant owner and contractor in Victoria and South Australia, and Origin is also now rapidly building its own battery portfolio.

Interestingly, despite some lack of reserve warnings from the market operator, prices on Tuesday were more moderate, and were kept below the threshold that would cause an AER investigation.

Still, the ball is in the regulator’s court.

Energy retailers cash in and send customer bills soaring as coal plants fail again

And: Electricity prices soar thanks to costly gas, coal outages and market manipulation